6 definitions you need to know while applying for an online payment gateway

- •Important information before you start

- •Step 1: Start the process on “Payments” page

- •Step 2: Let us know your business’s anticipated sizes and volume of transactions

- •Step 3: Sit back and watch your revenue coming in

- •FAQ: What if my business is new, and has no previous records?

- •Airwallex is your partner in growth

You’ve got your products or services defined, had your store set up, and decided that Airwallex is the most suitable and convenient option for your online payment gateway. Now, you’re about to unlock another important milestone: complete your KYB (Know Your Business) onboarding process, so that you can start receiving funds using the Airwallex online payment gateway.

Know Your Business (aka KYB) is a process to verify that a business is legitimate and safe to do business with. This is a fairly common practice among payment service providers, including Airwallex, and can help minimise the chance of fraud.

Important information before you start

There are some guiding principles that will help you breeze through the KYB process.

Understand what the 6 essential key terms entail. They’re straight-forward and easy to understand.

Always give your best estimates and allow some buffer for your business growth. This can ensure a smooth, stress-free experience in the future.

Your estimate should only include online transactions made by this payment gateway. Exclude all offline transactions and other transactions that you may have using other online payment platforms, e.g. in-store POS transactions or online affiliate incomes.

Let’s get on with it!

Step 1: Start the process on “Payments” page

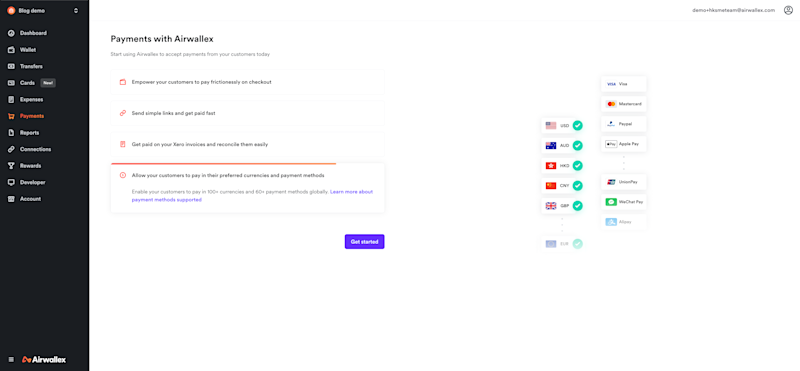

Login to your account and navigate to “Payments” on the left-hand sidebar.

Under “Payments with Airwallex”, click “Get started”.

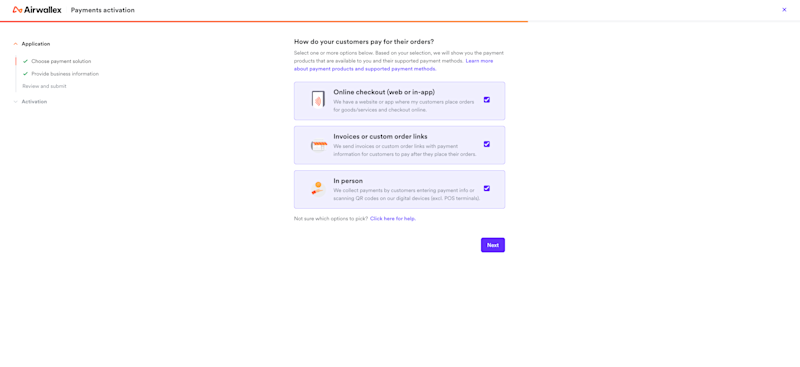

Then, choose your preferred payment solution(s).

Step 2: Let us know your business’s anticipated sizes and volume of transactions

Here, you’re required to provide some basic information and estimates of how much and how many transactions you'll be using this online payment gateway for in the next 12 months. If you don’t have past references, give us your best estimates.

Average transaction size (in your selected currency):

This means your customers’ average spending amount on each purchase.

To calculate the average transaction size, simply divide your total revenue by the number of transactions, ideally from the last 12 months, or any set period of time.

