TradeBridge redefines modern finance with Airwallex

Find out how TradeBridge uses Airwallex to power its intuitive, multi-currency finance platform.

TradeBridge is a fintech offering multi-currency funding to businesses in the eCommerce, healthcare, and corporate sectors.

Industry

Fintech

Company size

10–50 employees

Location

London, United Kingdom

Founded by Olivier Bonavero, Mark Coxhead, and Mark Spiteri, TradeBridge is a fintech company that provides multi-currency funding to businesses in the eCommerce, healthcare, and corporate sectors. By analyzing whole-business trading data, TradeBridge tailors loan facilities to meet each client’s unique financial needs, helping them scale efficiently.

The challenge

Managing multi-currency payments and collections

As TradeBridge expanded, it needed an end-to-end digital payment solution to efficiently transfer funds to clients, collect repayments from eCommerce platforms like Amazon and PayPal, and track real-time sales data. Traditional banking infrastructure lacked the flexibility required to support TradeBridge’s fast-moving clients, leading to delays, hidden costs, and limited visibility over financial transactions.

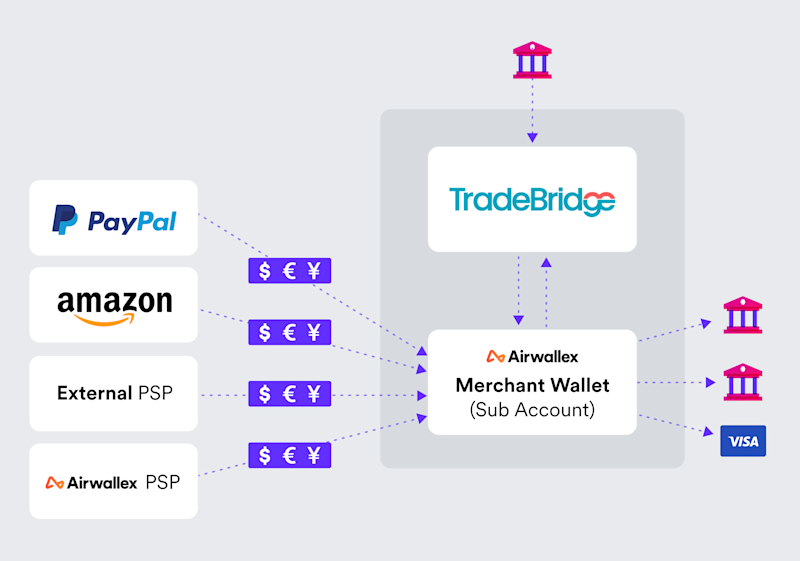

Also, many eCommerce platforms limit payouts to third-party bank accounts, making it challenging for TradeBridge to collect repayments directly. The company required a solution that couldn't only deliver funds quickly and cost-effectively and provide seamless integration with payment service providers (PSPs) to ensure smooth fund collection and reconciliation.

The solution

To overcome these challenges, TradeBridge integrated Airwallex’s financial infrastructure into its platform, enabling the creation of multi-currency digital wallets for each client. These wallets provide a centralized hub for receiving, holding, and managing funds in multiple currencies, streamlining both payouts and repayments.

Mark Coxhead

CEO and Co-Founder of TradeBridge

“The integration time was exceptionally good. What was great was how responsive the engineering team were. This is one of the first times we’ve worked with a provider and the time to get live has been as short as we were promised.”

With Airwallex, TradeBridge can now deliver funds in its clients’ preferred currencies without hidden conversion fees, reducing costs and increasing efficiency. The wallets also allow TradeBridge to collect multi-currency repayments directly from eCommerce platforms like Amazon, Shopify, and PayPal, ensuring a seamless cash flow process. Clients can settle funds directly from their eCommerce websites or PSPs into their Airwallex wallet, eliminating the need for multiple banking intermediaries.

Airwallex’s API integration provides real-time visibility into client receivables, allowing TradeBridge to adjust funding facilities based on up-to-date sales data. This level of financial insight ensures that businesses receive the capital they need when needed, without the inefficiencies of traditional lending models.

