OFX transfer: fees, FX rates, security and processing time

- •What is OFX?

- •What are the advantages of using OFX for money transfer?

- •How to transfer money via OFX?

- •Fees and charges for OFX

- •How long does it take to transfer with OFX?

- •Comparison between OFX and Airwallex

- •Airwallex: all-in-one financial platform for eCommerce and cross-border businesses

- •Frequently asked questions

What is OFX?

OzForex (OFX) is an international remittance company based in Australia. For over 20 years, OFX has specialised in providing cross-border money transfer services and is listed on the Australian Securities Exchange. Operating in over 190 countries and regions globally, OFX enables users to convert more than 50 currencies. OFX is well-known for its flexible remittance options and diverse services, including instant transfers, regular transfers, limit orders, and forward contracts. With offices established in various regions worldwide and regulated by local financial regulatory authorities, OFX assures users of reliable and secure international remittances solutions.

What are the advantages of using OFX for money transfer?

No remittance fees: OFX waives additional remittance fees. In contrast to traditional banks, utilising the platform's remittance services generally leads to lower total costs, enhancing business competitiveness.

Competitive FX rates: OFX offers customers tailored exchange rates influenced by market conditions, transfer amounts, and transfer frequency. These rates can provide benefits over standard market rates.

Flexibility: OFX offers versatile remittance solutions, including limit orders to lock in target FX rates and forward contracts to secure rates ahead of time. These features are invaluable for users managing FX rate fluctuations, allowing them to effectively control the operating costs.

Dedicated support: With over 20 years of global remittance expertise, OFX offers 24-hour customer support in both Chinese and English. This ensures that customers receive timely and comprehensive assistance throughout account opening and transfers.

Multi-currency Support: OFX supports remittances in over 50 currencies, offering a broad array of options to satisfy your needs for money transfers.

How to transfer money via OFX?

Step 1: Registration

To utilise the OFX Global Currency Account, business customers must first register on the OFX website.

Visit the official OFX website and click “Register”. Complete the online registration form.

Provide your personal details, the address of your business, nature of business, and more.

OFX then will contact you for "Know Your Customer" (KYC) and supplement a copy of the Corporate Client Agreement for your completion.

Once the documents are reviewed and approved, you can begin using the account for money transfer.

Upon making the first remittance, you will receive a confirmation call from the OFX team.

Step 2: Remittances

Once registered, customers can conveniently send remittances online or via the OFX mobile app.

Log in to the OFX platform or app.

Specify the sending and receiving currencies and remittance amount. The system will automatically display the FX rate, fees, and the amount the recipient will receive.

Confirm the FX rate and enter the recipient's personal information and bank details.

Verify the information and submit the transaction. Then, transfer the funds to OFX’s designated bank account.

After receiving the funds, OFX will process the exchange and initiate the remittance

OFX will send email notifications during both receipt and distribution of funds, allowing customers to track their remittance status.

Fees and charges for OFX

OFX offers a significant cost advantage for businesses by eliminating monthly or account setup fees and waiving additional transaction fees for remittances. Moreover, OFX stands out with its competitive exchange rates, which are aligned with current market rates. These rates can be tailored based on factors such as the amount, frequency, and currency pairs involved. As a result, customers making larger or more frequent remittances may benefit from more favourable exchange rates.

How long does it take to transfer with OFX?

The processing time via OFX varies based on the destination and currency. Typically, once receiving the transfer from the sender, OFX deposits the funds into the recipient's account within 1-2 business days. However, the exact timing depends on the remittance country and the banks' processing times.

Keep in mind that weekends or holidays may extend the timeline. Compared to traditional banks, OFX provides faster remittances, offering significant convenience for businesses.

