How Bowtie uses virtual corporate cards to streamline its operations in Hong Kong

In 2017, the Hong Kong Insurance Authority launched the virtual insurance license scheme, ushering the city into a new era of technology-enabled insurance. Amidst this sweeping industry-wide reform, Bowtie became licensed as Hong Kong's first virtual insurer in 2018. The pioneering Insurtech brand empowers consumers to take control of life protection decisions for themselves by eliminating paper, commissions and intermediaries.

Avoiding expensive international transaction fees with Airwallex

At the forefront of driving transformation across the industry, Bowtie seeks to integrate insurance into our daily life. To make insurance more accessible, the brand opened a healthcare clinic that offers medical consultations and a coffee shop where customers can discuss their policies with staff.

With multiple businesses under its umbrella, Bowtie regularly sources its supplies and equipment from numerous vendors and service providers located all around the world. Like many start-ups, Bowtie also subscribes to a number of SaaS applications, like Zendesk and AWS, which are billed in USD. Previously, Bowtie used local cards to make overseas payments to its suppliers or service providers, bearing heavy foreign exchange and transaction fees imposed by banks. With the help of Airwallex, Bowtie is able to save on global payments by eliminating such tedious fees.

Airwallex offers free multi-currency company cards that allow users to make online payments in multiple foreign currencies and can be used wherever Visa payments are accepted. Now when paying for SaaS subscriptions, Bowtie can directly settle its payments in USD with Airwallex Borderless Cards. Airwallex also offers market-beating foreign exchange rates and a convenient 24/7 web portal that allows users to carry out instant foreign exchange conversions – empowering Bowtie to make faster payments across the globe at lower rates.

“After using Airwallex, we are able to use their Company Cards to directly settle our foreign currency transactions. Airwallex doesn’t charge us any international transaction fees or TT fees. Their FX rates are also relatively competitive. Through Airwallex, we can save around 3-5% for these foreign currency payments."

Bowtie’s Deputy Chief Finanical Officer, Edwin Wong.

BOWTIE DEPUTY CHIEF FINANCIAL OFFICER: EDWIN WONG

This means for every HK$100,000 Bowtie spends on overseas business expenses, Airwallex helps Bowtie save around HK$3,000 to HK$5,000 in unnecessary fees.

Issuing Visa cards online for employees instantly

Another benefit that Bowtie has reported after using Airwallex is the increased control that it has over its team budgets. Prior to signing up for Airwallex’s service, like most businesses in Hong Kong, Bowtie relied on an inefficient employee expense reimbursement model to pay its staff back for business-related spending. When an employee placed an online ad or purchased a piece of equipment, they had to first make the purchase with their own money and create an expense report to get reimbursed after the fact. This created additional paperwork for both the company and staff. However, due to the lengthy application process with banks, Bowtie found it almost impossible to issue company cards for all its employees.

BOWTIE TEAM

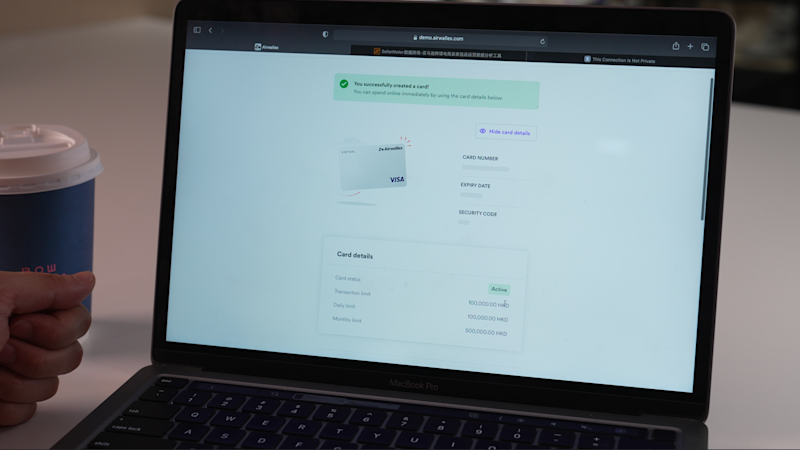

Thanks to Airwallex employee cards, Bowtie is able to issue free virtual Visa cards to its employees instantly online, enabling teams to make purchases easily to get the job done. Not only does this save the company time in expense reimbursement, but Bowtie can also track employee spending in real-time on Airwallex’s online portal to make sure that it is always on budget.

BOWTIE FINANCE TEAM ISSUING EMPLOYEE VISA CARDS ONLINE IN SECONDS

“We can use Airwallex to issue virtual cards for our employees online instantly, and they can start making transactions right away. Airwallex’s webapp allows us to control and set different spending limits for all employees, and manage everyone’s spending on the same platform, which has been incredibly convenient.” Bowtie Chief Commercial Officer, Gabriel Kung

Giving back to Hong Kong start-ups and SMEs

As Airwallex and Bowtie are both Hong Kong-based start-ups, there has been a great synergy between them from the get-go. Driven by a shared passion to give back to local start-ups and SMEs, they strive to offer best-in-class products and services to the community, be it digital insurance or borderless payment solutions. As more and more Hong Kong start-ups partner up with each other, together they can build a stronger start-up ecosystem in Hong Kong.

BOWTIE CHIEF COMMERICAL OFFICER: GABRIEL KUNG

Get multi-currency company cards online for free

Ready to scale your business with Airwallex? Get more from your spending with our free multi-currency company cards. Open a foreign currency account with us and say goodbye to high foreign exchange rates and bank transaction fees. Get started with us today and instantly create virtual Visa company cards for your employees that can be used right away! Click here to learn more. Click here to watch the full video interview with Bowtie.