Think your business doesn’t have to worry about foreign exchange risk? It may be time to think again.

Nowadays, foreign exchange risk isn’t just an issue for big multinational companies. Dealing with the headwinds and tailwinds of foreign exchange rate fluctuations is just a part of doing international business, with currency values constantly shifting against each other. In fact, any company that has international suppliers or customers located outside its home country is subject to foreign exchange fees and currency fluctuations.

Also, double currency conversions (having to convert currencies twice, once to your home currency and once to the currency of your providers) can cause your business to lose portions of your well-earned cash every time you make a transaction.

Fortunately, there are steps your business can take to avoid unnecessary currency conversions, reduce your operating costs, and lessen your business’s exposure to income uncertainty.

Sound like a smart move for your business’s global scale-up? Let’s dive in.

What is double conversion?

We think this is best spelled out with a scenario.

Let’s say you’re a business owner based in the US; however, you have European customers and suppliers. Without a Global Business Account, you’ll have to pay foreign exchange fees every time you collect money from your European customers, and then again when paying your European suppliers.

This is what we call double conversion.

Converting your foreign currency revenue to your local currency and then your home currency back to other foreign currencies to pay suppliers isn't only time-consuming but also costly. It can significantly damage your profits and bottom line.

When your business’s financial processes involve converting currency multiple times, you’re unnecessarily exposing yourself to currency exchange rate fluctuations. To save money, it pays (literally) to use the right financial instruments that prevent the need for double conversion and reduce your overall operating costs.

How to prevent double conversion

Utilize an Airwallex Global Account

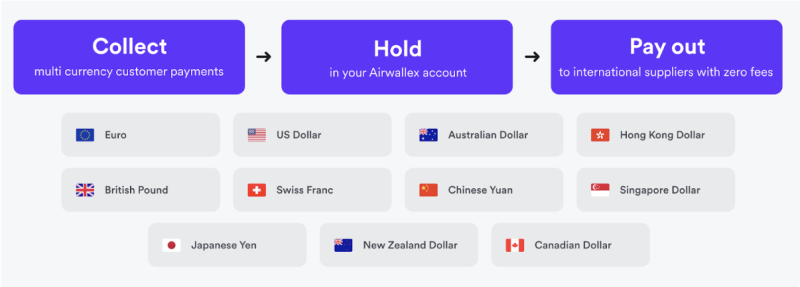

Opening an Airwallex Global Account allows your business to seamlessly trade in, convert, collect, hold, and pay in multiple foreign currencies from around the globe, including USD, EUR, AUD, HKD, GBP, and more.

How does an Airwallex Global Account work?

With a Global Account, you can open domestic and foreign currency accounts in minutes – all without visiting a bank branch (or even leaving your desk).

Then you can collect foreign currencies from your customers and hold them in your account, without being exposed to multiple unnecessary conversions.

Once you’ve collected a foreign currency in your account, you have two paths to choose from:

You can convert the money into your home currency. We offer a conversion rate between 0.5% and 1% above the interbank rate, which is significantly cheaper than other payment gateways and regular banks.

You can hold the money in your account without converting it, and use it to pay your suppliers or other international expenses in the future without paying transaction fees.

RYSE saves $25K+ annually by managing currency flows with Airwallex

RYSE, a fast-growing smart home tech company based in Canada, turned to Airwallex to simplify its cross-border financial operations and reduce currency conversion costs.

With 90% of its revenue in USD and most expenses in CAD, RYSE needed a way to collect in one currency and pay in another without double conversions. Using Airwallex’s multi-currency Global Account, RYSE can now collect in USD, hold or convert based on timing and need, and pay international vendors directly in local currencies.

The result? Over $25,000 in annual FX savings, faster international transfers, and more control over cash flow – all without juggling multiple bank accounts or manual wire transfers.

Paying suppliers and vendors

With an Airwallex Global Account, paying international suppliers and vendors is a breeze. You can collect funds from different countries, hold them in your Global Account, and then pay your suppliers directly from the platform in their local currency, making it simple for all.

