Stripe vs Airwallex: compare on fees, features and benefits

If your business sells products or services online, you'll need a payment gateway to accept credit and debit card payments from customers. Both Stripe and Airwallex offer payment gateways that can plug into your eCommerce store, but which solution is right for your business? Read on to find out how Airwallex compares to Stripe on price, features and benefits.

What is Stripe?

First things first — what is Stripe?

Stripe is a payment processing company that offers business owners a platform to accept single and recurring payments from customers.

Stripe offers a point-of-sale (POS) payment processor for brick-and-mortar retailers to accept in-person payments, and a payment gateway for eCommerce businesses to accept debit and credit card payments online. Mobile wallet payments, “buy now, pay later” and invoicing services are also available through Stripe.

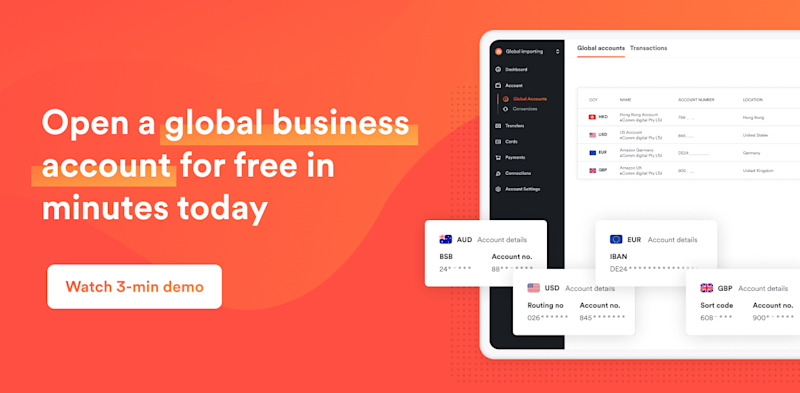

What is Airwallex?

Airwallex is a one-stop solution for cheaper and more efficient money management.

The Airwallex online payment gateway integrates seamlessly with Shopify, WooCommerce and Magento, and offers cheaper transaction fees for debit and credit card processing, and better FX rates than Stripe.

Airwallex allows eCommerce businesses to settle in multiple currencies "like-for-like" directly into a Global Account. In practice, this means your business can collect online payments from domestic and international customers in their local currency, manage funds in your Airwallex account, and use those funds to pay out to international suppliers using Airwallex Borderless Cards and high-speed Transfers to 150+ countries, all whilst avoiding costly currency conversions. If you do wish to convert currencies, you'll benefit from near-interbank exchange rates.

Compare Stripe with Airwallex

Use our comparison table to see how Stripe measures up against Airwallex on fees, features and benefits:

| Airwallex (Hong Kong) | Stripe (Hong Kong)* | |

|---|---|---|

| Free to sign up | ✅ | ✅ |

| Capabilities | Payment gateway, like-for-like settlement, Business Account and Corporate Visa Card |

Payment gateway |

| Countries and currencies | Process in 180+ countries and 170+ currencies |

Process in 180+ countries and 135+ currencies |

| Local card (HKD) fees | 3.3% + HK$2.35 | 3.4% + HK$2.35 |

| Overseas card (USD) fees | 3.6% + HK$2.35 + 1% overseas card fee = 4.6% + HK$2.35 |

3.9% + US$0.30 + 1% USD payout fee’ = approximately 4.9% + HK$2.35 |

| Overseas card (other major currencies**) fees |

3.6% + HK$2.35 + 1% overseas card fee = 4.6% + HK$2.35 |

3.9% + HK$2.35 + 2% FX fee^ = 5.9% + HK$2.35 |

| FX rate markup | As low as 0.2% above market FX rate |

2% above market FX rate |

| Account manager support | ✅ | No dedicated account manager |

| Fraud & 3DS | Included in gateway fee | HK$0.25/3DS for accounts with custom pricing |

* Retrieved 1 April 2024 from Stripe Pricing, https://stripe.com/en-hk/pricing. For reference purposes only. For details, please refer to the official website of Stripe.

