ACH vs. wire transfers: What’s the difference and how do they work?

Summary:

ACH and wire transfers are different methods for moving money electronically. They each have their own advantages and use cases.

In the United States, ACH (Automated Clearing House) is used for cost-effective domestic transfers.

In Canada, the equivalent is EFT (Electronic Funds Transfer).

While the infrastructure differs slightly, the concepts are the same: ACH and EFT transfers are ideal for recurring transactions, such as payroll and vendor payments. In contrast, wire transfers offer a faster but more expensive option for urgent or large payments.

When making transfers, choosing the right transfer method can impact your business’s cost and efficiency. ACH and EFT transfers often cost businesses significantly less than wire transfers, sometimes just a fraction of the price.

Understanding the differences between these two transfer methods can help you avoid unnecessary costs, ensure timely payments, and minimize disruptions to your business operations.

In this ACH vs. wire transfers guide, we’ll break down how each method works, when to use them, and which one makes the most financial sense for your business.

Feature | ACH and EFT transfers | Wire transfers |

|---|---|---|

Speed | 1–3 days | 24 hours or less |

Fees | Around CA$0.40–CA$1.50/transaction | Up to CA$35/transaction (domestic) |

Use cases | Monthly vendor payments and payroll | Large and/or urgent transactions |

Reversal | Can be reversed or returned within a specific time frame | Can't be reversed or returned once the funds are cleared |

Payment direction | Push and pull | Push only |

Availability | ACH in the US; EFT within Canada (domestic only) | International |

What’s an ACH transfer?

An ACH transfer is a US-based electronic bank transaction that moves money between accounts using the Automated Clearing House (ACH) network. In Canada, businesses use EFTs (Electronic Funds Transfers) for a similar purpose – moving money between domestic accounts cost-effectively.

Businesses often rely on ACH or EFT transfers for payroll, vendor payments, and recurring bills because they're significantly cheaper than wire transfers.

While wire transfers are faster, ACH/EFT transfers are ideal for making cost-effective, non-urgent domestic payments because they’re affordable and offer scheduling options that make it easier to manage recurring payments.

Although the ACH network primarily facilitates domestic US transfers, Canadian EFTs are also limited to domestic payments within Canada. For cross-border transactions, businesses in both countries typically use international wire transfers.

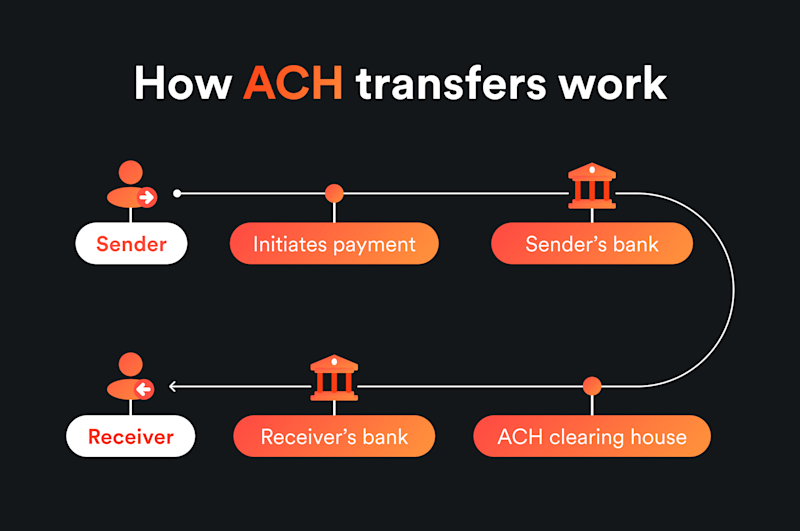

How ACH and EFT transfers work

ACH and EFT payments electronically transfer funds between two accounts.

The transfer process begins with the sender or receiver initiating an ACH or EFT transfer through online banking, a mobile app, or a direct request to a financial institution. The sender provides the necessary information, such as the recipient’s account number and the bank's transit or routing number, along with the transfer amount.

The ACH or EFT network processes the transaction. In the U.S., the sender’s bank sends the details to the ACH network; in Canada, financial institutions process EFTs through Payments Canada’s networks.

The recipient's bank will credit the funds, which are typically available within 1–3 business days. Both parties receive transfer confirmation via bank statements or online portals.

Fees vary, but you can expect to pay around CA$0.40 to CA$1.50 per EFT transaction in Canada, depending on the provider.

Examples of ACH and EFT transfers and their costs

ACH and EFT transfers can automate recurring expenses, such as software subscriptions, payroll, or vendor payments, allowing you to schedule them in advance and in batches.

These transactions can also help you avoid some of the costly fees associated with wire transfers.

Make an ACH transfer with Airwallex

What’s a wire transfer?

A wire transfer is an electronic payment method that moves money between bank accounts both domestically and internationally. These transfers are ideal for sending large sums of money quickly and securely.

You typically use a wire transfer to handle cross-border payments with suppliers, vendors, or partners, where speed, security, and reliability are essential. While ACH and EFT transfers are cost-effective, you may prefer wire transfers for time-sensitive transactions.

However, domestic and international wire transfers can be quite expensive, as both the sending and receiving banks may charge fees. Also, keep in mind that it’s difficult to reverse these once they’re complete – even if there’s an error.