Avoiding double conversion in this way can add hundreds of thousands back to your business’s bottom line, allowing you to dedicate your resources to realizing your organization’s vision.

Collecting money from customers and holding funds

The Airwallex Global Account’s seamless integration with international online marketplaces like eBay, Shopify, and PayPal makes it easy to accept payments from your customers in their local currency.

You can also hold funds in your account, meaning you can skip the queues, excessive paperwork, and even international travel trips that are sometimes required to set up bank accounts in countries outside the US.

Paying employees overseas

Having an Airwallex Global Account as part of your business’s financial infrastructure means you don’t have to pay unnecessary currency exchange fees when paying your overseas employees’ salaries. You can send your employees their funds fast and in full, with the full payment amount guaranteed on delivery when using the Airwallex local payment method (as opposed to the more traditional SWIFT network).

With hybrid and remote working now the ‘new normal’, you can empower your business to scale up globally by hiring (and paying) the people you really want on your team, no matter where they’re located. And in a way that doesn’t regularly hurt your bottom line.

Airwallex Corporate Cards minimize foreign exchange fees while traveling

With Airwallex Corporate Cards, you can reduce operating costs by minimizing foreign exchange fees when your team members travel internationally for business.

Our virtual and physical multi-currency Visa cards take seconds to set up and give your team the power to make seamless, low-fee transactions on your business’s behalf, no matter where they are in the world.

You’ll also easily stay in control of team budgets, with real-time monthly or total spend limits tracked in a single, easy-to-use spend management platform.

No foreign transaction fees

Airwallex cards take away the hassle of managing complex international balance sheets, with 0% international card transaction fees.

No more surprise foreign transaction fees on items like software subscriptions or marketing. You’ll be able to save time and realise immediate cost savings, so your team can stop worrying about the nitty-gritty and instead focus on using their skills to grow your business.

For example, RYSE (the fast-growing business we mentioned earlier) previously juggled multiple platforms and paid unnecessary FX and transfer fees on recurring expenses like software subscriptions. By switching to Airwallex and assigning unique Corporate Cards to each service provider, they streamlined expense tracking and avoided international transaction fees. Combined with the ability to pay from their Global Account’s multi-currency balance, this helped RYSE improve cash flow and reduce operational friction.

Only pay 0.5–1% above the interbank rate on FX fees

Why expose your business to unnecessary and expensive currency fluctuations when reducing your operating costs and improving your cash flow is so simple? With Airwallex, you’ll only ever pay our market-leading rate of just 0.5–1% above the interbank rate on foreign exchange fees, saving you money when making regular payments to your providers and employees.

Make payments directly with your multi-currency balance

With Airwallex corproate and employee cards, your team can easily pay for international expenses. The multi-currency balance of your Airwallex Global Account will make it easy to navigate the finances of international travel, as you save money both abroad (with low foreign exchange fees) and at home in the US (with up to 1.5% cashback on your domestic card spend).

For example, if one of your team members travelled from the US to Hong Kong for business, they could use the HKD within the Airwallex Global Account (their ‘HK wallet’) attached to their personal Airwallex Cards to pay for items during the trip.

How does preventing double conversion improve your bottom line?

Preventing double conversion brings many benefits for US businesses, including improving your organisation’s bottom line by saving you money (and time).

Save a minimum of 2–3% on FX by stopping double conversion

Stopping double conversion will save you a minimum of 2–3% more money than the standard double currency conversion rates for US dollars. You’ll always have access to our best rates with an Airwallex Global Account, no matter how big or small the transaction is.

Streamline operations to keep headcount and overhead low

Offering end-to-end expense management, Airwallex removes the need for large and clunky accounting teams, giving you the power to make decisions that lower your overheads and boost your bottom line. No more complicated expense reconciling and receipt collecting – just the right digital financial instrument for your business that gives you easy, real-time visibility over where your money is going.

Improve customer experience by collecting in local currencies

Allowing customers to pay for your products in their local currency reduces checkout friction, raises sales, and fuels your business’s global growth. Whether you’re a small business that’s just expanded into selling overseas or the owner of a larger and more mature company, improving the experience for your global customers should be at the forefront of your mind to ensure future success.

