What’s subscription payment processing? How to make it work for your business

- •What’s subscription payment processing?

- •How does subscription payment processing work?

- •5 types of subscription payment models

- •How subscription payment processing benefits your business

- •Challenges of managing subscription payments

- •Key features to look for in a subscription payment provider

- •How to set up subscription payments

- •Simplify subscription payments with Airwallex

- •Subscription payment processing frequently asked questions

Key takeaways:

Subscription payment processing makes it easy to handle recurring payments, promoting steady cash flow while keeping customers happy.

Businesses can choose from subscription pricing models like flat-rate, tiered, freemium, pay-as-you-go, or hybrid.

Successful subscription payments depend on reliable payment providers that support multiple payment methods and have systems to handle failed payments and automate subscription payments.

Subscription payment processing is essential for companies offering subscription-based products or services, such as streaming platforms, SaaS businesses, and membership programs.

With the global subscription economy positioned to reach US$1 trillion by 20281, this payment model is quickly becoming a go-to choice for businesses aiming for steady revenue and improved customer satisfaction.

Learn more about subscription payment processing, how to set it up for your business, and the different subscription pricing models in this guide.

What’s subscription payment processing?

Subscription payment processing is a system that lets businesses accept fixed and recurring customer payments for an ongoing service. This helps ensure you receive payments consistently.

Payment processors equip subscription-based businesses with a way to manage subscription payments effortlessly. Automated payment features ensure customers are billed accurately and on time, according to their preferred schedule.

These features help make the billing process easier, reduce administrative burdens, and improve customer satisfaction by ensuring that payments are handled easily and reliably.

Subscription management made easy with Airwallex

How does subscription payment processing work?

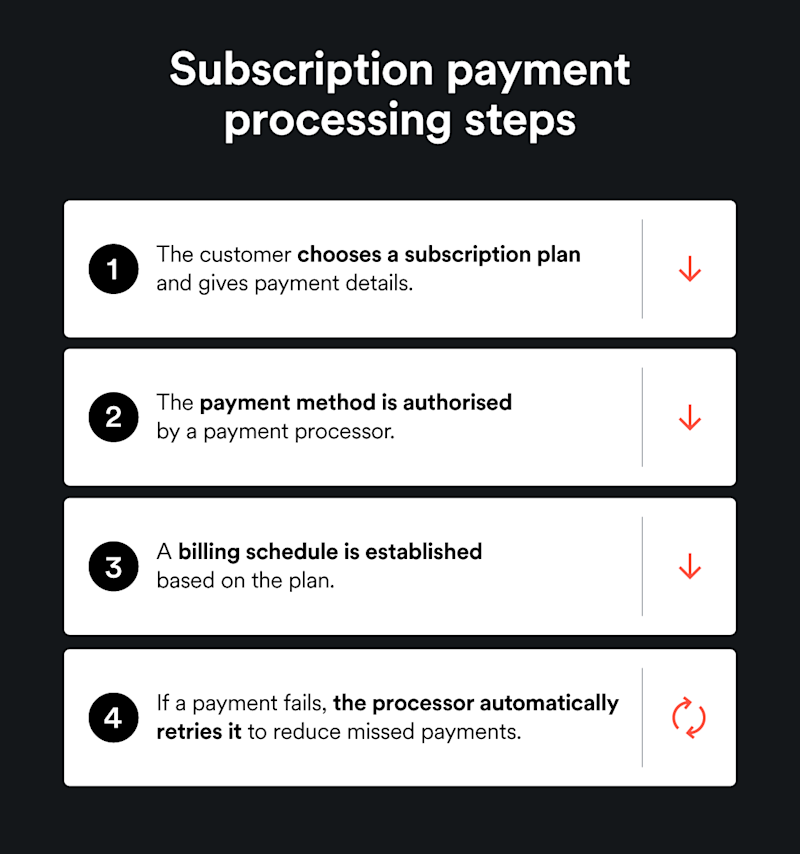

Subscription payment processing makes it easy for businesses to handle subscription payments. Below is an overview of how it works:

Customer sign-up: Customers select a subscription plan and provide payment details. Your website will then prompt them to authorise their information storage for future billing. You can encrypt and securely store this information using a payment gateway.

Payment authorisation: A payment processor verifies the payment method, checks fund availability, and ensures the transaction meets security standards.

Recurring payment setup: A billing schedule is established based on the customer’s chosen plan. This ensures payments occur automatically at regular intervals.

Failed payment handling: If a payment fails due to insufficient funds, an expired card, or other issues, the system automatically retries the transaction at optimal intervals to improve success rates and minimise missed payments.

5 types of subscription payment models

There are several types of subscription payment models:

Flat rate

Flat-rate subscriptions are the simplest pricing model on this list. You charge customers a fixed amount at regular intervals on pre-set dates. This structure offers a predictable revenue stream, ideal for businesses that provide consistent service value regardless of customer usage.

Example: Streaming streaming services like Netflix charge a flat monthly fee for unlimited access to their libraries.

Tiered

Tiered subscription models let you offer multiple pricing options. Each option is tailored to different usage levels, features, or service tiers. This strategy helps businesses reach a wider audience by aligning pricing with varying business needs and preferences.

Example: Software platforms like HubSpot offer tiered pricing plans, ranging from basic features for small businesses to more complex options for enterprise users.

Freemium

Freemium models provide basic services for free and are used to entice users to upgrade to paid plans for premium features. This approach helps grow a user base, enhance customer experiences, and turn free users into paying customers over time.

Example: Canva lets users access essential design tools at no cost while offering advanced features and templates through paid subscriptions.

