How to open a business bank account in Australia from the US

- •Open a business bank account in Australia from the US

- •Why do I need a business bank account?

- •Choosing the right type of business bank account

- •Requirements to open a bank account in Australia

- •How to open a business bank account

- •How long does it usually take to open a bank account?

- •What fees to expect from a business bank account

- •Can you open a business bank account online?

- •Airwallex is your alternative to business bank accounts

Open a business bank account in Australia from the US

Setting up your business is the start of an exciting journey. And one of the first major things you’ll need to do is open a bank account.

But it’s not as straightforward as opening a personal account. The type of business you run will determine the type of account you need.

Here’s what you need to know to successfully open a business bank account in Australia.

Why do I need a business bank account?

Depending on your business structure, having a business bank account is a tax requirement. If your business operates under a company, partnership, or trust structure, then tax obligations require you to open a specific business bank account.

If you’re operating as a sole trader, however, you don’t have those requirements, and a personal bank account will most likely be suitable for your needs.

But a business bank account provides you with a number of benefits too that you won’t get with a personal bank account.

Your business account will make it easier to track your business cash flow. It allows you to separate your personal spending from your business income and expenses. It also provides a clear financial record for your tax obligations, making your financial reporting much, much easier.

Choosing the right type of business bank account

Much like your personal bank account, there are a few options to choose from when setting up your bank account.

Everyday transaction account

A high-traffic account for your everyday cash flow. These typically come in either a low-fee or no-fee option, and a premium option with more flexibility. It’s important to check the details of these business accounts though, as some accounts only allow a certain number of daily transactions.

Specialized accounts

Some banks have specialized accounts depending on the type of business you operate. This includes accounts for farm management support and not-for-profit organizations.

A savings account

Some banks provide options for business savings accounts, where you can keep your finances safe from being chipped away by expenses. Depending on the bank, you should be able to find options for standard savings accounts, term deposits, or options to create a cash reserve for your business.

Requirements to open a bank account in Australia

To ensure your business account setup is smooth, it’s helpful to have all the necessary documents on hand.

While the particulars may vary depending on the bank account you set up, these are the standard details and documents you’ll need to open a business bank account in Australia.

What details and documents you’ll need to get started

The full name of your company as it’s registered by the Australia Securities and Investments Commission (ASIC)

The address of your primary place of business

The address where your business is registered

Your Australian Company Number (ACN)

Your Australian Business Number (ABN)

Your business’ tax file number

The full names and one form of photo ID for each director. This can be your driver’s license or a valid passport. You can provide the original or a certified copy

The full names and one form of photo ID for anyone who will be operating the account. Again, you can provide the original or a certified copy

The type of industry your business is in

If your business operates under a trust or a partnership structure you’ll need to provide either the original or certified copy of your trust deed or partnership document

How to open a business bank account

While setting up a business account takes a little longer than a personal account, it’s not an onerous task. Here are the steps usually required to get started.

Compare bank accounts and find the one that suits your needs.

Head to the bank’s website and fill out the application form. You’ll need all the information detailed above, including your form of identification.

Submit your application.

Once the bank verifies your identity and business details they’ll open your bank account for you. You can now start using your bank account.

Receive any necessary credit or debit cards.

How long does it usually take to open a bank account?

Unlike in other countries, you can set up a business bank account in Australia entirely online. So if you have all the necessary information and documentation prepared prior, the application process should only take around 10-20 minutes.

Once you’ve submitted your application your bank should get in contact with you within the next 24-48 hours to confirm your identity and details.

Alternatively, you can take all your documents and details to a branch that specializes in business accounts, and speak directly to a business account specialist.

What fees to expect from a business bank account

Monthly fees

Unlike a personal bank account, business bank accounts often charge a monthly fee. While some are available for $0 a month, these will have limited capabilities. A business account monthly fee can range from around $10-$22 per month.

Transaction fees

Online transactions are usually free, which is fine if most of your financial transactions are done through net banking. Transactions where you need to withdraw or deposit cash, are known as ‘assisted transactions’. Most business accounts provide a certain amount of transactions per month, with unlimited assisted transactions if you opt for a more premium product. If you exceed your free threshold, assisted transactions can then range from $0.50 to $3.50 per transaction.

Currency exchange fees

Business accounts make your financials easier, but not necessarily cheaper. You’ll still be required to pay fees for currency conversions (around 1-4% of your total transaction) and foreign transactions (around 1-3% of your total transaction). So if you’re dealing with a high volume of international suppliers, this will add up.

ATM fees

Within Australia, you can withdraw cash at an ATM free of charge on your business account. But depositing cash counts towards your assisted transactions, so in some circumstances, you may be paying up to $3.50 just to deposit money into your account. Also, these may not be mentioned on the banks’ websites, but you can still expect to pay a withdrawal fee when getting money out at a foreign ATM.

Establishment fee

While you typically won’t be charged a fee just to set up your account, some banks may charge an establishment fee when transferring your existing account to a new account with them. This can set you back around $40, depending on the bank. So it’s not much, but it is something to be aware of.

Internet banking fees

Most banks include this as part of their package, but some banks (ANZ in particular) do charge for business internet banking.

Can you open a business bank account online?

Depending on your business structure, it may be possible to open a business account online. For simple business structures like sole traders that don't require extensive ID verification for multiple stakeholders, there is a greater likelihood that the bank account can be opened online. However, it is common for banks to request a face-to-face meeting at a branch between yourself and all account holders before allowing you to open a business bank account.