What about currency fluctuations?

What is foreign currency risk?

The exchange rates between the currencies of different countries are never fixed. They are freely traded on the global financial market and fluctuate for various reasons. Employment rates, inflation, trade deals, and government changes can all impact the foreign exchange rate between two currencies, which shifts daily.

With this in mind, foreign currency risk is the financial risk that results from fluctuations in the value of a home currency against a foreign currency. For example, if you’re a US-based business that buys raw materials from Japan, a foreign currency risk could be if the value of the US dollar crashes against the Japanese Yen, making it very expensive for your business to purchase the materials required to manufacture your products.

What’s the impact?

To some degree, all businesses are at the mercy of the currency market and must take proactive steps to safeguard themselves from currency volatility risk. The impact of currency fluctuations can be widespread for businesses, usually depending on the business supply chain, specific volatility, and other liabilities.

Transaction risk

Currency fluctuations can risk individual contracts and obligations your business might have. This could include being in jeopardy of being unable to pay foreign suppliers due to shifting foreign currency exchange rates and the subsequent squeeze on your profit margins.

Translation risk

Your balance sheet can suffer losses from currency fluctuations when your company denominates some of its assets, income, or liabilities in foreign currency (which you might do if you have foreign subsidiaries). The actual value of your assets hasn’t changed, but the value of your balance sheet can go up and down, potentially causing medium or long-term risk to your business.

Economic risk

Exchange rate changes can also reduce the competitiveness of US-based companies in the long run, regardless of whether or not they sell overseas. For example, suppose you manufacture all your products in the US. In that case, you’ll still be directly competing with other companies utilizing overseas imports, which may be cheaper due to currency fluctuations.

How to mitigate risks

With the right processes, you can reduce your exposure to foreign currency exchange rate fluctuations and protect your business through global market uncertainty. There are four more traditional ways you might do this:

Pass on the risk to your suppliers and customers by only operating in US dollars (or whatever your native currency is), meaning they bear the burden of conversion.

Use forward exchange deals to hedge against currency fluctuations. This is similar to insurance, where a related currency investment is set up and designed to offset changes in currency values, evening out the risk for businesses.

Open a foreign currency bank account with a regular US bank and then ‘match’ your sales receipts from one foreign customer paying you funds, to a foreign supplier that you owe funds to in the same currency.

Unfortunately, all of these strategies have cons. Unless you’re a large business with global leverage and a strong track record of success, the organisations you work with and customers who buy from you may refuse to take on the risk of conversion themselves. Your suppliers may refuse to invoice in US dollars, and your customers may go elsewhere.

The ‘matching’ strategy has more potential; however, it would require tedious bookkeeping and complex accounting to keep track of matching all your business’s international transactions.

Avoiding double currency conversion and reducing operating costs with Airwallex

The ideal way to mitigate double currency conversion risk (and reduce your operating costs) is to operate with an Airwallex Global Account. This account lets you open foreign currency accounts that give you a legitimate international financial presence, without needing to set up a physical entity in the country.

With Airwallex, you can seamlessly manage your money’s global movements, including taking customer payments, paying suppliers, holding money in multiple currencies, and exchanging currencies with transparent, competitive pricing.

In addition to the business process benefits, an Airwallex Global Account will also improve your bottom line by mitigating your business’s exposure to foreign currency risks. There will be no double conversions and no unnecessary transaction fees.

The best part? You can set up your Airwallex Global Account online for free. If you have questions, contact the Airwallex team for a free demonstration of our financial infrastructure, which can revolutionize the way you do business throughout the US and beyond.

Airwallex Editorial Team

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

Posted in:

TransfersShare

- What is double conversion?

- How to prevent double conversion

- RYSE saves $25K+ annually by managing currency flows with Airwallex

- Airwallex Corporate Cards minimize foreign exchange fees while traveling

- How does preventing double conversion improve your bottom line?

- What about currency fluctuations?

- How to mitigate risks

- Avoiding double currency conversion and reducing operating costs with Airwallex