Airwallex debuts card payment acceptance in the UK and Europe to support surging ecommerce growth

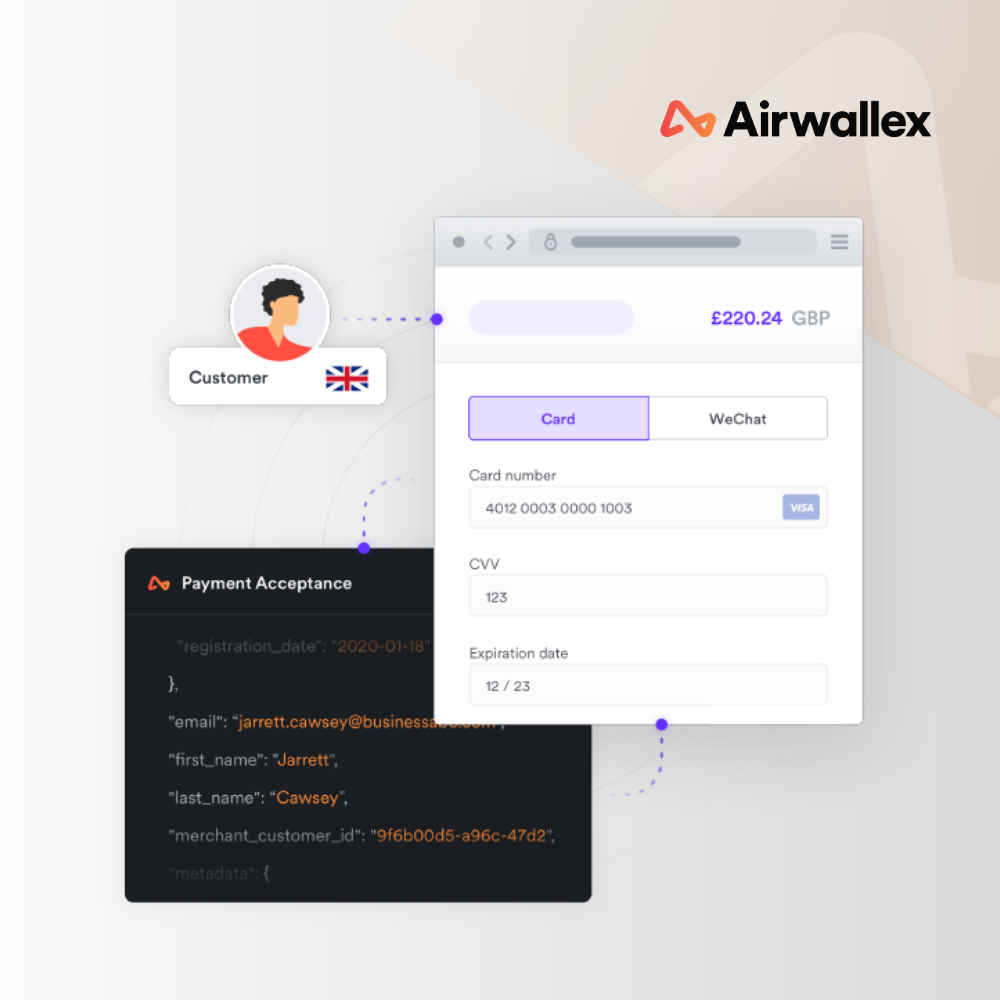

Global fintech leader Airwallex has launched its card payment acceptance solution in the United Kingdom and Europe allowing merchants to accept card payments around the world seamlessly and securely. The solution will initially support Visa and Mastercard card payments, with more payment methods planned.

In the UK alone, ecommerce sales are expected to grow by 17.6% compared to last year in light of COVID-19. Airwallex has seen double digit revenue growth from its ecommerce customers in 2020, fuelled by the rapid acceleration of online spending globally. As businesses look further afield for growth opportunities, the importance of removing the unnecessary foreign exchange fees charged by banks and other payment providers has never been more critical. These fees are often hidden within inflated exchange rates, additional international payment fees, as well as auto-conversion by issuers and gateways at extremely poor rates.

Unlock global growth

Airwallex’s card payment acceptance solution enables merchants to receive funds from anywhere in the world Visa and Mastercard are accepted – They can then hold these funds in Airwallex accounts in over 15 currencies, exchange currencies at the mid-market rate with a small transparent margin, and repatriate funds back to home markets with zero payment fees. This makes the process simpler, more cost-effective, and totally transparent for merchants.

This new offering is a key part of Airwallex’s mission to support business growth with an end-to-end financial services platform. Now, merchants in the UK and Europe can access payments, collections, FX, and virtual global accounts in a single platform, and without the high fees that traditionally come with operating overseas. By working seamlessly with Airwallex’s platform to enable efficient management of multiple currencies, the new solution eliminates the need to work with multiple providers or to open bank accounts in different markets.

The new card payment acceptance solution is aimed to go live in other key markets such as Australia and Hong Kong later this year.

James Butland, VP of Global Banking said: “Ecommerce merchants today have access to many tech-driven ecommerce solutions that can help them easily set up and run their international operations. Existing cross-border financial services, which is a crucial part of this process, do not offer the same seamless experience. Merchants have to patch together different finance solutions to accept payments, repatriate funds from other markets and pay suppliers – these include payment gateways, business bank accounts in different markets, FX providers and remittance solutions. Managing these different solutions can be cumbersome and costly, and as a result, become a barrier to successful global expansion.”

“With the introduction of our new card payment acceptance product Airwallex now offers everything a merchant needs to operate internationally in an end-to-end platform at the lowest cost. As ecommerce growth continues to accelerate Airwallex is committed to bringing products and services to market that help scale the digital economy and support businesses of all sizes in operating globally.”

This announcement follows the Airwallex’s recent record US$160million Series D fundraising in April and is further evidence of the company’s commitment in the UK and mainland Europe, with plans to hire 50+ new talent in the region by 2021. This already includes Nigel Thacker, SVP Sales, who recently joined the London office and will take an instrumental role in expanding the European team alongside James Butland, VP of Global Banking. With more than 20 years of experience in the finance industry, Thacker was formerly SVP of Sales at Adyen and also worked for Vocalink, Barclays and RBS.

If you have any questions or would like to request further information, please contact Michael Treacy at [email protected]

Ready to scale your business with Airwallex? Get more from your spending with our free multi-currency virtual cards. Open a foreign currency account with us and say goodbye to high foreign exchange rates and bank transaction fees. You can make international money transfers in multiple currencies, in one business day or less.

Streamline your financial operations

Related article: Airwallex Hires Tech Veteran As New EMEA General Manager