Comparison between OFX and Airwallex

OFX provides a variety of remittance solutions like instant transfers, forward contracts, and limit orders. These options allow businesses to tailor their fund management strategies according to their needs. Airwallex, on the other hand, offers a comprehensive financial platform that includes OFX’s features and more. With these tools at their disposal, businesses can streamline their international transactions and improve cash flow management.

| OFX | Airwallex |

|---|---|---|

Fees | No additional remittance fees, but FX rate might include a premium | 120 countries via local rails incur $0 TT fees |

FX rates | Tailored according to currency, transfer amount, frequency and market conditions | 60+ trade currencies at interbank rates |

Minimum remittance amount | Most major currencies are at around US$150 | None |

Supported currencies | 50+ | 60+ |

Features | Dedicated Alliance Manager and limit orders | All-in-one solution including Global Account, Borderless Visa Card and more |

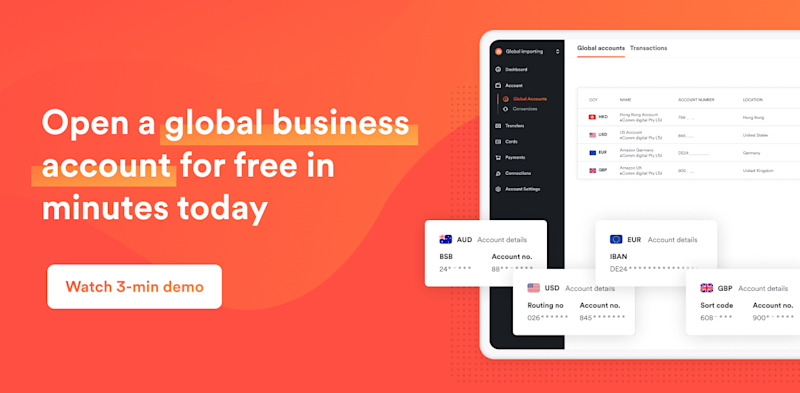

Airwallex: all-in-one financial platform for eCommerce and cross-border businesses

Airwallex is a comprehensive suite of solutions for businesses of all sizes to manage their international payments. Designed with corporate users in mind, particularly those in eCommerce and cross-border businesses, Airwallex provides essential tools for multi-currency fund management. Key services include Global Accounts and Borderless Visa Cards, which make it an attractive choice for modern enterprises. With Airwallex, approximately 85% of money transfers are credited within hours or on the same day. The Borderless Visa Card enables the issuance of multi-currency cards across 40 markets, allowing businesses to pay directly from balances with 0% foreign transaction fees and streamline employee expense management.

Beyond its efficient and user-friendly services, Airwallex places a strong emphasis on security and compliance. Licensed as a Money Service Operator (MSO) in Hong Kong, it is regulated by the Hong Kong Customs & Excise Department. Furthermore, Airwalles is authorised and regulated by financial authorities in different countries including Australia, Singapore, US, Canada, UK and more. This ensures that all transactions are conducted securely and transparently.

Frequently asked questions

1. Is it safe to transfer with OFX?

OFX is regulated by multiple regulatory authorities globally and is registered in various major markets, making its remittance services reliable. In addition, OFX employs multiple layers of security measures, such as identity verification and fraud detection during account setup, to maximise the protection of users' funds and personal information and reduce risks.

2. Is there a limit on the remittance amount for OFX?

OFX has a minimum remittance amount of approximately 150 USD and no maximum limit. However, when customers send large remittances, they must ensure compliance with the financial regulatory standards and local laws across different countries.

3. Does OFX offer business accounts?

OFX offers Global Currency Accounts for corporate users. These accounts support multiple currencies, allowing businesses to receive and make international payments. They are ideally suited for various types of small and medium enterprises and eCommerce platforms.

Sources:

Information on OFX was retrieved as of October 2024, from below sources. Information provided is for reference only. Please refer to the official website of OFX for the most up-to-date details.

1. https://www.ofx.com/clp/hk/2020-ofxpert/business/index-zh.html

2. https://www.ofx.com/en-gb/faqs/

3. https://www.ofx.com/en-gb/exchange-rates/

Disclaimer: We wrote this article in 2024. The information was based on our own online research and we were not able to manually test each tool or provider. The information is provided for educational purposes only and a reader should consider the specific requirements of their business when evaluating providers. This research is reviewed every six months. This publication does not constitute legal, tax, or professional advice from Airwallex nor substitute seeking such advice, and makes no express or implied representations / warranties / guarantees regarding content accuracy, completeness, or currency. If you would like to request an update, feel free to contact us at [email protected]. Airwallex (Hong Kong) Limited is regulated by the Customs & Excise Department and holds a Money Service Operator license (MSO License No. 16-09-01929).

Share

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

View this article in another region:AustraliaHong Kong SAR - 繁體中文New Zealand