The best way to collect payments from Canada

Looking to start selling in foreign marketplaces? If so, Canada should be at the top of your list.

Canada is the second-largest country in the world with one of the most thriving economies based on gross domestic product (GDP). Canada ranks ninth in the world with upwards of $1.64 trillion in nominal GDP.

Canada also has wide-scale diversity with varied cultures, world-class consumer brands, and an abundance of digitally savvy people. They’ve quickly caught on to the technology revolution.

That being said, Canada offers strategic opportunities for US businesses looking to expand.

Why should your US business expand to Canada?

Many business owners are realizing that Canada holds great opportunity for growth given its close proximity, large market size, and engagement in foreign investment and technology.

There’s also cultural similarities such as few language barriers between the US and Canada — both countries’ national language is English. Easier communication makes it more feasible to negotiate business terms and pursue other growth endeavors.

Canada is also our neighbor. Many eCommerce businesses selling through a foreign Amazon account or other online marketplaces such as eBay, Etsy, and more can ship and deliver much faster than an overseas vendor.

Additionally, the Canadian Dollar (CAD) is the sixth most tradeable currency in the world, while the USD ranks first. This makes converting CAD to USD (or vice versa) easier than most other currencies. However, global business accounts with Airwallex make foreign payouts and conversions as easy as possible regardless of the currency.

What is the best way to collect payments from Canada?

Regardless of the online marketplace you choose to sell on, collecting payments from Canada isn’t as difficult as you may think — as long as you use a trusted platform.

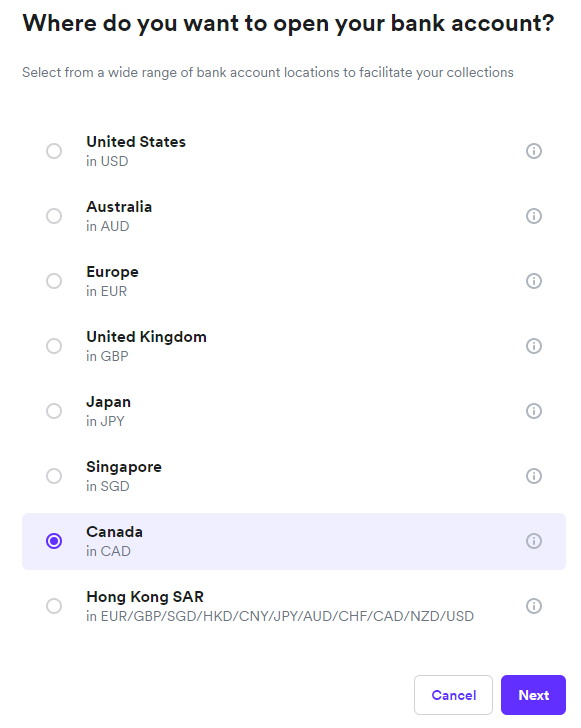

Airwallex is a global fintech platform that offers both domestic and foreign currency accounts cooperating with over 30 currencies in more than 144 countries.

Airwallex’s modern technology allows you to instantly receive USD (converted from CAD) into your online global business account with competitively low foreign exchange (FX) rates and minimal to no transfer fees. You can also avoid those lengthy bank transfer delays commonly experienced with traditional wires.

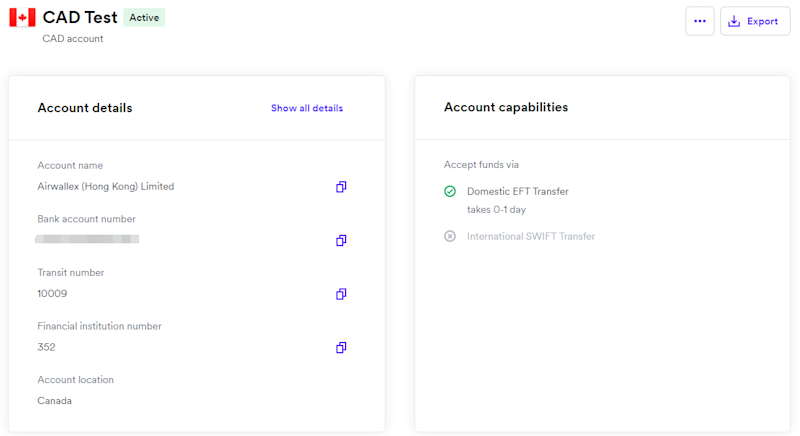

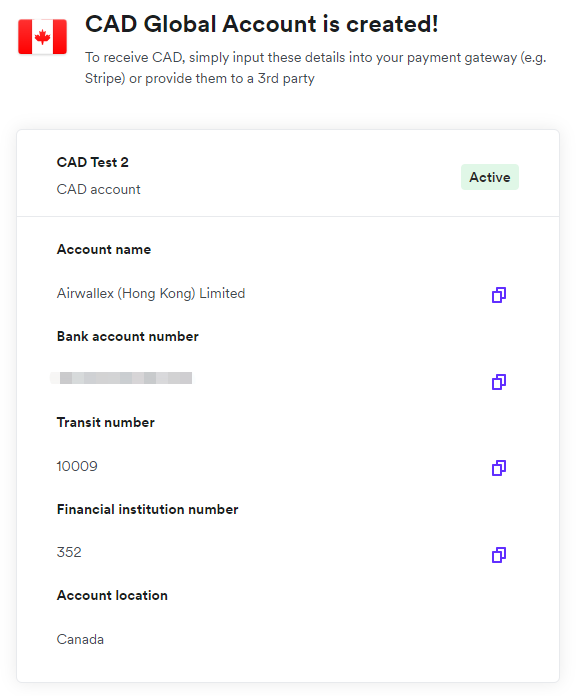

Our modern technology allows you to instantly receive CAD into a dedicated CAD global business account, without the hassle of setting up a local bank account in person.

How to open an Airwallex global business account

Signing up for an Airwallex foreign currency account means you can skip the bank queues and paperwork. Our borderless accounts allow you to engage more time and energy into your expansion rather than the financial intricacies of transferring foreign payouts and more — we’ll take care of it.

In fact, you can start accepting payments from your Canadian customers with just a few clicks. Here’s a rundown on how to get started on a borderless global account with Airwallex:

Sign up: Our global business accounts are free to open.

Set up: Our team will help you set up a local CAD account.

Enter details: Enter your Airwallex business account details into your eCommerce marketplace (or other third-party selling account).

Receive funds: It’s simply a short matter of time before your funds arrive.

Convert currency: Once your Canadian business is up and running, you can either hold your incoming funds as CAD, or convert it to USD without getting stung with hidden FX fees.

With an Airwallex borderless account, you can quickly receive funds as well as pay globally distributed teams more efficiently.

Sign-up with Airwallex to facilitate your expansion to Canada

If your business is expanding to Canada, don’t hesitate to create a global business account with Airwallex. Sign up for free and enjoy instant payouts with payment links, competitive FX rates when transferring money, borderless cards, and zero monthly account fees.

Share

Related Posts

How to use Airwallex for automated insurance payouts

•5 minutes

Wallets, cards, and the flywheel effect: the formula for marketpl...

•6 minutes