What is a prepaid card? Differences from credit and debit cards

Key takeaways:

Prepaid cards transfer funds from a preloaded balance rather than connecting to a bank account or credit line.

They make online payments like a credit or debit card, but they don’t have credit lines. This protects personal credit lines and prevents overspending.

Prepaid cards are ideal for increased security (no personal bank ties), sticking to a budget, and separating your business spending from personal accounts.

The number of digital payments a person makes on average has gone up by 85 percent between 2012 and 2021.1 This is because more people want easy ways to pay in person and online. This is especially true for businesses that need flexible and safe ways for employees to make purchases.

Prepaid cards are digital payment alternatives to credit and debit cards that make payments from a preloaded balance. This is great for budgeting and security, but it doesn’t have the same perks as corporate credit cards, like rewards points and cashback.

The preloaded balance is the key differentiator, but there are some other differences to know before opening a new card.

What is a prepaid card?

A prepaid card is different from a credit or debit card. It’s a digital payment card funded with a preloaded balance. You open a card, load funds, and then use it for payments as you would any other card. You can even create multiple cards for different employees or departments and manage their funds accordingly.

Prepaid cards work with in-person card readers, online shopping, and even ATMs for withdrawals, depending on the card. So, what are the benefits of a prepaid card over other digital card payment methods? Here’s the gist:

Pros: | Cons: |

|---|---|

Preloaded balance sets a spending limit No ties to your personal credit line and no impact on your credit score Flexible usage - spend online, in-person, or withdraw cash via ATMs | No rewards or cashback Limited recourse if card is misused Cards may have loading limits and may not be ideal for larger transactions Fees tied to withdrawals, reloading balances, transfers, and more Limited ability to use this overseas Limited expense management controls May not be integrated to your accounting solution |

Prepaid cards vs. credit and debit cards

The most important difference is how you fund your card transactions. Prepaid cards don’t have access to your individual or business account like debit cards or an individual line of credit, like credit cards.

This prevents you from overspending and can provide protection from fraud since lost cards or stolen details have finite funds.

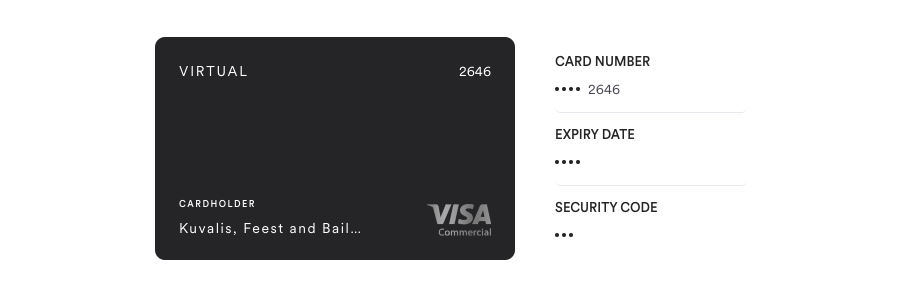

Providers like Airwallex also offer single- and multi-use Virtual Cards. These debit cards help prevent overspending like prepaid cards do, but come with extra fraud protections and lets you earn cashback as you spend. The card details are stored digitally and you can cancel them at any time, to prevent misusage. Also, if you have multi-currency balances, you can spend in those currencies without incurring foreign exchange fees.

On the other hand, traditional business credit and debit cards are tied to your business and its private banking details. This adds a little more risk, but these same cards have stronger regulations and protections from entities like the U.S. Consumer Financial Protection Bureau or UK Financial Conduct Authority.

| Cash source | Security | Fees (vary by card) |

|---|---|---|---|

Prepaid card | Preloaded balance | No ties to personal credit or bank account Limited consumer protections | Maintenance fees Reloading fees ATM fees Foreign transaction fees |

Credit card | Line of credit Limit determined by card holder and credit limit | Advanced consumer protections Best fraud protections | Annual fee Late fee Interest fee Foreign transaction fee |

Debit card | Checking account Determined by account balance | Decent consumer protections Can have higher liability for fraud | Out-of-network ATM fees Overdraft fees |

Unlock global growth

How do prepaid cards work?