Maximum transaction size (in your selected currency):

This is the maximum amount of funds per transaction that will go in or out your account.

Consider this carefully — you’d want this number to match with your largest possible order amount, and at the same time, reflect your business growth in the future.

Average monthly volume (in your selected currency):

This means your customers‘ monthly spending amount.

Only successful transactions should be included in the calculation. Make sure you exclude all transactions related to merchant fees, refunds and reimbursements.

Percentage of products or services provided to international customers

“International customers” refers to customers that reside in a country or region different from where your business is registered. In other words, this means the percentage of transactions that will be conducted in foreign currencies or will involve overseas transfers.

Let’s say you’re an online bookstore owner based in Hong Kong. In the last 12 months, your business generated 800 transactions from the local market in HKD, and 200 transactions from the US, Singapore, and other countries and regions outside of Hong Kong in foreign currencies.

To calculate your percentage of products or services provided to international customers, you can simply follow this simple formula:

Number of foreign transactions / Total number of transactions x 100%

In the bookstore example, it would be

200 / (800 + 200) x 100% = 20%

Delivery time

Delivery time is also referred to as order fulfilment days or shipping dates. Regardless of what it’s called, it essentially means the time needed for your customers to receive their goods or services, after paying for their orders.

There are 3 options you can choose from:

You provide the goods or services before customers pay for their orders (This may be applicable to SaaS Software subscription and digital product merchants)

A time range

Exact number of days

If you have existing online payment operations, there are 2 more numbers we’ll need from you:

Dispute rate

Dispute rate is the percentage of total successful payments that are claimed as disputed charges by card schemes.

Normally, you can easily locate the Dispute Rate in your payment dashboard. For example, if you’re a Stripe user, the number sits on the “Radar for Fraud Teams” in the dashboard; PayPal users can find the Dispute Rate in the Resolution Centre.

If you have trouble finding this information, please contact your payment provider.

Refund rates

Refund rate is the percentage of total successful payments that are refunded to your customers.

Step 3: Sit back and watch your revenue coming in

Because it’s that easy to complete the KYB process!

Worth noting though, it will take time for our operations team to review your application. Our team is working around the clock to support businesses, and you will be notified in no time once your application is processed.

FAQ: What if my business is new, and has no previous records?

Remember the guiding principles? Always give your best estimates, and allow some buffer for your business growth.

This applies to new businesses too. There is absolutely no reason to worry even if you don’t have any numbers at hand.

We recommend that you create a 6-month projection, with a reasonable estimate for the maximum ticket size.

Again, take into account your business growth, so that your online payment gateway will still work like a champ with no hiccups.

Got questions about the KYB process? Reach out to your dedicated Product Specialist or Account Manager. We are always standing by to help you troubleshoot, and help you unleash the full potential of your business through our online payment and a full suite of FinTech services.

Airwallex is your partner in growth

If you haven’t already, sign up for an Airwallex Global Business Account and unlock your growth potential, worldwide. Airwallex also offers market-beating exchange rates and company and employee cards to help you streamline your finances.

Get in touch with us today to explore how Airwallex can help you to achieve your business goals. Want to hear what our customers say before signing up? Check out the success stories of our customers in eCommerce, including fashion label Ginger, vegan leather apparel brand SOULMATTE and digital transformation consultancy DigitSense, to get inspired!

Share

Sophia Cheng is a content strategist at Airwallex, specialising in FinTech, startups, and SMEs. She has a robust background in the fintech industry spanning investments to payments, having previously worked for a leading roboadvisor in Hong Kong. Her background provides a holistic view of technology and finance and how they can play a crucial role in streamlining financial operations for businesses.

View this article in another region:Hong Kong SAR - 繁體中文United Kingdom

Related Posts

Opening a mainland China bank account for Hong Kong businesses: p...

•10 min

Five popular eCommerce platforms in Hong Kong: pricing, features,...

•10 min