Mark Coxhead

CEO and Co-Founder of TradeBridge

“What we want to offer is a holistic product that is suitable for globally ambitious eCommerce businesses. In order to do that, we need to be able to deal globally with those clients, and that’s where Airwallex comes in. Into one global business account we can receive our repayments in a way that meets the requirements of the different marketplaces.”

The results

A scalable financial infrastructure for global growth

With Airwallex’s multi-currency capabilities, TradeBridge has built a more intuitive and scalable funding solution for modern businesses. Clients can access funds immediately, convert them into their preferred currencies, and make payments without waiting days for bank transfers.

With a robust financial infrastructure in place, TradeBridge is now positioned for global growth. Airwallex will support TradeBridge as it scales across Europe, Asia, and the US, helping more businesses unlock capital without limitations.

“Companies like Airwallex give online businesses a chance to be global players in a way that would have been too difficult before,” says Mark Coxhead, Co-Founder of TradeBridge. “The global platform allows us to take our product to the world.”

Jed Rose, GM of Airwallex EMEA, adds, “TradeBridge provides crucial financing to businesses across multiple sectors and leverages technology to ensure their products meet the needs of modern businesses. We’re delighted to support TradeBridge in building the financial infrastructure to help them and their clients scale internationally.”

Mark Coxhead

CEO and Co-Founder of TradeBridge

“We seek to provide products that are fit for the markets we serve, with all of the tools that are available to us. The digital infrastructure that companies like Airwallex provide enables us to build really great products for clients.”

What users say about Airwallex

"Airwallex has been a game changer for all our banking needs. As a fast-growing startup, we need a scalable yet cost-efficient batch payment solution to pay our employees and vendors both inside and outside Hong Kong. Airwallex helps us save money on every bank transfer with their near-zero transaction fee and market-beating FX rates. We also use Airwallex’s multi-currency Visa cards for business travel expenses and SaaS subscriptions to avoid hidden bank fees that would otherwise have been difficult to spot. Would highly recommend other startups to get started with Airwallex!"

Henson Tsai

Founder, SleekFlow

"Airwallex has been great for our team - it makes payments and transfers so much easier, and has saved us significant amounts of time compared to what we were doing before with HSBC. Airwallex's platform is easy to use and very intuitive. Airwallex virtual card has solved most of our painpoints with sharing corporate card numbers and credit card limits. The best part is being able to save money on all our monthly bank transfers, and we've already saved thousands of dollars by using Airwallex. Airwallex's support has also been highly responsive to troubleshoot any issues in a timely manner."

Sarah Chang

Co-founder & COO, Forkast.News

“Airwallex provides us with flexibility and cost savings in dealing internationally. We used Airwallex to receive our recent global fundraising round and pay international suppliers and are saving at least 5% per dollar transferred versus the big banks.”

George van Dyck

Finance Manager, Zoomo

“Airwallex has been a game changer for us. I cannot recommend these guys enough. The forex services are super efficient and super competitive. The customer service is not gold-plated, it's solid gold. One of the best eCommerce services for merchants we have come across since PayPal hit the scene 20 years ago."

Murray Kester

CEO, Cosmetics Now – eCommerce

“Having all our global SaaS subscriptions in one place has streamlined our finance processes and enabled better tracking and control of expenses. It’s even better knowing that Airwallex isn’t hitting us with any international transaction fees.”

Warren Durling

Chief Operating Officer, Dovetail – Digital Agency

“Airwallex is our one-stop shop for all our banking needs, in one easy-to-use interface. Without Airwallex, we would not have been able to scale our business as fast as what we’ve been able to achieve.”

Andrew Ford and Rosa-Clare Willis

Co-founders, Crockd – eCommerce

“Airwallex saves us $40,000 annually in collections costs from our sales on Amazon, which is the majority of our sales in the U.S. market. It also allows us to ‘repurpose’ our international currencies. For example, if we sell in Europe we can pay European suppliers in Euros as well. There’s no need to ‘double convert."

Edward Agaba

Controller, Dalstrong