What is a direct deposit: how it works and benefits explained

- •What is a direct deposit?

- •How direct deposit works

- •How long does direct deposit take to complete?

- •The difference between direct debit vs direct deposit

- •Example use cases of direct deposits

- •Pros and cons of direct deposit for payroll

- •Common problems of direct deposits

- •How Airwallex can help simplify direct deposits

Imagine cutting down the hours (or even days) spent on payroll each pay period. 28% of businesses1 struggle with manual and inefficient payroll methods, which increases operational costs and leads to delays in employee payroll payments. It's clear that a more streamlined approach could offer several benefits for businesses.

Direct deposit can transform your payroll process, reducing some of the administrative burden to ensure employees receive their pay on time, every time.

Key takeaways:

Direct deposits streamline your payroll process, reducing the administrative workload.

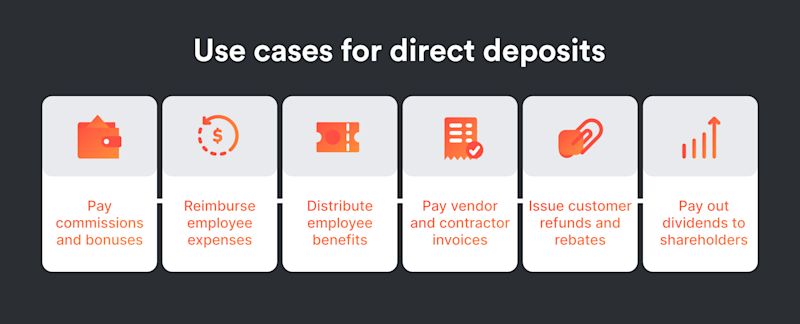

Direct deposits can be used for a variety of transactions, like paying employee commissions, reimbursing employee expenses, distributing benefits, paying bills, and more.

Airwallex has a vast local payment network, removing the need to use SWIFT for international payments - making it faster and cheaper.

What is a direct deposit?

Direct deposit is a type of payment method. It uses an electronic network to securely transfer funds from a payer’s bank account to a payee’s bank account. Businesses often use it to pay employees, as it eliminates the need for traditional paper cheques, making payroll processing faster and easier.

The specific network used for direct deposit can vary based on where your business and employees' banks are located. For example, when sending funds internationally, a bank in the US will use the Automated Clearing House (ACH) network for the direct deposit ACH transfer, while a bank in the UK will likely use the Bankers’ Automated Clearing Services (Bacs) Direct Credit network, or the Society for Worldwide Interbank Financial Telecommunications (SWIFT) network. When international payments that can be processed via local payment networks, they are faster and cheaper by avoiding international transfer fees.

When setting up a direct deposit, you designate the pay date, ensuring your employees receive their wages on time. This removes risks often associated with paper cheques, like delivery delays, lost or stolen cheques, and manual human errors, like misspellings.

Since the funds are transferred and deposited electronically, they’re either credited to the employee's bank account immediately or within a short time frame, depending on the bank’s policies and systems. This means employees don't have to wait as long for the money to clear.

How direct deposit works

Say you manage payroll for a small eCommerce business based in the US. You currently use paper cheques to pay your US-based employees on the 1st of each month, but have decided to switch to direct deposit to streamline the process.

To set up direct deposit and enrol your employees, you must first use a secure method to gather the necessary documents and banking details from your employees. Next, you submit the payroll instructions to your bank two to five business days (depending on your bank and payroll provider) before payday. The bank then forwards your instructions to the ACH network.

The ACH network reviews the payment information and starts the process for each employee’s pay to be sent to their respective bank accounts. The ACH network processes transactions at specific intervals throughout the day. Once processed, the banks will then receive and carry out the instructions. After the payments have been approved, the banks will make the transfer and directly deposit the funds into your employees' accounts.

This switch to direct deposit makes things easier for both you and your employees. For your business, it reduces the administrative workload for cheque preparation and distribution, and saves on printing and mailing costs. For your employees, it provides a faster, secure, and convenient way to receive their pay.

How long does direct deposit take to complete?