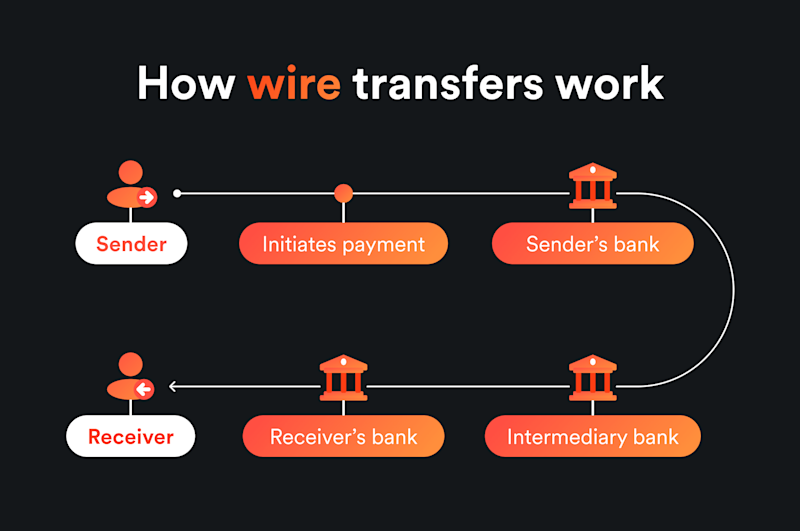

How wire transfers work

Wire transfers use a network of banks and financial institutions to move money from one account to another.

The process begins when you, the sender, provide your bank with the recipient’s details, including their name, account number, and bank information.

For international transfers, you’ll also need a SWIFT or IBAN code.

You’ll pay the transfer fee, which can vary depending on the bank and type of transfer. Your bank will then verify your identity and authorize the transaction.

Once approved, your bank securely transmits the payment instructions to the recipient’s bank through a secure network, such as SWIFT, sometimes using intermediary banks. Finally, the recipient’s bank processes the payment and deposits the funds.

A domestic wire transfer can take a few hours to complete, while international wire transfers can take 1–5 business days, depending on where you’re sending money.

For domestic wire transfers within Canada, you can expect to pay up to CA$35 per transfer. International wire transfers can cost anywhere from CA$50 to CA$80. Additional costs for foreign exchange or currency conversion may also apply.

Examples of wire transfers and their ongoing costs

Businesses often use wire transfers to make fast and secure payments, especially across borders. For example, if you're paying international contractors or suppliers, wire transfers can be a reliable way to ensure funds arrive without delays.

However, you’ll need to account for foreign exchange rates and processing fees. To save money on wire transfers without sacrificing efficiency, you can opt for a business bank account that offers transparent pricing and competitive FX rates.

Make a wire transfer with Airwallex

How to overcome payment challenges

Managing payments is a routine part of running a business, and choosing the right transfer method for each payment can help you stay on top of transaction costs and processing times.

But a transfer method is just one piece of the puzzle. Managing multiple currencies, tracking payments, and having real-time visibility into your cash flow are all crucial for running a global business.

Here are proactive steps you can take to simplify payments, reduce costs, and improve efficiency:

Open local currency accounts so you can utilize domestic and local transfers

Opening local currency accounts allows businesses to tap into domestic rails, such as ACH in the US or EFT in Canada, rather than relying solely on costly international wire transfers. This significantly reduces conversion fees, speeds up transaction times, and eliminates unnecessary foreign exchange markups.

With local payment networks, your business can complete cross-border payments more efficiently and affordably.

Use a provider that can access the Interbank rate to reduce your costs

Choosing a provider that offers access to the interbank exchange rate – the rate banks use to trade currencies rather than the marked-up rates provided by traditional banks – can significantly cut down FX costs. This ensures your business isn’t overpaying on conversions, helping you maintain healthy margins.

Centralized financial management

Managing your finances across multiple tools and platforms, currencies, and bank accounts can result in fragmented financial operations, leading to bottlenecks, inconsistent data, and reconciliation errors. By using a single tool for your financial management, you can see all your inflows and outflows from a single place of truth.

The smarter way to send and receive payments

While ACH and EFT transfers offer cost-effective solutions for recurring payments, wire transfers provide speed for urgent or large international transactions. Knowing the differences between these methods – and having the flexibility to choose – helps businesses avoid delays and minimize unnecessary fees.

With Airwallex, you can make payouts in 150+ countries and regions, and transact in 60+ currencies with lower fees and faster delivery.

With an Airwallex Business Account, you can open local currency accounts with local banking details – even if you aren't physically present in the market.

Unlike traditional payment providers that charge high FX and transaction fees, Airwallex offers flexible options across local and global transfer networks, helping you find the most cost-effective and efficient solution.

Beyond transfers, Airwallex offers a complete financial platform with built-in Spend Management, simplifying financial management in one place.

Take your payments to the next level with Airwallex

ACH and wire transfers frequently asked questions

Is wiring the same as ACH?

No. Wire transfers and ACH (or EFT) transfers are both types of electronic fund transfers (EFTs), but they work differently. Wire transfers are quicker and commonly used for urgent or high-value payments, though they have higher fees. ACH and EFT transfers are slower but more cost-effective.

Which is better, ACH or wire transfer?

ACH (or EFT) transfers are better for routine, cost-effective payments, such as payroll and vendor invoices, while wire transfers are ideal for urgent, high-value transactions. Wire transfers are faster but more expensive; ACH and EFT are slower but more affordable.

Is ACH a routing number or wire?

ACH transfers and wire transfers both use routing numbers, but they rely on different processing networks. In the US, ACH transfers use routing numbers specific to the ACH network. In Canada, EFTs use a combination of institution numbers and transit numbers. Both ACH and EFT transfers are batch-processed, while wire transfers are processed in real time and cannot be reversed once sent.

Share

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

View this article in another region:Canada - EnglishUnited StatesGlobal

Related Posts

International wire transfer: How to quickly send money abroad

•5 minutes