Boost your Shopify sales with an express checkout experience leveraging Apple Pay and Google Pay

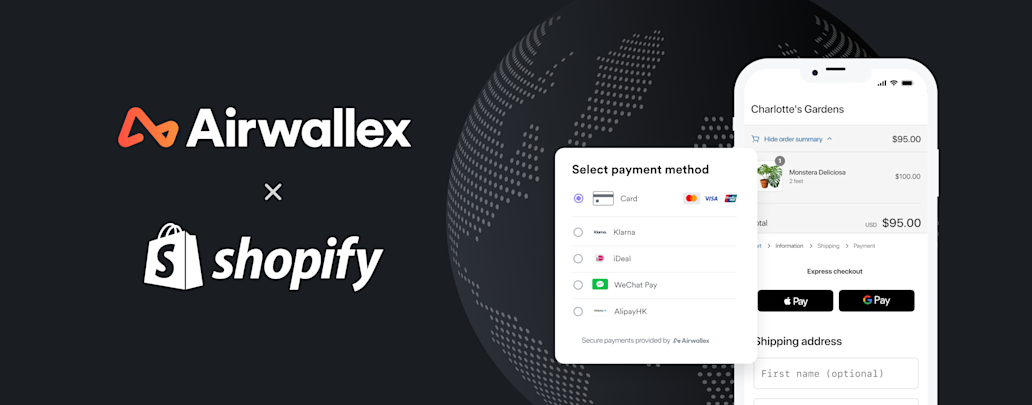

If you’re a merchant selling on Shopify, there are two factors that are crucial to your bottom line. The first is avoiding unnecessary costs, and the second is removing any obstacles that are getting in the way of customers completing their transaction. That’s why it’s good news that Airwallex has become the first payment services provider on Shopify to support both Apple Pay and Google Pay express checkout.

Airwallex launched its payments app for Shopify merchants in 2022. This allows Shopify vendors to accept and hold payments in multiple currencies, avoiding costly foreign-exchange fees. These foreign currencies can then be used to pay overseas suppliers. Where currency conversion is unavoidable, you can access interbank FX rates.

Now, Airwallex offers an even more powerful solution for Shopify merchants. With Apple Pay and Google Pay integration, customers can complete their payment in just a few taps, without even leaving the Shopify platform. That means that vendors using Airwallex as their payment provider can not only lower costs, but also boost their conversion rates.

It has been found that seven in ten shoppers abandon their shopping carts after they have added items, without completing the transaction. Abandoned carts are a huge problem for vendors on Shopify and other platforms, so boosting the percentage of shoppers who complete transactions is a surefire way to increase merchant profits.

Seamless checkout experience with Apple Pay and Google Pay

It’s now simple for Shopify merchants using Airwallex Payments to add Apple Pay and Google Pay as part of an express checkout experience.

The Apple Pay and Google Pay checkout buttons appear before customers are required to fill out any information forms on Shopify. This removes any friction from the checkout process. The result is an effortless experience that is likely to have a positive impact on the merchant’s shopping cart conversion rate.

Customers on Shopify will be able to pay with their saved card information and address, whether they are using mobile or desktop devices. And while the process is quick, it is also secure. Biometric authentication happens almost instantly in the form of either fingerprint or facial recognition. These verification methods are hard to fake or hack, and easy for the customer to use.

Of course, not every Shopify customer will be a registered Apple Pay or Google Pay user. Those not using express checkout methods will still be able to enter their payment information directly on the merchant’s checkout page, ensuring conversion rates stay as high as possible.

How mobile payment apps have improved the eCommerce checkout experience

Google Wallet launched in 2011 as a mobile payments technology that aimed to replace credit cards. Since then, it has been re-formatted and re-named several times, as Android Pay, Google Pay Send and Google Pay. Also known as GPay, Google Pay was launched as a mobile app in 2020.

Apple Pay launched in 2014, also aiming to provide a new payment method for smartphone users. Apple team leaders pointed out that Apple Pay isn’t just quick and easy to use, it is also secure and private. No purchase history is collected, strangers are less likely to see private information that is on the front of bank cards, and payments can be quickly suspended if a device is lost.

By 2023, it has been estimated that 150 million people will use Google Pay and over 500 million people will use Apple Pay globally. A 2023 study showed that half of Gen Z consumers use Apple Pay, making them the generation most likely to do so and the share of Apple Pay and Google Pay among all wallets has grown from 12% to over 20% in the last 5 years.

Power your global Shopify checkout with Airwallex

With Airwallex as your payment services provider (PSP) you can:

Accept card payments without redirecting your customers to a different checkout page

Improve your checkout conversion rates by offering Apple Pay, Google Pay and 60+ local payment methods

Safeguard against fraud with our 3DS fraud engine and customizable risk settings, streamline customer refunds, and improve global acceptance rates.

Eliminate costly FX fees that eat away at your margins

Airwallex is now directly integrated with five major card networks: Visa, Mastercard, UnionPay International, American Express, and JCB. More than 60 local payment methods are available to create a fully local checkout experience for global customers. These include Buy Now Pay Later (BNPL) payment methods like Klarna, iDeal, Giropay, and Bancontact.

With Airwallex, you can accept multi-currency payments without unnecessary fees. Collect international payments from customers in 180+ countries directly into your Airwallex Global Account. Funds can be collected in 10+ currencies and settled into your Airwallex account without being forced to convert funds to your home currency. This money can then be used to pay international suppliers, employees, and contractors using Airwallex’s Borderless Cards or Transfers to 150+ countries. When you do want to convert currency, you can access interbank FX rates through Airwallex.

Any merchants using Airwallex have the peace of mind of knowing their money is secure. Modern infrastructure allows Airwallex to implement best-in-class security controls which are monitored 24/7 to keep accounts safe, and Airwallex meets the highest international security standards in addition to local regulatory requirements.

Add Airwallex payments to your Shopify store today

Shopify merchants can integrate with Airwallex’s online payments solution without any development work. You can get up and running in minutes; there’s no coding required.

Airwallex was already offering a market-beating service for Shopify merchants, especially those operating across borders or with ambitions to do so. Now that service is even more powerful with the introduction of Apple Pay and Google Pay express checkout. The service is seamless, secure, and cost-effective.

Get started with Airwallex today.

Share

View this article in another region:Hong Kong SAR - 繁體中文Global