What is a telegraphic transfer?

Telegraphic transfers can be used to send funds to almost any country in the world. They are available in many major banks and can be used to transfer large sums of money across borders, making them a versatile cross-border payment option for many businesses, especially those who make regular payments to international contractors or suppliers.

If your business works with overseas suppliers, it is important to be able to pay them on time using international money transfer methods that process funds quickly. Choosing the right payment processing method can not only help your business make timely payments and maintain good supplier relations, but it can also save your business money over time by avoiding unfavourable transfer fees and exchange rates.

Read on to learn how telegraphic transfers work, the costs and time frame associated with TT payment, and how you can use them to settle business payments with overseas vendors and suppliers.

What is a Telegraphic Transfer (TT)?

Telegraphic transfer, also known as TT payment or TT transfer, is a method of transferring funds electronically from one bank account to another, typically across international borders. It involves a direct transfer of funds from the sender's bank to the recipient's bank through secure banking channels.

TTs are often used for international money transfers and can be initiated online or through a bank branch. They are known for their speed, security, and global reach, making them a popular choice for businesses making overseas transactions.

Meanwhile, Electronic Funds Transfer (EFT) is a broader umbrella term that refers to the electronic transfer of funds. It encompasses various electronic payment methods, including wire transfers, telegraphic transfers, peer-to-peer payments, Automated Clearing House (ACH) transfers, QR code payments (e.g. PayNow and PayLah!), direct deposits, and debit/credit card transactions.

Eager to learn more about speedy and reliable international payments? Discover our product suite here.

How Telegraphic Transfers work

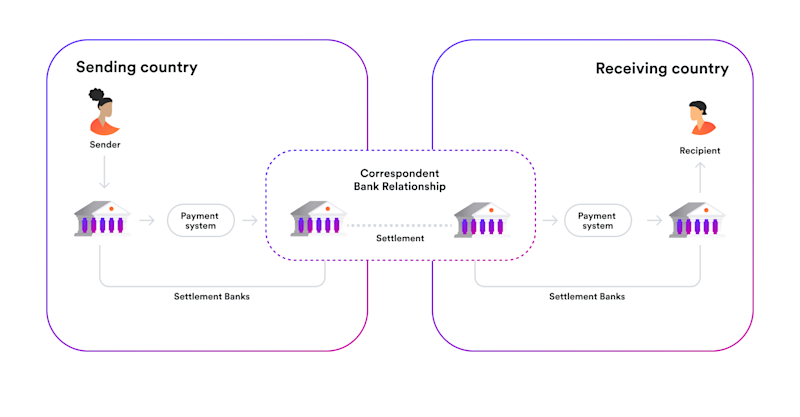

The current process of making a TT payment is entirely digital, leveraging a secure network of banks and a messaging system called SWIFT. Here’s a breakdown of the key players involved in an international telegraphic transfer and how they make your cross-border payment work:

Between the sender and the recipient, the parties involved are;

The sending bank – The sender’s bank initiates the TT transfer. It verifies their information, deducts the transfer amount from their account, and transmits the transfer instructions.

The receiving bank – Your recipient’s bank plays a crucial role in verifying the transfer details and crediting the cross-border payment to your recipient's account.

Intermediary banks – In some cases, additional banks might be involved, particularly if the sending and receiving banks lack a direct relationship. These intermediary banks act as relays, passing on the transfer instructions and funds like a baton in a relay race.

What are the steps involved in a telegraphic transfer?

Let’s paint a more detailed picture with a step-by-step view of telegraphic transfers.

1. Gather the necessary information

Before performing the TT payment via a bank’s online platform, the sender must ensure they have all the necessary details to avoid any delays in the transfer process.

These details include the sender’s full name and bank account information, as well as the recipient’s full name and bank account number. Additionally, the sender will need the recipient’s bank name and the bank's unique identifier for international transactions, also known as the SWIFT code.

2. Verification and fees

The sender’s bank will verify the information they’ve provided, ensuring their funds go to the intended recipient, and that the transfer amount matches their instructions. It will also inform them of any applicable fees associated with the TT transfer, including the:

SWIFT transfer fee: A flat fee charged by the bank for processing the transfer via SWIFT in order to cover its administrative costs.

Commission: A fee based on a percentage of the transfer amount. This can vary depending on the bank and the transfer amount.

Intermediary bank charges: If intermediary banks are involved, they may have their own fees that get added to the overall cost.

3. Transferring the money

Once the sender has reviewed and approved the foreign telegraphic transfer, their bank will deduct the full amount from their account. The sender should ensure they have sufficient funds in their account to cover the entire amount.

4. The sender’s money is sent by SWIFT

The sender’s bank then utilises the secure SWIFT network to transmit an electronic message containing all the necessary bank wire details. This message acts like a digital envelope carrying important instructions, including:

Your recipient's name and bank information

The transfer amount and currency

Any special instructions you may have included, such as the purpose of the telegraphic transfer

The sender’s bank may send the message directly to the recipient’s bank if they have a direct relationship. Otherwise, it will be routed through intermediary banks until it reaches the recipient.

5. The recipient receives money

International telegraphic transfers typically take 1-5 business days to complete, as mentioned above. This depends on several factors, such as the countries involved, intermediary banks (if any), currency exchange processes, the weekends, and bank holidays.

How much do Telegraphic Transfers cost?

The cost of a telegraphic transfer depends on many changing variables, including various bank transfer fees and currency exchange rates. Senders should factor in these fees and rates into their overall sums whenever they’re performing a telegraphic transfer payment.

