Insights from latest 2024 research: challenges and development trends for Hong Kong trading SMEs

Kirstie Lau

Brand Content Marketing Manager

Trade has long been pivotal to Hong Kong's economic growth, positioning the city as a global trade hub that draws businesses from the globe for commercial ventures. According to the Hong Kong Trade Development Council, import and export activities constituted 16.3% of Hong Kong's GDP in 2022. In 2023, the total value of trade in goods reached $1,131 billion (about HK$8,822 billion).

In the third quarter of 2024, Airwallex conducted a focused study on the import and export trade of small and medium enterprises (SMEs) in Hong Kong. Despite escalating operating costs, the study revealed that businesses engaged in cross-border trade in Hong Kong remain committed to growth and expansion. This article will summarise the report's key findings, such as businesses' current understanding of Hong Kong's trade advantages, primary operational challenges, industry strategies, and the trajectory of business expansion. We discovered that the digitisation of financial processes and establishing a foothold on global eCommerce platforms are key trends propelling industry evolution. Read on to gain a deeper understanding of industry perspectives and to make better, more informed strategic decisions.

What are the advantages of engaging in trade in Hong Kong?

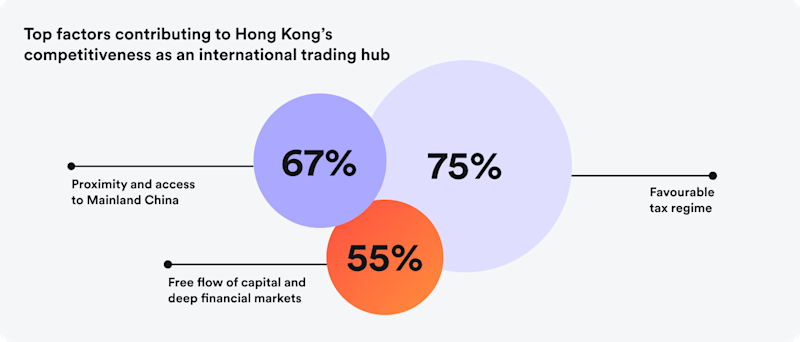

The report, "The Future of Hong Kong Trade: Embracing Tech-Drive Solutions for Global Growth" interviewed 105 trading companies in Hong Kong across various trade sectors including catering, clothing, cosmetics, household goods, electronics, and healthcare products. The companies highlighted three key advantages of Hong Kong as a global trade hub: its superior tax system, close proximity to Mainland China, and a stable financial market.

The report reveals industry professionals' confidence in the current landscape and their plans for expansion. Remarkably, 82% of the surveyed companies intend to enter or operate in at least one new market within the next six months. The implementation of various free trade agreements has further reinforced Hong Kong's position as a gateway to Asian markets. The report also highlights that many companies are eyeing Asia for expansion, with popular markets including Northeast Asia, Southeast Asia, and Europe.

The top 3 pain points for local SME traders

While the local and global business environments attract enterprises to expand, the reality of rising operating costs and financial pressures cannot be overlooked. Over half of the respondents identified increased costs related to supply and logistics as their most pressing concern, worsened by global supply chain disruptions and inflation. Cash flow management poses another major challenge, especially in cross-border transactions where diverse regulatory requirements complicate fund flows. Additionally, 40% of the respondents noted that FX fluctuations and higher transaction costs are significant hurdles they face.

How do businesses respond to challenges?

In response to the aforementioned challenges, surveyed enterprises are striving to cut costs across multiple areas, such as logistics, inventory, professional fees, office rent, utilities, and financial market expenses. Exporters and re-exporters, in particular, are focusing on minimising financial market costs by targeting reductions in banking service fees, payment transaction charges, FX fees, and other financial services.

To boost competitiveness, surveyed enterprises are adopting various strategies, such as entering new or niche markets and strengthening business partnerships. They are also increasingly using more efficient cross-border payment services. The report reveals that 26% of traders relying on traditional payment solutions express some dissatisfaction with their service performance in FX handling, receiving and making payments. Although this percentage might seem modest, it underscores concerns about slow remittance processing, high transaction costs, cumbersome documentation, and limited payment options, emphasizing the value of digital payment platforms.

