Art of the payments possible: 9 Embedded Finance use cases

- •Online travel agents, booking engines and airlines can offer travel cards

- •Micropayments for artist and creator royalties

- •The house rental market could be much more efficient and joined up

- •The construction industry needs a financial solution that works for customers and builders

- •Gaming companies can build a marketplace to share revenue with modders

- •Improving reconciliation for car dealers

- •Group weekends away could do with a centralised kitty and spending cards

- •Creating a financial super-app for restaurants

- •Creating a financial super-app for marketplaces

What if you could code financial services into your product stack? You might be dreaming the art of the payments possible. But pinch yourself. You’re not dreaming.

Embedded finance excites us at Airwallex. It means our customers can embed our accounts, payments and cards into their own tech stacks and build imaginative solutions for their customers. It means companies no longer automatically think ‘bank’ when they need financial infrastructure but they hop onto Jira to log a request to their developers. Embedded finance is API-first, after all. It creates operational efficiency as much as its primary objectives of product stickiness and increased customer lifetime value.

More and more, those customers are non-financial services. They might be a software company serving a particularly niche sector - like farm management - but have always wished they could build a tailored-to-sector financial services experience after years of disappointing traditional banking integrations.

And there are so many niche sectors waiting for their software providers to deliver a tailor made financial services experience; too many possibilities to cover in this article. That said, the embedded finance team is never one to stray from a challenge.

We asked the team a very simple question: “If you could build or improve any proposition with embedded finance, what would you build and why?”

Online travel agents, booking engines and airlines can offer travel cards

Inspired by Tim

The travel ForEx industry is overdue for an overhaul. It’s a complete rip-off and deals only in physical cash which can be lost/stolen, and if you run out on holiday, you need to use your bank card to take cash out of an ATM/local solution which again, will be very expensive.

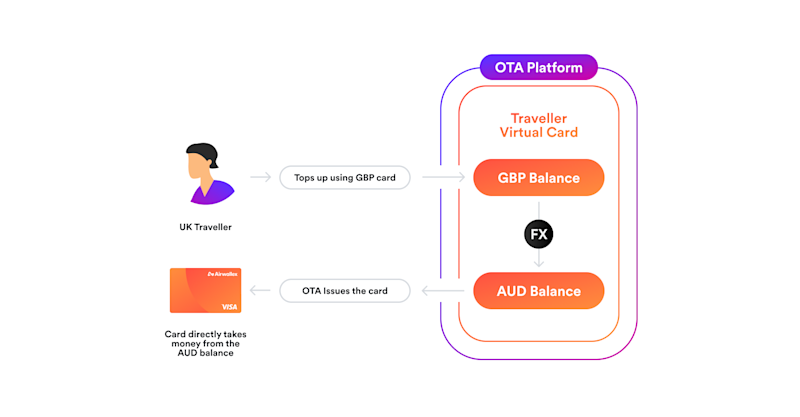

I think there’s a big embedded finance opportunity for Online Travel Agents (OTAs) and airlines. As soon as you book a ticket/hotel, the OTA or airline knows that, at a certain time, you’re going to go to X country. If that country uses a different currency from where you live, they’re uniquely positioned to offer an add-on which is a card loaded with that currency at preferential rates.

Tracking the subsequent spend would not only provide a monetisation opportunity for the travel company, but would give them unparalleled insight into the spending behaviours of their travellers, giving them a great opportunity to accurately upsell and cross sell on their next holiday, or recommend suitable restaurants/bars, tourist attractions et cetera. It’s a value add for all involved.

Micropayments for artist and creator royalties

Inspired by Stephanie

Embedded finance has paved the way for gig and creator economy workers to own their creations while profiting from platforms like Uber, TikTok and Twitch. However, the music industry has been stuck in the dark ages for decades now.

Envision a world where artists and creators can share their work on streaming platforms such as Spotify, Apple Music or YouTube which has an embedded payment link to receive donations and/or royalties from their work instantly. Viewers and listeners alike could donate micro funds directly to their favourite artists. After watching a music video, each artist could get their royalties paid out in their preferred/local currency. A digital tip!

With EmFi, global creators can own their music and IP while being paid for their hard work.

The house rental market could be much more efficient and joined up

Inspired by Alex

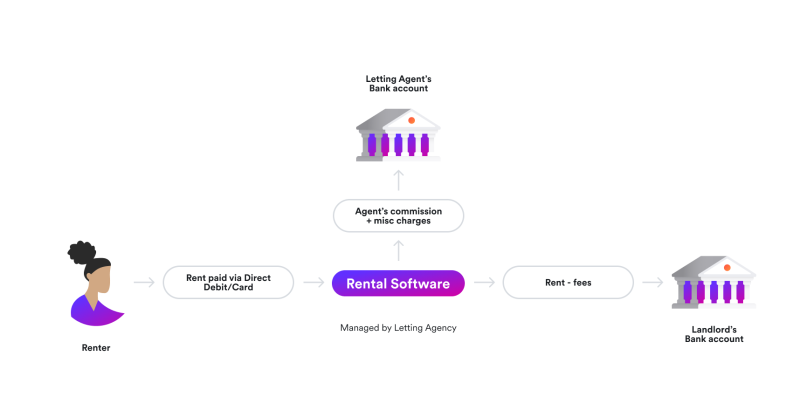

If I worked for a rental or property software provider, I would build a single, consolidated financial solution that covers all the needs of estate/letting agents.