When you prepare and submit direct deposits, the process from submission to completion usually takes about one to five business days. The exact time can vary based on factors like the amount being transferred, the banks involved, whether the deposits are domestic or international, and the payment network being used.

Once processed, funds are usually available to your employees within one to two business days after being deposited into their bank accounts, depending on their bank's processing times.

Streamline your business’ direct deposits.

The difference between direct debit vs direct deposit

While direct debit and direct deposit are both methods that streamline financial transactions, they serve different purposes.

Direct debit: authorises someone to take money from you.

Direct deposit: involves you sending money to someone else.

When you use direct debit, you authorise a person or another business to pull money directly from your bank account. Think of it like giving them permission to reach into your account and take the amount owed. While you grant permission to pull the funds, it's the recipient who initiates the actual debit. Direct debit is often used for recurring payments like utility bills or software subscriptions.

Direct deposit, on the other hand, involves you pushing funds from your business’ bank account to someone else’s bank account. With direct deposit, you authorise your bank to transfer the money directly from your business’ account to the recipient’s account. Businesses commonly use this method to deposit payroll cheques into their employees’ bank accounts, ensuring they’re paid securely and on time.

Example use cases of direct deposits

Direct deposit can be used for a range of financial transactions outside payroll. Here are some examples of what else your business can do with direct deposit.

Pros and cons of direct deposit for payroll

Although direct deposit offers many use cases to improve your payroll and financial efficiency, it’s important to weigh both the pros and cons before deciding if it’s the right choice for your business.

Direct deposit pros

Streamlines your payroll process and improves administrative efficiency

Reduces the risk of manual data entry errors

Eliminates the risk of lost or stolen cheques

Improves employee satisfaction and convenience

Decreases costs associated with printing and mailing

Is kept secure through the bank and network’s strong security measures and protocols

Direct deposit cons

Requires initial setup and integration with current payroll systems in advance

Making last-minute changes to payment amounts or accounts can be difficult

May incur bank fees, especially for international payments using networks such as SWIFT

Common problems of direct deposits

While direct deposit is a convenient and efficient payment method to help streamline your financial operations, it does come with challenges to consider.

Complexities and costs for global businesses

Different countries have varying banking systems and processes, which can make setting up direct deposit to pay employees in other regions more challenging. Cross-border transactions often come with foreign currency (FX) conversion fees, and international transfer fees, which can quickly add up. Some banks charge fees for direct deposit services, which can add to your operational costs. These fees can vary widely depending on the bank and may include charges for setting up direct deposit, processing each transaction, or maintaining the service.

Administrative upkeep

Though direct deposit does reduce the administrative burden of payroll preparation and distribution, maintaining accurate employee records can require additional upkeep. Traditional methods often involve manual entry and updates within your payroll system, which can be time-consuming and more prone to human error, especially with frequent changes like new hires, terminations, or account updates.

To overcome these challenges and streamline your payroll process, consider partnering with a comprehensive global financial operations platform to reduce the friction points associated with direct deposit.

How Airwallex can help simplify direct deposits

For growing businesses, an Airwallex Business Account could be the ideal solution to help you manage your payroll. You’ll cut time spent on admin tasks, minimise fees, and ensure your employees are paid on time. As an end-to-end financial operations platform, Airwallex combines payment acceptance, expense management software, fund management, and pay out solutions for businesses, all on one platform.

You can pay your employees in 150+ countries using the balances in your multi-currency Wallet, saving on FX fees. For 120+ of these countries, payments will be sent over local payment rails, avoiding the fees usually associated with international payments. The funds are also processed really quickly, with approximately 60% being received instantly.

By transferring these funds directly to their local bank accounts from your dashboard, you can make global payroll fast, efficient, and cost-effective, ensuring smoother and more streamlined financial operations for your business.

Manage your end-to-end finances across borders.

Source:

1https://www.bamboohr.com/resources/assets/ebooks/bamboohr-state-of-hr-2024.pdf

Share

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

View this article in another region:AustraliaCanada - EnglishCanada - undefinedEurope - EnglishEurope - NederlandsNew ZealandUnited KingdomUnited States

Related Posts

What is the SWIFT banking and payment system? How it works in 3 s...

•6 minutes