Transformative trends: Digitising financial operations and expanding into global eCommerce platforms

Embracing emerging financial technology (FinTech) is a rapidly rising trend within the industry. According to the report, up to 90% of the participating enterprises are prepared to use digital payment platforms for processing some FX and cross-border remittances over the next six months. Furthermore, 40% of respondents identify their companies as "actively seeking innovators of cutting-edge technologies," highlighting the industry's swift movement toward digital transformation.

The results highlight two primary development trends in the trade industry. Notably, half of the surveyed enterprises have opted to digitize financial workflows—encompassing payments, accounting, and fintech—and to invest in global eCommerce platforms. Other key investment areas include artificial intelligence and robotics, supply chain visibility and tracking, along with marketing and customer relationship management technologies.

How do digital payments and fintech boost profitability?

Digital payments and fintech are popular in the local trade industry, with three-quarters of surveyed enterprises regularly utilizing these platforms for payment and FX transactions, and 92% of these businesses express satisfaction or high satisfaction with the services offered. This satisfaction rate notably surpasses the 75% seen with traditional services. Traders primarily choose fintech platforms for cross-border payments due to easier account opening, lower costs, and faster processing times.

How to leverage Airwallex for digitising financial operations?

Your trade partners and transaction counterparts come from all over the world, frequently requiring cross-border remittances for imports and exports. Currency exchange and FX fees can significantly impact your company's profits. Airwallex, an all-in-one financial and remittance platform, offers a solution by digitising and streamlining financial operations to suit your business needs. With Airwallex, you can save on unnecessary expenses by reducing both financial costs and manpower across various areas.

1. Centralise the management of multi-currency funds without necessitating forced currency exchanges

Airwallex's Global Account allows you to conveniently open an account in your company's name anytime and anywhere online. You receive bank names, branch codes, and dedicated account numbers for various currencies like GBP, USD, AUD, CAD, AED, and more. You can deposit receipts directly into the corresponding currency account, deducting only when payments are needed, which allows you to avoid unnecessary double currency exchanges. Manage funds across different currencies from a centralised platform, where multi-currency transaction records are clear at a glance.

2. Utilise local payment channels to reduce FX costs

Airwallex's international money transfer service allows you to send money in over 60 currencies to 150+ countries and regions. By using local payment channels, you can avoid high FX costs. We offer competitive FX rates with no hidden transaction fees, so you can save and earn more with every transaction.

3. Synchronise transaction data with accounting software to expedite reconciliation

Integrate your Airwallex Business Account with accounting software like Xero to automatically sync local and international transaction data. This integration not only supports paperless and sustainable operations but also speeds up monthly reconciliations and minimises manual recording errors.

4. Streamline processes with bulk payments

Streamline your global trade operations with bulk payment transfers to up to 1,000 recipients worldwide, in various currencies and through multiple transfer methods—all without the need for programming skills.

Customer case study: GreenPrice saves up to six-figures annually through Airwallex

GreenPrice is a company committed to sustainable living through the resale of perishable and expired food products. In its initial stages, GreenPrice relied on traditional banks for international transactions, conducting up to 80 transactions monthly with overseas suppliers. However, they faced limitations due to the transaction caps set by banks on SMEs. Each transaction also incurred SWIFT fees of HKD $150-200. Furthermore, those transfers took at least three business days and were often delayed by holidays, hindering their daily operations significantly.

With Airwallex, GreenPrice streamlined their transfer process through local payment channels, avoiding SWIFT systems and reducing transaction costs to just HKD $2-3 each. This resulted in monthly savings of six figures on international transaction and exchange fees, allowing them to reinvest those resources into business development. Funds arrive in as little as 30 minutes, facilitating trust-building with suppliers. With no minimum transaction limits, GreenPrice gained the flexibility to adjust transaction frequency and amounts based on market demands, such as sampling products from new suppliers in small batches to explore opportunities.

Airwallex offers you the most reliable support for your international transactions and daily financial operations. Open a free Airwallex Business Account and complete the process online with no opening charges.

View this article in another region:Hong Kong SAR - 繁體中文

Kirstie Lau

Brand Content Marketing Manager

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

Posted in:

Finance operationsShare

- What are the advantages of engaging in trade in Hong Kong?

- The top 3 pain points for local SME traders

- How do businesses respond to challenges?

- Transformative trends: Digitising financial operations and expanding into global eCommerce platforms

- How do digital payments and fintech boost profitability?

- How to leverage Airwallex for digitising financial operations?

- Customer case study: GreenPrice saves up to six-figures annually through Airwallex