The most obvious would be an acquiring service to make it easier (and more trustworthy) for customers to pay deposits and rent with the most suitable payment method; no more chasing the tenants to set up a direct debit or remember the reference you gave them to make reconciliation easier on your end.

I’d also extend the payment flow beyond customer collections to paying out to homeowners, both domestically and internationally. You could even programmatically deduct the cost of the handyman and any fees before forwarding on the rent to the owner.

Why not go one step further? You could offer debit cards for estate agents to hand out to employees so they can earn rewards and cashback. The estate agents would benefit from a consolidated view of all employee expenses, setting limits and controls in the process.

The construction industry needs a financial solution that works for customers and builders

Inspired by Dave

The construction industry is ripe for disruption. Having been through a recent building project, the payment flows are all over the place. I think there’s a payments possibility for a SaaS company to make payments work for everyone in the chain: From builders, to customers, to suppliers.

Builders: Builders need credit to buy wholesale supplies before projects. Builders need to easily itemise, quote and bill customers, and to issue one-off or recurring payment links easily to customers whenever work is completed. Builders also need to pay out to sub-contractors and employees, and pay out in foreign currency depending on supplier location. Likewise, builders need a robust and controlled company card deck to make on-site decisions easier and more efficient for project managers.

Customers: Customers won’t pay for work that is not done so it means each project is broken up into stages of payments. Customers might want to use finance to pay builders. Builders need to be paid on time so they can pay their own staff who are often paid daily/weekly/monthly.

Gaming companies can build a marketplace to share revenue with modders

Inspired by Robin

Gaming companies often rely on avid gamers turned developers (modders) to build mods (character skin, game worlds etc) which other gamers typically have to download from third party websites for free. Instead of neglecting this obvious need among their customers, gaming companies could now leverage embedded finance to create a marketplace within their platform. This would allow gamers to buy and download the skins directly from a trusted source, while the gaming company can share a percentage with the respective modders in their chosen currency. This opens up a huge revenue opportunity for both the gaming companies and the developers - while creating additional value for the gamers. Everybody wins!

Improving reconciliation for car dealers

Inspired by Robin

Car dealers often have a hellish time reconciling payments for car purchases for several reasons:

Customers pay for car purchases via bank transfers (in cases where full payment is made) which have to be manually checked and verified by logging into the car dealer's bank.

The final bill for the car purchase often includes several line items - such as additional accessories, maintenance, insurance, warranty etc. - some of which get added on the day of car delivery.

This presents an opportunity for a fintech platform to help dealerships create an invoice for car purchase. This invoice could carry the details for a virtual account that is unique to each car buyer. When the car buyer pays the amount, the status for all the invoice line items automatically changes to paid. Along with auto reconciliation of payments, this also helps them create reports for different departments in a seamless manner.

Group weekends away could do with a centralised kitty and spending cards

Inspired by Jonathan

Imagine Splitwise, with the addition of your “stag/hen kitty,” with a central account and card that everyone is connected to.

Stag/hen parties are notorious for creating a complicated matrix of who owes what and to whom and often leaves the organiser out of pocket. Some spend split apps have tried to solve the problem but they only solve the admin side of things and that’s a headache too far for an already sore head.

What if a spend split app combined with a debit card? Each member of the group could pay their contribution into a central account linked to a debit card in the organiser’s name and have all group accommodation and activities paid for. You could make the cards multi-currency for group holidays abroad. You could further monetise the product by tracking spending insights and creating recommendations, incentives and partner offers.

Creating a financial super-app for restaurants

Inspired by Ryan

Uber, Deliveroo and JustEat changed the game when it came to how a simple geo-locator apps could create a marketplace to elevate the takeaway scene. It’s not only made getting the Friday night takeaway easier, it’s also provided additional revenue sources for previously non-takeaway restaurants.

I’ve often thought about the potential of the app -> restaurant -> takeaway -> customer payment workflow while eating pizza on a Saturday night. The main use case which is currently solved by most acquirer services is the payment between customer and restaurant, where the takeaway app sits outside of the flow of funds. Separately, the restaurant needs to pay out suppliers and staff and often from the same local customer collection accounts.

What if a takeaway software provider could become the accounts and payments platform for the restaurants? It would create a single, consolidated financial hub where restaurants could collect into designated collection accounts (as many as they want) while also offering tailored-to-sector pay out functionality to allow my favourite pizza restaurant to buy its delicious San Marzano tomatoes from Italy - holding and paying in Euros for favourable terms.

Creating a financial super-app for marketplaces

Inspired by Ryan

The same logic also works for any marketplace. Companies like Etsy and Vinted could go the route of Shopify by moving from facilitator to platform and ‘owning’ the end-to-end flow between seller and buyer.

Imagine a clothing marketplace. They could create an account for each seller and incentivise its use by making it a one-click purchase for buyers, effectively building their own cost-saving payments network within their tech environment. The best part is that the embedded finance product (i.e. the accounts and intra-payments) would be white labelled from a regulated provider so it’s all packaged up and ready to go - all the marketplace needs to do is add branding and work out pricing.

Share

David manages the content for Airwallex. He specialises in content that helps EMEA businesses navigate global and local payments and banking.

View this article in another region:AustraliaCanada - EnglishCanada - undefinedHong Kong SARUnited States

Related Posts

Q&A: How Airwallex solves the treasurer’s historic headache

•5 minutes

Invoice like a pro: How to master the process

•9 minutes

The real cost of payment gateways for businesses

•12 minutes