A complete guide for cross-border trades: tools for overseas and Mainland China transfers

E-commerce is gaining rapid momentum in Hong Kong. However, due to the complications of cross-border logistics and international customs clearance procedures, many e-commerce businesses can only stay local. Today, with financial technology and cross-border e-commerce reaching a level of maturity, it’s time for your e-commerce business to expand globally.

What is cross-border e-commerce?

Simply put, it’s a form of online shop, where product display, order placement, payment, and customer service all happen online. The difference is that the buyer and seller are in different countries or regions, involving various currencies, tariffs, and export procedures. Cross-border transactions and logistics are inevitable challenges, as most e-commerce businesses do not have overseas warehouses,

What are the existing cross-border transaction tools?

You should be no stranger to cross-border payment tools such as PayPal and Alipay, if you have any online shopping experience. Yet, for cross-border e-commerce, you will need to consider tools that support B2B transactions, enabling payment to suppliers and collection from corporate clients. The most popular cross-border transaction tools are:

PayPal

Western Union

Alipay

WeChat Pay

Payoneer

Credit cards

Cross-border logistics

Cross-border logistics may sound like a headache; but when you look closer, you only need to consider one of two ways: arrange delivery by yourself, or sign up for a cross-border e-commerce platform with an integrated logistics system.

If you decide to manage order fulfilment by yourself, you will first need to choose between international express, air freight, or sea freight. Any good business person will know that delivery speed is key to customer satisfaction. Nonetheless, the faster the delivery, the higher the cost. You will also need to be careful with export declaration and import customs clearance procedures, as even the slightest mistake may cost you the whole shipment.

Cross-border e-commerce platforms with one-stop logistics management services may be a simpler and more cost-effective option. Platforms such as Amazon offer a hassle-free integrated solution, with warehousing, stock management, and delivery tracking all on auto-pilot. As an e-commerce owner, all you need to do is to ship sufficient stock to the designated third-party warehouse. When the system receives an order, your product will automatically be packed and shipped without you lifting a finger.

Mainland China cross-border transaction tools: WeChat Pay vs. Alipay

WeChat Pay and AliPay are the two most popular payment tools in mainland China. They each have launched a Hong Kong version to facilitate cross-border payments.

The major difference between the two is that, WeChat Pay is a function within the WeChat app, which also doubles as an instant messaging application used by most people in China; Alipay is solely a payment tool.

Because of this fundamental difference, generally speaking, WeChat Pay is mainly used for daily consumption, such as grocery shopping and dining, whereas Alipay is mostly for cross-border online shopping.

That said, for cross-border e-commerce owners, it’s best to sign up for both WeChat Pay and Alipay accounts to tap into the vast market.

Cross-border transactions with WeChat Pay HK and AlipayHK

WeChat Pay HK and AlipayHK are the Hong Kong versions launched by the two app giants. This allows Hong Kong users to spend in Hong Kong as well as in mainland China, without having to link with a mainland Chinese bank card. Hong Kong users can simply tie their app accounts with a Hong Kong bank card instead. All RMB spending will then automatically be converted to HKD for settlement.

It is worth noting that to use the apps for cross-border transactions in mainland China, users must first go through the identity verification process. We highly recommend that you complete the authentication ahead of time, as the approval process will take approximately 7 working days to complete.

| WeChat Pay HK | AlipayHK | |

|---|---|---|

| Authentication not completed and not yet linked with Hong Kong credit card/bank account | Cannot perform cross-border transaction | Cannot perform cross-border transaction |

| Authentication not completed and linked with Hong Kong credit card/bank account | Annual transaction limit: HK$25,000 Maximum balance: HK$3,000 |

|

| Authentication completed and identity verification completed (with your mobile number, scan HKID, and facial scan) | 5 transactions of no more than HK$ 500 each per day, or a maximum of HK$ 1,000 per day without a Payment Password HK$ 30,000 per day once Payment Password is set up Maximum balance: HK$ 100,000 |

Transaction limit: Pay by balance: HK$ 50,000 Pay by bank account: HK$ 20,000 Pay by credit card: depends on the credit limit Pop-up limit: HK$ 30,000 per month; HK$ 200,000 per year |

| Approval time | Approximately 7 working days | |

Note: The above information is relevant to WeChat Pay HK only. If you are using Weixin Pay (WeChat Pay in China), the requirements of identity verification and transaction limits may differ.

*Information as of 4 January 2024. Please refer to the official websites for more details.

Overseas cross-border transaction tools: PayPal vs. Western Union

PayPal is one of the most used cross-border payment tools around the world. Users can register for an account for free with only their email address and basic personal information. With the PayPal Commerce Platform, cross-border e-commerce owners can offer a wide range of international payment options for their customers, including credit cards and debit cards. By reaching global customers, PayPal can be a valuable tool for global business expansion.

Western Union is an express money transfer company, offering online remittance, mobile app transfer, and “start online, pay in-store” services. For cross-border transactions, you will simply need the recipient’s bank details. No account with Western Union is required. Transfers can be credited within minutes, and recipients can collect cash in one of the Western Union outlets - a value-added option for e-commerce owners who need to pay suppliers in cash. You may also choose to use the “Start Online, Pay In-Store” option, where you can lock in the online exchange rate for 12 hours, within which you will need to visit an agent location to pay for the transfer in person.

Cross-border transactions with PayPal and Western Union

PayPal users can simply register for a PayPal account with an email address. Users can start cross-border transactions right away once they link a credit card or bank account to their PayPal account. On the contrary, Western Union users can initiate cross-border transfers without an account. All you need is the recipient’s bank details, and you can track remittance progress until the transfer is completed - in as fast as a few minutes.

