How to calculate cost of sales for your business

- •What is cost of sales?

- •Cost of sales vs. cost of goods sold

- •Why is cost of sales important?

- •How to calculate cost of sales

- •What is the formula for calculating cost of sales?

- •What should I include in my cost of sales?

- •Should SaaS companies track cost of sales?

- •How to use the cost of sales formula to calculate gross profit

- •Airwallex can help you manage your money across borders more efficiently

One of the common challenges I hear when I talk to eComm and SaaS businesses is how to calculate the cost of sales. This comes up in conversation a lot as I discuss how these businesses collect, manage, and spend their business funds.

So I want to help clarify exactly how to do this calculation and why it’s important for your business. Why? Because understanding how to calculate your cost of sales is one of the core concepts for running a profitable eCommerce business.

Tracking the cost of sales (also called cost of goods sold or COGS) gives you vital insights into how well you’re pricing your products as well as other financial metrics.

Calculating your cost of sales doesn’t have to be tricky. In this guide we’ll explain what to include and how to choose the right formula based on your eComm business.

Finally, we’ll provide some examples so you can gain a deeper understanding of how to calculate your cost of sales.

What is cost of sales?

Investopedia.com defines cost of sales as the direct costs of producing the goods sold by a company.

To put it another way, cost of sales represents all the expenses that are directly involved in creating or acquiring the products (or services) you sell.

Cost of sales vs. cost of goods sold

If you’re wondering whether cost of sales and cost of goods sold are the same thing, the answer is yes.

The terms cost of sales and cost of goods sold are used interchangeably. Don’t confuse this with the cost of revenue, as this is something different.

Why is cost of sales important?

Calculating the cost of sales isn’t just something you need to do when it comes round to submitting your accounts.

Keeping track of cost of sales gives retailers a clear insight into one of the key financial metrics for establishing and maintaining a profitable eComm business. And that’s relevant all year round.

In addition, once you have your cost of sales, you can calculate your gross profit and your gross profit margin. We’ll cover this later in the article.

Importantly, you can leverage these insights to make informed decisions about your business to optimize profit levels.

How to calculate cost of sales

It might not be immediately obvious which expenses you should include in a cost of sales calculation and which you should leave out.

The simplest way to make the decision is to imagine what would happen if you stopped paying for a certain expense. Would you still have a product to sell?

If you can’t produce your product without a certain cost, you can feel confident that it should be included in your cost of sales calculation.

That doesn’t mean you should only include the cost of raw materials in your calculations. Manufacturing and storage costs, and even the cost of licensing software may be necessary to get your products made.

If your business doesn't make products but buys them to sell on, you will use the amount you paid your suppliers and the cost of shipping your products to your warehouse in your cost of sales calculation.

Other expenses may help increase sales, retain staff, and create a positive working environment, but if your product would still exist without them, they don’t count towards the cost of sales.

What is the formula for calculating cost of sales?

The first thing you need to know is that the calculation you use for the cost of sales depends on whether you sell goods/products, or services.

We’ll cover each of these in turn.

Formula for calculating cost of sales for goods and products

The formula for calculating cost of sales is:

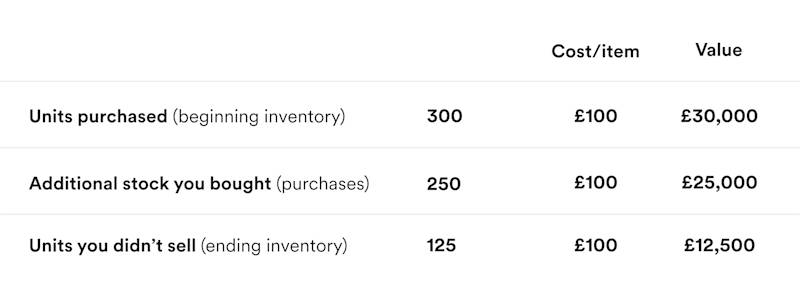

Cost of sales = beginning inventory + purchases – ending inventory.

Let’s go through each of these one by one.

Beginning inventory

If you’re calculating the cost of sales for a certain tax year or month, you need to know how much stock you had at the beginning of this period. This is your beginning inventory.

Purchases

'Purchases' refers to the cost of making or buying any new stock that was added to your inventory during the time period in question.

Ending inventory

Finally, you need to know how much stock you had at the end of this period. This is your ending inventory, i.e. items you didn’t sell.

Cost of sales = $30,000 + $25,000 - $12,500 = $42,500

What should I include in my cost of sales?

Whether you sell goods or services, you might be wondering which expenses to include in the cost of sales. Well, you’re not alone.

The truth is, it can be tricky to know which items should typically be included in a cost of sales calculation and which should be left out.

Essential vs. non-essential costs

The simplest way to decide what to include in your cost of sales calculation is to imagine what would happen if you stopped paying for that expense. Without it, would you still have a product to sell?

If there’s no way you could still produce your product without that expense, then it should be included in the cost of sales calculation.

The cost of raw materials, product storage, shipping or freight, and manufacturing employees’ wages are all essential.

How about licensing software? If it’s essential to getting the product or item made, then you should include it.

Other types of expenses may help increase sales, retain staff, and create a positive working environment. These may be vital to help your business grow in the long run, but if the product could still be made without them, don’t count towards the cost of sales.

Should SaaS companies track cost of sales?

If your eComm business is service based, you might be unsure whether you need to track the cost of sales.

SaaS companies don’t usually carry inventory. However, these types of business have direct costs, for example DevOps or internal engineering teams.

This is in addition to other essentials needed for creating or delivering the product, like hosting and third-party software.

Cost of sales is a key metric for SaaS companies because this figure is used to calculate the gross margin.

It’s not just business owners and CFOs that want to know this. Investors and acquirers are also interested in a SaaS company’s gross margin, so they can assess the quality of revenue - an important market for valuations.

For this reason, tracking cost of sales is important for SaaS companies.

How to use the cost of sales formula to calculate gross profit

Once you've worked out the cost of sales, you can calculate your gross profit using the formula:

Revenue - cost of sales = gross profit

It’s important to note that to calculate your net profit, you need to deduct other costs such as operating, tax, and interest expenses.

Once you know your cost of sales (and therefore your gross profit) you can determine the efficiency of your business.

Do you need to switch suppliers or raise your prices? How much money is left over to pay off debts? Is your profitability improving or declining over time?

These are crucial considerations for small eCommerce businesses with ambitions to grow.

Airwallex can help you manage your money across borders more efficiently

Running your eComm business efficiently while also driving growth can be challenging, especially if you’re a small team.

Choosing the right tools that simplify financial operations empower scaling companies to take advantage of opportunities and drive improvements to their bottom-line.

Airwallex is a business account that helps you reduce the cost of trading across borders.

With an Airwallex foreign currency account, you can collect, hold and send money in multiple currencies around the world whilst avoiding unnecessary conversion and transfer fees.

What's more, your Airwallex account is seamlessly integrated with Xero, so your bookkeeping will be updated automatically.

To see how we can help you stay on top of your business expenses, lower costs and maximise profitability, click below to watch a 3-minute demo.

Related article: Break-even analysis

Share

Rebecca is one of the eComm payments specialists at Airwallex EMEA. Rebecca helps eComm and travel businesses navigate the world of international payments.

View this article in another region:AustraliaCanada - EnglishCanada - undefinedEurope - EnglishEurope - NederlandsUnited KingdomGlobal

Related Posts

How to use Airwallex for automated insurance payouts

•5 minutes

Wallets, cards, and the flywheel effect: the formula for marketpl...

•6 minutes