Prepaid cards are simple. First, you choose a card, then choose a dollar amount you want to preload for spending. You’ll cash out and pay that preloaded amount plus any card opening fees. Then, your prepaid card is loaded with the preapproved balance and is almost instantly ready for purchases.

Once the card is loaded, employees can make purchases in person and online to complete business expenses as they would with a credit or debit card. Even international payments are permitted, though there are better ways to save money on cross-border payments.

You can purchase prepaid physical and virtual cards online and in person at local grocery and convenience stores. However, this can be troublesome and inefficient as the process needs to be repeated every single time you run out of funds.

Prepaid card alternatives

Businesses like the transparency of using prepaid cards. But prepaid cards have their own limitations. There are times when you might need a credit or debit card, especially for more frequent and larger purchases.

Secured credit cards with a collateral cash deposit are a good alternative for people with low credit who can’t qualify for traditional credit cards.

International business debit cards are a flexible alternative for businesses to simplify spending and transact in multiple currencies.

Virtual credit and debit cards allow businesses to create single- or multi-use cards that help protect the business’ finances and eradicate the need for reimbursements.

How to choose the right card for your business

All cards have different rules and requirements depending on the card type and provider. Some have perks like free ATM withdrawals, while others charge inactivity fees. Here’s a rundown of key features to pay attention to:

Card perks:

Liability protections

Cashback rewards

Expense management features

Ability to assign cards for specific uses or purposes

Spending controls

Multi-currency features

Common fees:

Monthly maintenance and service

Prepaid card reloading

ATM withdrawal

Foreign transaction

Inactivity

Overdraft

Beyond the fees and user benefits, consider the card’s expiration date and any included security protections. Prepaid cards are eligible for FDIC deposit insurance coverage if the card issuer is an FDIC-insured bank and your card is properly registered.

Credit and debit cards have these additional protections built in. There are also more business-specific cards available if you’re looking for credit, debit, or virtual card options.

Prepaid cards: Frequently asked questions

Do prepaid cards expire?

Prepaid cards typically have an expiration date, though they’re good for several years. You can also renew active cards and may automatically receive one before your current card expires.

But, the funds loaded onto a prepaid card don’t expire. Those can be transferred to a new card if your existing card is about to expire. You can also request a refund for an existing balance by contacting the card provider directly.

How much money can you put on a prepaid card?

Every card and provider will have a different card limit, so shop around for the best fit for you. Some cards go up to $20,000+, but something under $10,000 is much more common for consumer use.

Beyond the card’s limit, you can preload as much money as you have available. Just know that daily spending and reloading limits affect how you can use your card.

What are the benefits of prepaid cards?

Prepaid cards are best for managing expenses with a little extra security since they aren’t tied to your personal bank or credit line. You can set a spending limit with the preloaded amount and even add spending controls for sub accounts, depending on the card.

Because it’s independent of your personal banking details, if it’s lost or stolen, strangers can’t access your full funds. On top of that, you don’t need a credit check or security deposit to open a prepaid card.

What are the disadvantages of prepaid cards?

Prepaid cards are flexible, but every payment method has its risks. Prepaid card providers tend to tack on several fees, from monthly maintenance costs to inactivity fees and withdrawal charges.

They’re also not helpful if you need to build credit with your regular spending. And the consumer protections aren’t as significant as traditional credit or debit cards, though many prepaid cards are provided and covered by FDIC-insured banks.

Stay flexible with virtual business debit cards

Prepaid cards are credit-free options for business spending. They’re easy to use and reload, though there are many limitations and a few fees to be aware of. And those fees add up fast, especially if you regularly reload the card for ongoing business expenses.

Instead, explore Airwallex’s Business Account and our financial solutions like the Airwallex Corporate Cards with Expense Management features built in. Save on foreign exchange and transaction fees with cross-border business, issue employee cards globally, and streamline your business spending.

Streamline your financial operations

Sources

https://www.bis.org/statistics/payment_stats/commentary2301.pdf

Share

View this article in another region:AustraliaCanada - EnglishCanada - undefinedEuropeNew ZealandSingaporeUnited KingdomUnited States

Related Posts

How to choose the right virtual debit card for your business

•5 minutes