The best business bank accounts in Australia in 2024

- •Best business bank accounts in Australia in 2023

- •What is a business bank account?

- •Business bank accounts versus personal bank accounts

- •The benefits of a good business bank account

- •How to evaluate the best business bank account for your needs

- •Compare the best business bank accounts in Australia

- •What about small businesses?

- •Discover the no-limit business account made for small businesses

- •FAQs

Best business bank accounts in Australia in 2023

With so many of the big four and challenger banks claiming to have the best business bank account, it’s not easy finding the right one for your business.

Owning a business means you have to walk and chew gum at the same time. You’re forced to become a skilled marketer, an all-star recruiter, and a self-taught finance expert. And then comes the key decisions like choosing a business bank account that will help you grow and manage your cash flow.

So what fees, features and benefits should you look for when choosing a business bank account?

It all depends on the way you use it.

But first, let’s explore what a business bank account is and why you absolutely need one. (No one wants the hassle of working out which transactions were for dinner or their business.)

What is a business bank account?

A business bank account is a type of bank account that's opened in the name of an entity — as opposed to an individual.

Those who’ve tried to operate their personal and business affairs from the same account know this can get quite complex as your business grows. That’s why dedicated business bank accounts exist. They’re designed to provide business owners with the support, functionality and visibility they need to manage their business.

For many businesses, it’s also a legal requirement. If your business is registered as a company, partnership or trust in Australia, you are required to open a business bank account for tax purposes.

Business bank accounts versus personal bank accounts

There are some key differences between personal and business bank accounts that differentiate the two.

Where personal bank accounts are typically no- or low-fee, business bank accounts will likely have fees attached. It’s typically only around $10 a month, but it’s there to cover the extra services they provide.

And speaking of services, when compared against personal bank accounts, business bank accounts provide an expanded service offering. You’ll likely find specialised merchant services, business loan and overdraft facilities, term deposit functions, invoicing tools, and increased reporting and accounting features. Some even have connected foreign currency accounts to enable international banking.

Due to the nature of the account, business bank accounts have higher daily spend limits, too. You’re not just paying for your groceries or paying off your credit card—you’re paying vendors and clients.

The benefits of a good business bank account

It’s not hard to see the benefits of a bank account for small businesses.

They’re made specifically for businesses, so they have more functionality built into their service.

They’re safer. A business bank account clearly separates your personal finances from your business finances, adding that extra layer of security between personal and professional dealings.

It’s easier to track your business dealings. With a business bank account, it’s all there in one place, so can easily see your incoming and outgoings.

You spend less time on admin. A separate business bank account keeps all your business financials in one place. You don’t have to rummage through your e-receipts to separate tax from personal payments.

It prepares you for the future. A business bank account makes it easier to manage to scale your business.

How to evaluate the best business bank account for your needs

Here are some key things to think about when comparing your choices, to help you find the best business bank account for your small business. It’s not exhaustive, but it can help make the process easier.

Account fees. Have a look at the account fees and see if they match the service level offering. And keep in mind that some business bank accounts have a fee-free option.

International fees. As a growing business you might be doing business with international entities, so it’s important to find a bank that offers competitive rates to send and receive money internationally.

A strong branch network. Some international banks don’t have any branches in Australia, so if you need to deal directly with that bank, make sure they have a partner bank in Australia that you can visit.

Does it have an online platform or portal? A comprehensive online business banking portal will make it much easier to manage your finances.

Overdraft facility. You won’t always need overdraft facilities, but it’s comforting to know it’s there when you do.

Account limits. Some business bank accounts limit the number of people able to use the account, so check this first.

Staff-assisted transactions. Check for staff-assisted transaction fees. If you regularly receive cash payments, find a bank that doesn’t charge for in-branch staff-assisted deposits.

Airwallex Business Account

We’ve included the Airwallex Business Account as a comparison, so you can see what a better alternative looks like.

Fees

None. Airwallex doesn’t charge any monthly account fees, international fees, withdrawal fees, telephone enquiry fees—nothing. Just pay a small FX margin whenever you convert funds into different currencies, which is either 0.4% or 0.6%.

Features and benefits

Create multi-currency business accounts. Create individual foreign currency accounts for 11+ currencies so you can send, hold, and receive international currencies, and avoid double conversions.

Global FX and International Payments. Make Money Transfers to 150+ countries, in over 40 different currencies.

Access virtual debit cards. Create multiple virtual debit cards in seconds, and start using them immediately.

Physical multi-currency cards. Create and order physical debit cards for your team and have them sent out instantly, without needing to visit a branch.

Expense management. Throw away the receipts and replace repetitive work and clunky software with an accurate, zero-touch experience your employees will love.

Xero integration. Your Airwallex Business Account syncs seamlessly with Xero, so you can keep all your financial information up to date, making reconciliation a breeze.

Low FX rates. We only ever charge 0.4% or 0.6% above the interbank FX rate, so you always get the best rate possible—up to 90% better than what the Big 4 can offer.

Get started right away. As soon as your account is verified, you can use it right away. No waiting around for authorisation.

Compare the best business bank accounts in Australia

With that tongue-twister out of the way, let’s look at the key features for each of the Big Four Banks’ business bank account offerings.