’ Stripe supports USD payout for Hong Kong entity companies if the client can provide a U.S. domiciled USD account.

** Other major currencies include AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD and SGD using Airwallex like-for-like settlement.

^ Assume the payout is in HKD for a company registered in Hong Kong.

Stripe fees explained

Stripe charges a fee for each successful credit or debit card transaction.

Stripe fees vary depending on whether the card your customer uses to pay is domestic or international. The fee also differs when your customer chooses to pay with their Chinese wallet.

In addition to their transaction fees, Stripe charges a 2% FX fee if you wish to convert foreign currencies to your domestic currency.

Airwallex fees explained

Airwallex also charges a per-transaction fee for successful credit and debit card payments. These fees vary depending on whether the card payment is domestic or international.

Airwallex supports businesses that operate globally by allowing you to eliminate costly currency conversion fees with like-for-like settlement. If you do wish to convert currencies, Airwallex offers market-leading FX rates as low as 0.2% above interbank FX rates.

Airwallex Global Accounts explained

Airwallex Global Accounts allow you to collect, manage and send multiple currencies without converting funds to your home currency. For example, if your business has European customers, you can collect payment in EUR, manage the EUR in your account, then use those funds to pay for expenses such as SaaS subscriptions and supply chain costs without being subject to FX fees.

You can transfer funds from your account to 150+ countries and regions, or pay out using your Borderless Cards.

Use Airwallex for more streamlined global money management

Airwallex integrates seamlessly with eCommerce platforms such as Shopify, WooCommerce and Magento. Once set up, you can accept customer payments from 180+ countries and regions directly into your Global Account.

Airwallex multi-currency settlement allows you to accept foreign currency payments without auto-converting to your home currency, saving you money on each international transaction. If you do wish to convert your funds, you can take advantage of Airwallex’s low FX rates.

The benefits of Airwallex's online payment gateway include:

Accept payments from 180+ countries and regions and 160+ payment methods.

Settle like-for-like in 12+ currencies directly into your Global Account. Avoid double conversions and hedge against currency fluctuations.

Make use of a multi-entity account structure so you can manage your sub-brands with a central, consolidated group dashboard view.

Pay out to suppliers and staff in multiple currencies from your multi-currency account, avoiding FX fees by repurposing the funds you collect in the same currency.

Enjoy competitive FX rates — just as low as 0.2% above the interbank exchange rate.

Choose from flexible integration options, ranging from a simple plug-and-play solution to a fully customisable checkout.

Reduce chargebacks and improve payment acceptance rates with our pre-chargeback program and smart retry logic.

Protect against fraud with our 3DS fraud engine.

Enjoy the benefits of Airwallex’s full product suite, including multi-currency Global Accounts, Borderless Cards, end-to-end expense management including software to manage expenses, employee reimbursements, and invoices, faster and cheaper global transfers and embedded finance.

Integrate with your accounting software for easy reconciliation, including Xero, QuickBooks, NetSuite and more.

Integrate Airwallex with Shopify, Magento and WooCommerce and save on FX.

The benefits of Stripe’s online payment gateway include:

Get paid globally in 135+ currencies and dozens of payment methods.

Flexible integration options, from hosted payment pages to fully customisable flows.

Protect your business from fraud and increase authorisation rates on every payment using Stripe’s machine learning and data from millions of businesses.

Create customisable invoices to accept recurring or one-off payments.

Stripe’s full stack of products and services includes online payments, billing, invoicing, point of sale and embedded finance.

*Retrieved as of 19 February 2024. Information provided is for reference only. Please refer to Stripe's official website for the most up-to-date details.

Final thoughts

HK and global eCommerce companies can save money while growing their businesses at home and abroad by signing up for an Airwallex Business Account.

Share

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

View this article in another region:AustraliaHong Kong SAR - 繁體中文SingaporeUnited KingdomUnited States