Pay-as-you-go

Pay-as-you-go subscriptions charge customers based on actual usage, often in metered formats. This model is common in industries like utilities, telecommunications, and cloud services.

Example: Amazon Web Services (AWS) charges businesses based on how much storage and other resources they use.

Hybrid

Hybrid subscription models blend different payment structures, providing flexibility and adaptability. This works well for businesses that bundle basic services with add-ons. Because of its flexibility, customers can tailor their experience to their own needs.

Example: Amazon Prime combines flat-rate membership fees with optional pay-as-you-go purchases, such as digital rentals or groceries.

How subscription payment processing benefits your business

Subscription payment processing offers benefits for subscription-based companies across various industries. Here are the key benefits:

Predictable cash flow: Subscription payment processing creates a steady revenue stream, making it easier to forecast growth, manage cash flow, and plan finances.

Improved customer experience: Subscription billing offers a hassle-free payment process, making it convenient for customers to make payments and reducing your risk of missed payments.

Operational efficiency: Certain aspects of subscription billing can be automated, reducing administrative work like invoicing and payment collection.

Providers like Airwallex can easily handle subscription upgrades, downgrades, and cancellations, ensuring a smooth transition for your customers. You can also customise billing cycles to match your specific business needs, whether daily, weekly, monthly, or at any other interval.

Challenges of managing subscription payments

Managing subscription payments also involves additional considerations. Here are some factors to keep in mind if your business is accepting subscription payments:

Failed payments

When customer subscription payments don’t go through, your business can experience a revenue loss. This can occur for many reasons, including insufficient funds. Having a payment processor that can retry failed payments can help reduce involuntary churn by automatically trying the transaction again, making the billing process smoother and more reliable for both you and your customers.

Scalability and flexibility

As your business scales, managing subscription payments grows more complex. Offering diverse payment methods across markets while navigating multiple providers and regional regulations can be challenging. If it's too hard to cancel, upgrade, or downgrade subscriptions, customers may dispute a transaction, leading to lost revenue through chargeback fees.

Key features to look for in a subscription payment provider

The right partner can simplify subscription payments management and ensure a smoother billing process for your customers. Here are the key features to prioritise when selecting a payment solution:

Reliable subscription payment system

A payment system that understands the unique needs of a subscription-based business can help you manage complex subscription logic, customer and payment information. Having a partner that allows you to design subscription logic and pricing models, means you can charge your customers on a billing cycle without manual intervention.

Automated failed payment handling

Choose a payment provider that can effectively handle failed payments. Built-in features like Airwallex’s smart retry logic can automatically retry declined transactions at optimal intervals, helping to reduce missed payments. The ideal partner will also be able to automatically send you alerts about failed payments, subscription renewals, and other important updates. This feature adds transparency and encourages quick action, improving the customer experience.

Support for multiple payment methods

A versatile payment processor should also accept various payment methods and let you make global payments, expanding your business’s reach. Our recent research shows that 77% of global consumers are likely to abandon their cart if their preferred payment method isn't available at checkout.2 By integrating these local payment methods, you can improve the checkout experience.

Integration capabilities

Integration with your existing tools makes payments quick and easy. Some payment processing partners offer easy integration with tools like CRM systems, accounting software, and eCommerce platforms. This helps to ensure that subscription billing data can be synced across all your systems, helping you reduce errors, and improve overall efficiency.

Make collecting subscriptions a breeze

How to set up subscription payments

Setting up subscription payments is a straightforward process that helps your business create a reliable revenue stream. Here’s how to set up subscription payments for your business in five steps:

Choose a payment processor: Select a payment processor that’s built to support subscription businesses. Look for features like automated billing, retry logic, and global currency support.

Set billing model: Define your subscription tiers and pricing structures, and set up subscription logic and billing cycles so you can eliminate manual tasks.

Offer multiple payment options: Make sure customers can easily pay in their preferred method, including credit cards, Buy Now, Pay Later (BNPL) solutions, digital wallets, and bank transfers.

Enable retry logic: Set up your subscription logic and reminders on missed payments to boost revenue and minimise involuntary churn from failed payments.

Simplify subscription payments with Airwallex

Automate your billing with Airwallex’s Payments. Subscription businesses rely on Airwallex to manage the lifecycle of subscription and recurring payments from global customers.

You can easily set up and customise your billing logic, including automated reminders for missed payments which helps reduce involuntary churn and boost your revenue. Airwallex also supports global customers, making it easier to expand internationally without the hassle of managing different payment systems.

But, Airwallex goes far beyond payment processing. We provide a complete financial end-to-end solution to help you manage your finances. Apart from helping you collect subscription revenue in multiple currencies, we also make it easy to pay out to overseas suppliers or employees in their preferred currency.

If you're ready to make subscription payments easier and take control of your financial operations, get started with Airwallex today.

Manage subscription payments smarter today

Subscription payment processing frequently asked questions

What is subscription payment processing?

Subscription payment processing is the system that enables businesses to automatically charge customers regularly for products or services, such as monthly memberships or software subscriptions.

What is the subscriber payment method?

The subscriber payment method is the way customers are automatically billed regularly to maintain their subscription. Common methods include credit cards, debit cards, and digital wallets.

How do I accept monthly subscription payments?

To accept monthly subscription payments, select a reliable processor like Airwallex, set up a plan, integrate the gateway, collect payment info, automate billing, manage subscriptions, and monitor transactions.

Sources:

https://www.juniperresearch.com/research/fintech-payments/ecommerce/subscription-economy-market-report/

Share

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

View this article in another region:AustraliaEurope - EnglishEurope - NederlandsNew ZealandUnited KingdomUnited States

Related Posts

What is a chargeback fee: How can you avoid them?

•8 minutes