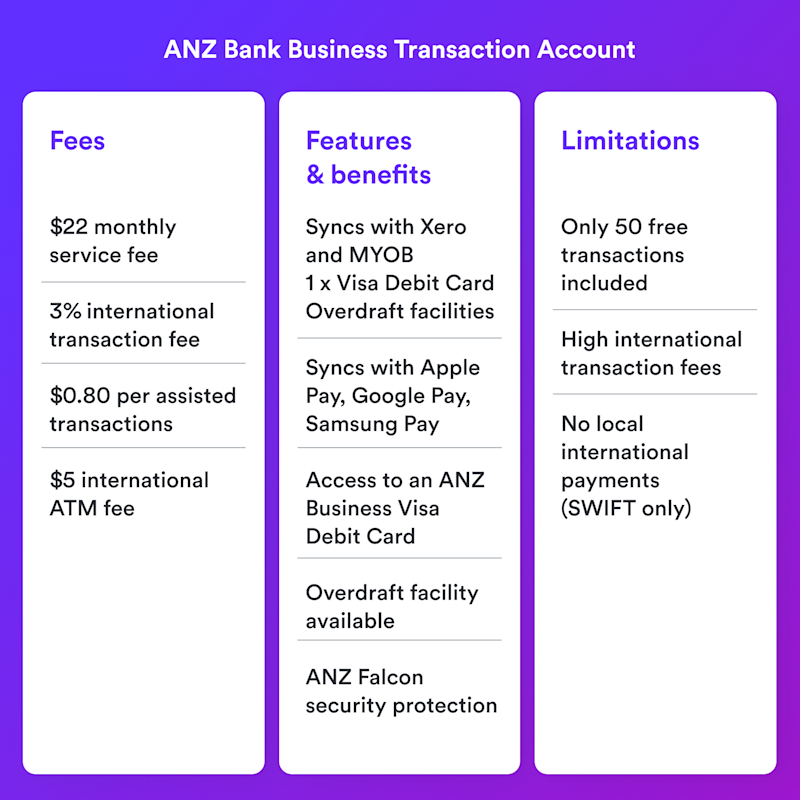

ANZ Bank Business Extra Account

Fees

$22 monthly service fee

3% international transaction fee

$0.80 fee for staff-assisted transactions, merchant deposits, and cheque transactions

$5 international ATM fee

Features and benefits

Syncs with accounting platforms like Xero and MYOB

Syncs with Apple Pay, Google Pay, Samsung Pay

Access to an ANZ Business Visa Debit Card

Overdraft facility available

ANZ Falcon security protection

Limitations

There are only 50 free transactions included with the fee.

High international transaction fees

No option for local international payments (SWIFT only)

Commonwealth Bank Business Transaction Account

Fees

Switchable $0 - $10 monthly account fee option

$3 per assisted transaction

$15 overdraw fee

$5 + 3% international ATM fee

3% international transaction fee

Features and benefits

No minimum account balance

Comes linked with a Visa Debit Card

Syncs with accounting platforms like Xero and MYOB

Syncs with Apple Pay, Google Pay

Real-time banking alerts

No transaction limits

Limitations

High international transaction fees

No option for local international payments (SWIFT only)

Only one business debit card per account

National Australia Bank Business Everyday Account

Fees

$10 account fee

Features and benefits

Linked NAB Business Visa Debit Card available

Free assisted transactions

No ATM fees

Limitations

This option has fewer features than other business bank accounts.

High international transaction fees

No option for local international payments (SWIFT only)

Westpac Bank Business One Low Plan

Fees

$10 monthly account fee

$1 for in-branch deposits or withdrawals

$0.25 - $0.25 telephone banking enquiry

$5 + foreign surcharge for foreign ATMs

3% international transaction fee

$15 overdraw fee

Features and benefits

Unlimited electronic transactions

25 assisted transactions

Complimentary online invoicing tool

Business Mastercard included

Syncs with accounting platforms like Xero and MYOB

Limitations

There are a few more fees associated with this account—the charges for telephone banking enquiries are an unusual one.

High international transaction fees

No option for local international payments (SWIFT only)

What about small businesses?

Finding a business account built specifically for small businesses can be challenging, but there are a few key criteria to look for in your search. Small business bank accounts should be low/no monthly fees and do not charge penalties for not achieving minimum deposit thresholds. When cash flow is tight, every dollar counts and so this flexibility will enable your business to continue to use capital where it's needed most. It's also critical to find a small business bank account that will grow with you. As your business grows, so do your payment needs and their complexity. By opening a small business bank account that has features like international payments, online payment processing and card creation from day one, you save yourself countless hours of having to switch in a year or two when you've outgrown your current provider. Check out the Airwallex business account for a low-fee business account that will do just that.

Discover the no-limit business account made for small businesses

Airwallex Business Accounts are made to provide the best business account experience to Australian small businesses, without any of the limitations of the big banks. Open, operate, and send and receive foreign currencies transaction fee-free. Manage your business financials from one central hub. And never pay any bank teller or phone enquiry fees ever.

Get in touch with us today to book a demo and see how an Airwallex Business Account can help you grow.

Related article: Open a business bank account in Australia

FAQs

Which bank is best for small businesses in Australia?

There is no one best bank for small businesses, only the most suitable bank for your business. Choose the bank that provides the services you need.

What do I need to open a business bank account in Australia?

It varies from bank to bank, but generally, the banks will require at least two documents out of the following four:

Australian Passport (current or one that has expired within the last 2 years)

Australian Visa in foreign passport

Australian driver’s licence

Australian Medicare card

Share

Joe Romeo is responsible for scaling our Airwallex's product adoption in the UK and the world. An all-around growth enthusiast, Joe's speciality lies in SEO, organic acquisition and making lasagna.

Related Posts

How to open a business bank account in Australia from Singapore

•7 minutes