Unfortunately, these fees and rates can add up quickly. When all of these costs are combined, the sender may end up having to pay more than what was originally listed on the recipient’s invoice to them.

‘Inward’ and ‘outward’ telegraphic transfers

To more thoroughly understand the structure of related costs, it can also be helpful to understand the difference between an ‘inward’ and ‘outward’ when thinking about what is TT.

Banks generally use the terms "inward" and "outward" wire transfer or remittance to describe the direction in which money is being sent.

An inward telegraphic transfer is when your bank account receives money from an external source. It’s an “incoming” fund transfer from your bank’s perspective and can mean a payment from an overseas bank account or a local transfer.

An outward telegraphic transfer is when you send money from your bank account to a local or overseas recipient. It is an “outgoing” transfer from your bank’s perspective.

Each type of transfer has its own fee structure, which can include a commission, flat processing fee, and other bank charges.

Best ways to send a telegraphic transfer

Kicking off the telegraphic transfer process will depend on your banking provider, as processes will differ depending on which service you use.

In many cases, you may be able to log in to your online portal and navigate to a link to ‘Telegraphic Transfer’. These may also be titled something like ‘International Transfers’, ‘Send Money Globally’ or similar. Sending from an online portal could be considered the best way to conduct a telegraphic transfer, as it will be easier for the sender and can be done on their own time.

However, a bank may also require you to request the service in-person at a branch, which may be less convenient for the individual. If this is the case, it’s recommended to take all the required details along.

Alternatives to a telegraphic transfer

Telegraphic transfers are a tried and tested method for sending and receiving money internationally – but this process does also have its drawbacks and limitations which may encourage senders and recipients to look at alternative services.

What makes Airwallex an alternative telegraphic transfers?

If transaction fees and unfavourable conversion rates are eating into your margins, Airwallex offers another way to handle international payments.

Fast, cost-effective transfers through local payment rails

Like many payment specialists, Airwallex offers efficient and low-cost international transfers. Unlike other fintech firms, however, Airwallex uses local payment rails to minimise the complexities, fees, and delays often associated with TT payments.

Move money like a local in 12 currencies

Airwallex offers a robust Global Account that lets you operate with local business accounts in several countries. With a Global Account, you actually get a local bank code, branch code, and dedicated account numbers - without having to visit a physical bank branch.

This makes it easy for you to receive and hold funds in USD, GBP, CNY, and other leading currencies. You can also use these funds to make local payments, which helps you avoid multiple conversions and their associated fees.

Streamline spending with physical and virtual corporate cards

Beyond payments, Airwallex offers additional financial tools like the multi-currency Borderless Card. Available as both physical and virtual debit cards, the Borderless Card runs on the Visa network and lets you pay using funds in your multi-currency account, eliminating unnecessary conversion fees.

The Borderless Card comes with expense management features that let you view and approve transactions in real time. Businesses can create as many cards for different departments and employees. The card also supports greater control over your employees’ purchases with the ability to set spending limits and restrict purchases to only specific merchant types.

Learn more about the next-generation tools for international money transfer

Do you think that Airwallex’s international transfers could fit your business’ needs? Learn more about our advanced suite of transfers and FX tools, and discover the rest of our Business Account offering.

International transfers at lower cost

FAQs:

Are telegraphic transfers safe?

Telegraphic Transfers are generally regarded as a secure way to send funds abroad. There are various variables involved in security and reliability, as well as local compliance and regulatory requirements depending on the locations in which the transfers are sent and received.

2. Are telegraphic transfers expensive?

The costs of telegraphic transfers will depend on the recipient and sender’s associated bank fees, plus the various exchange rates that may apply. See a more detailed breakdown of costs and comparisons above.

3. What are the disadvantages of a telegraphic transfer?

The three main disadvantages of telegraphic transfers include;

Hidden transfer fees

Banks often charge fees to both senders and receivers for telegraphic transfers. If intermediary or correspondent banks are involved, they might also levy their own charges, leading to multiple fees for a single transaction.

2. Foreign exchange risk

Exchange rates offered by banks are often unfavourable to business owners. That’s because banks earn a margin by offering customers a less favourable exchange rate than the interbank rate - the rate at which they can obtain the currency themselves.

These unfavourable rates can give you greater exposure to foreign exchange risk - the possibility of losing money due to changes in the exchange rate between the time you make the sale and the time you receive the payment.

3. Slow transfer speed

A TT is not always instantaneous. International transfers, in particular, can take several days to complete, especially if they involve intermediary banks or pass through countries with slower banking infrastructures. Factors like public holidays or unforeseen technical issues can also influence the transaction speed.

It can sometimes be difficult to track a TT, especially if there are delays. Some banks might not provide real-time updates or detailed information about the transfer's status or any hold-ups it's encountering.

Share

David is a fintech writer at Airwallex, specialising in content that aids EMEA businesses in navigating global and local payments and banking. With a rich background in finance, business, and accountancy journalism, David brings over a decade of experience. Previously, he was the Head of Content and Press at a leading financial services company and trade journalist at a media group specialising in business and finance.

View this article in another region:AustraliaCanada - EnglishCanada - undefinedMalaysiaNew ZealandSingaporeUnited StatesVietnamGlobal

Related Posts

Q&A: How Airwallex solves the treasurer’s historic headache

•5 minutes

Invoice like a pro: How to master the process

•9 minutes