The bank will usually request that you make an appointment at a local branch and come equipped with the documents stated in this article and also ask you further questions about your business operations, as well as how you plan to use the account.

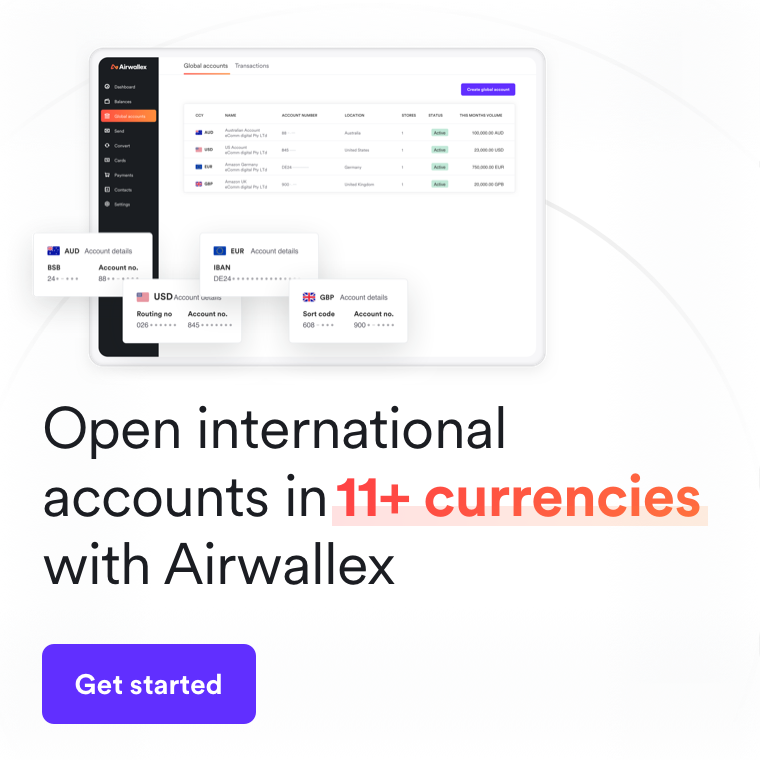

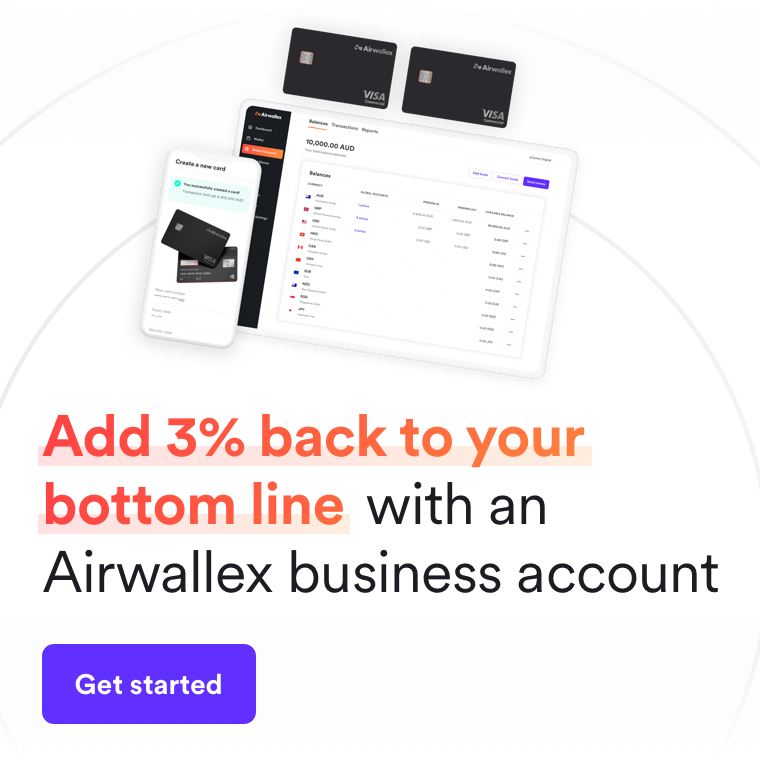

Airwallex is your alternative to business bank accounts

Traditional business bank accounts in Australia are useful—but they have their drawbacks. Airwallex Foreign Currency Accounts are a fee-free business account solution designed to help your business grow.

An Airwallex AUD Global Account provides you with a business bank account alternative that makes your finances easier. There are no sign-up fees, and no monthly fees, ever, and you can make as many deposits or withdrawals as you need, free of charge. Sending and receiving money internationally is cheaper, too, with just a small 0.3%-0.6% margin on top of your transaction. If your business has plans to scale overseas, or you do a lot of business with international suppliers, Airwallex provides you with the tools to make expanding into new markets a walk in the park.

With an easy online setup, and immediate access to your banking from approval, there’s no business downtime—you can start sending and receiving funds immediately, no need to visit a branch! Your account can also sync directly to Xero, making your end of year financials a breeze.

So for your business banking needs, click here to open an Airwallex AUD Global Account online and take the headache out of your business banking.

Related article:

Our products and services in Australia are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221. Any information provided is for general information purposes only and does not take into account your objectives, financial situation or needs. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs. Please read and consider the Product Disclosure Statement available on our website before using our service.

Share

Related Posts

When should (or shouldn’t) your business be in the flow of funds?

•6 minutes

How travel companies can save millions on cross-border payments

•6 minutes