For PayPal merchants, any commercial transactions, including online shopping, will incur 3 merchant charges: commercial transaction rate, fixed fee, and additional percentage-based fee for international commercial transactions. For Hong Kong e-commerce, the transaction fee is 3.9% + a fixed fee of HK$2.35, plus an additional 0.5% fee for foreign exchange.

As for Western Union, the service fees and foreign exchange rates vary depending on the currency and location of the recipients. The best way to find out all related charges and exchange rates is to go to the official website of Western Union. Notably, the fee for online remittances is different from in-store transfers.

| Requirements | Fees | |

|---|---|---|

| PayPal | Email address and basic personal information Verification is not mandatory but will impose a limit to cross-border transaction amount |

For each transaction: Commercial transaction rate 3.9% Fixed fee HK$2.35 Additional 0.5% fee for international commercial transactions |

| Western Union | Only requires recipient’s bank details to initiate cross-border transfer | Service fees and foreign exchange rates vary depending on the currency and location. Different fees for online remittances and in-store transfers. |

*Fixed fees vary depending on the currency received. All fixed fees listed in this article are based on HKD.

*Information as of 4 January 2024. Please refer to the official websites for more details.

Advantages and risks of PayPal and Western Union

Cross-border e-commerce, like all business, involves risks. Although PayPal and Western Union are two of the most trusted international payment tools, there are a few important things to note:

| Advantages | Risks | |

|---|---|---|

| PayPal | Customers in some markets have already accustomed to using PayPal, minimizing concerns and fractions of cross-border transactions | It’s not uncommon for freezing merchant account, possibly impacting your cash flow. |

| Western Union | Express international money transfer Fees borne by the buyer/payee Option to collect cash before order fulfillment |

Chance of fraud as buyers can cancel the remittance before the merchant withdraws funds and after the order is shipped |

*Transfer money via credit card or cash deposit to the merchant’s bank through Western Union can be completed in as fast as 24 hours. However, the remittee can cancel the transaction if the merchant has not accepted the payment, payment has not arrived, or if the transaction is held up due to technical issues.

FAQ for cross-border payments

Can I use a Hong Kong offshore business account for cross-border payments?

Yes. In fact, if the transaction volume or amount is large, using a Hong Kong offshore business account for cross-border transactions is a wiser option, as you can bypass the transaction limits imposed by cross-border payment platforms. However, the downside is that you will need to bear the hefty transaction fees and long processing time.

Which one is the cost-effective cross-border transaction tool?

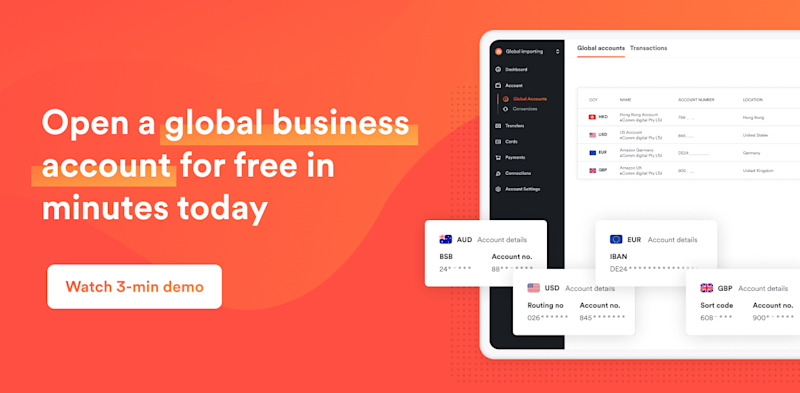

Airwallex is a remarkably cost-effective international payment tool for cross-border retailers and suppliers. With Airwallex Multi-Currency Global Account, international e-commerce owners can collect payments in 12 currencies, without worrying the extra costs associated with forced conversion. You can also seamlessly integrate Airwallex with a plethora of e-commerce platforms, and offer over 160 local online payment options for customers around the globe, including credit cards, Apple Pay, Google Pay, and Alipay, streamlining cross-border cash flow management.

More importantly, Airwallex never charges international transaction service fees or monthly fees. We only charge an additional fee of as low as 0.2%, on top of the interbank foreign exchange rate for cross-border transactions.

Airwallex Business Account for eCommerce – enjoy up to 80% off international shipping

What's more – if you have international shipping needs, propel your business with our exclusive discounts with FedEx. Eligible customers can enjoy up to 80% off on international shipping* for new FedEx corporate account.

Sign up for free today, and experience cross-border transfer services beyond the status quo. Stand out from the fierce competition of e-commerce, take your business global, and take advantage of our FinTech-powered services to unlock your growth potential.

Reference:

WeChat Pay HK FAQ: https://pay.wechat.com/en/index.shtml

Alipay HK FAQ: Making Payment and Bill Payment: https://www.alipayhk.com/en/faq-shoppers/making-payment-bill-payment/

Alipay HK FAQ: Top up and withdrawal: https://www.alipayhk.com/en/faq-shoppers/top-up/

PayPal Fees for Sellers: https://www.paypal.com/hk/webapps/mpp/merchant-fees?locale.x=en_HK

Western Union Frequently Asked Questions: https://www.westernunion.com/hk/en/frequently-asked-questions.html

*T&Cs apply.

Share

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

View this article in another region:Hong Kong SAR - 繁體中文