What is an Airwallex Global Account?

- •How is an Airwallex Global Account different from a foreign currency bank account?

- •Why is the ability to open a global account in different locales significant?

- •A simple payment solution for different currencies

- •How are Airwallex accounts used?

- •What is the pricing of an Airwallex Global Account?

- •What does an international payment cost with the Airwallex Global Account?

- •Unlock new levels of expansion for your business

An Airwallex Global Account gives your business the power to transform the way you operate financially on the international stage. It’s a business bank account with a difference, empowering you to quickly and easily open domestic and foreign currency accounts in minutes; without needing to visit a bank branch.

That’s right; you can skip the red tape, bank queues and excessive paperwork by opening foreign currency accounts in the UK, Europe, Hong Kong, Japan, Australia and New Zealand — right from your desk in the US.

An innovative payment solution, the Airwallex Global Account means you can seamlessly collect payments from your international customers in their preferred currency, unlocking new global revenue streams for your business. You can also spend your sales proceeds later in the same currency, eliminating unnecessary conversion fees, expensive transaction fees and cumbersome processes.

If you need to convert foreign currencies into USD (or vice versa), you'll benefit from Airwallex’s market-leading exchange rates.

The Airwallex Global Account seamlessly integrates with online marketplaces like eBay, Shopify and PayPal allowing you to collect funds without unnecessary currency exchange. The account also integrates with accounting software Xero, alleviating the need for tedious and time-wasting data entry.

How is an Airwallex Global Account different from a foreign currency bank account?

Global business accounts and foreign currency accounts work in a similar way. However, the Airwallex Global Account is designed to make managing multiple currencies easier and cheaper than a bank.

Banks may request that you make an in-branch appointment before opening a foreign currency account. It may take anywhere from five days to four weeks until the bank has processed your application and your account is up and running. If you operate in multiple currencies, you will have to open separate bank accounts for each currency, leading to a fractured financial experience and additional admin for your team.

The benefit of an Airwallex global business account is that you can open 12 foreign currency accounts online at the click of a button, without visiting a bank branch. Our accounts come with local bank details, allowing you to receive, hold and send multiple currencies without being subject to FX fees. We also don't charge account fees or transaction fees.

Airwallex allows you to manage all your funds in one place. You can view your multi-currency balances from a single interface, spend in multiple currencies with your Borderless Cards, transfer funds to suppliers and employees around the world, and view all transaction data in one platform.

Airwallex provides an efficient and simple way to create a local banking presence for your business in a specific region, without having to open an actual entity there.

Why is the ability to open a global account in different locales significant?

Opening an Airwallex Global Account gives you all the inherent benefits of a digital business account, but with added features that are purpose-designed for a global scale - complete with no signup fees and zero monthly fees. It’s innovative fintech that’s been created to help your business operate seamlessly between countries.

Setting up a number of global accounts in different localities brings a number of benefits to your business operations (and your bottom line).

A simple payment solution for different currencies

Payment gateways like PayPal, Shopify and Amazon Pay charge high foreign exchange fees for different currencies. Putting your money into an Airwallex Global Account means you can avoid paying exchange fees, as the account allows you to receive, hold and send money across borders without needing to exchange currencies.

For example, if you’re based in the US marketplace, you could collect money from your customers in Hong Kong, keep that money in your Global Account, and then use it to pay your suppliers in Hong Kong, all while paying no exchange fees.

How are Airwallex accounts used?

Airwallex Global Accounts are used by high-growth businesses all over the world at all different stages of their international expansion.

Check out some of these case studies to explore how businesses are improving their bottom lines with Airwallex.

What is the pricing of an Airwallex Global Account?

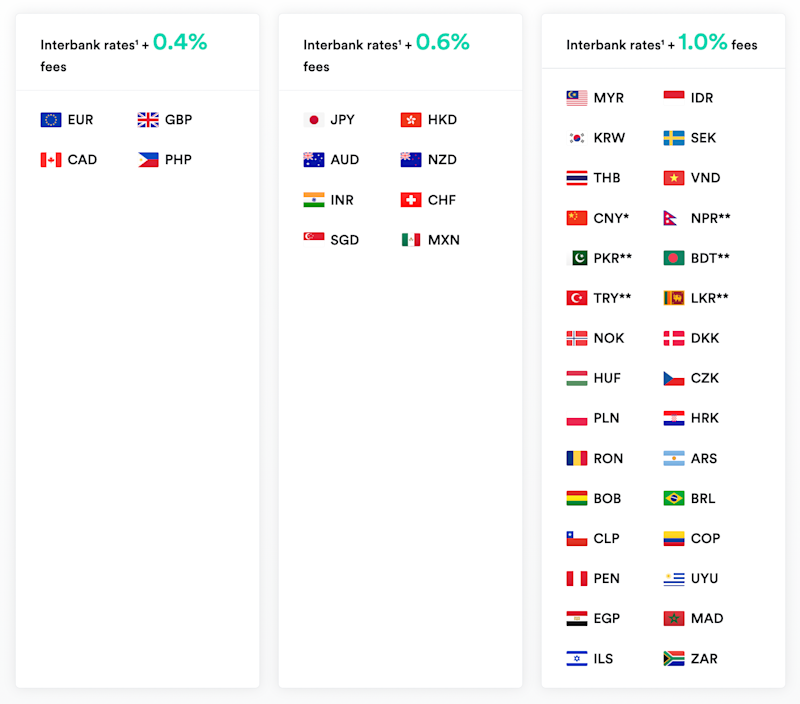

With no monthly fees, no card fees and only a small margin on top of our interbank FX rates — our competitive, simple and transparent pricing is a win for your business.

What does an international payment cost with the Airwallex Global Account?

Sending money to countries in their local currency incurs 0% international transaction fees with our local payment technology. We only charge a small margin on FX when you exchange currencies.

To send non-local currencies overseas (e.g. to send USD to Hong Kong), we can still assist, however will need to charge an additional payment fee to cover the cost of using the SWIFT network.

Unlock new levels of expansion for your business

As your business expands its horizons, Airwallex is here to support you. Airwallex Global Accounts are designed to make it as easy as possible to send and receive foreign currencies.

So, if you’re looking for a simple and efficient way to do business around the world — sign up free today.

Share

Related Posts

How to use Airwallex for automated insurance payouts

•5 minutes

Wallets, cards, and the flywheel effect: the formula for marketpl...

•6 minutes