Should you set up a US entity for your eCommerce business?

The United States represents the second largest cross-border eCommerce market in the world, with worth $586B in 2019. It’s no wonder many Australian eCommerce businesses are expanding into the United States.

As your US sales and customer demand grow, it’s important / a natural question for business owners to assess if they should set up a separate US entity for their eCommerce business.

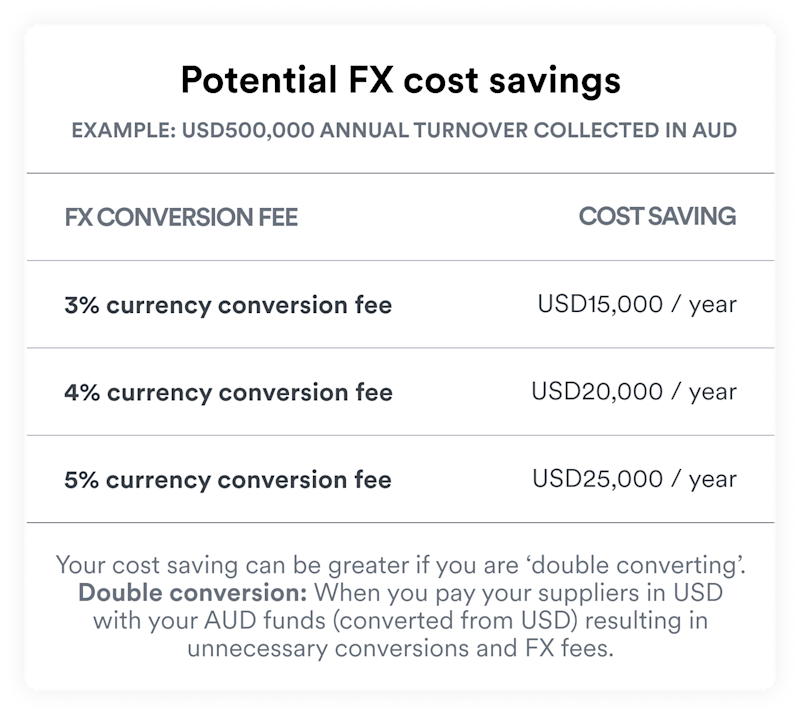

“The main benefit for Australian businesses considering a US entity is receiving payouts in USD from their eCommerce platforms like Shopify, Stripe and others. The net benefit becomes significant especially for our eCommerce clients with USD500,000 annual sales from their US operations to justify the effort,” explains Dan

Unlock global growth

What are the costs involved in setting up a US entity?

Once a business understands its potential cost savings from unnecessary currency conversions, it’s crucial to assess the cost and steps involved.

Upfront set up

This process can take 2 - 3 months, and vary between USD$2,000 to USD$10,000 depending on the size and complexity of your eCommerce business.

1. Incorporate your business

There are a number of online incorporation services such as Stripe Atlas that help businesses set up a simple US entity for a flat fee. eCommerce business can also work with an experienced accountant and lawyer to set up the right structure.

Your decision on your business entity type (e.g. Limited Liability Corporation, Limited Partnership or Corporation) and the state you incorporate under will have different implications on the state tax and registered agent requirements.

Once you have decided on the right business entity and state of incorporation for your eCommerce business, you now need to set up your US phone number, a virtual office for a physical US address and apply for an EIN number that will also be used to set up your US eCommerce accounts.

2. Create the necessary intercompany agreements

Once your US entity is set up, you will effectively have two separate entities. Having the right intercompany agreements during this setup ensures that you are meeting legal requirements when exchanging funds between these entities.

There are two main types of intercompany agreements.

First, a management services agreement sets out the appropriate fee that your US entity will pay to your ‘home’ entity for performing the majority of the management services required.

Second, a licensing agreement that specifies any IP and trademarks your ‘home’ entity has and the licensing fee schedule that the US entity will adhere to.

Ongoing requirements for your US entity

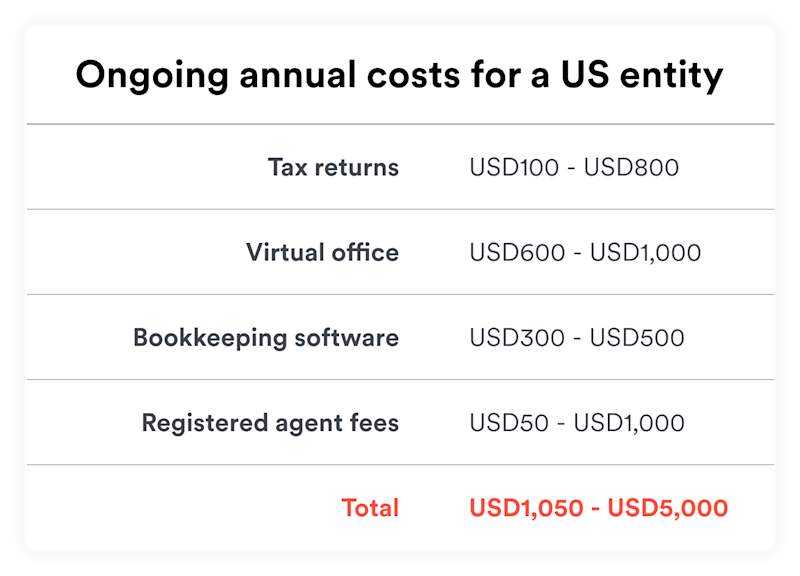

With a US entity, the ongoing effort and costs could be minimal with the right professional support and can range between USD$1,050 to USD$5,000.

From your initial setup, you will need to pay the ongoing costs for your virtual office for a physical US address and your appointed registered agent fees. Alongside that, you will need an additional accounting software license or premium plan to support your US entity and USD transactions. For example, Xero’s Premium 5 plan supports multiple currencies.

Each year, you will also need to file federal and state tax returns for your US entity with the help of a US tax accountant, as well as a state annual report to meet legal requirements. With the right professional support, this process does not need to be time-consuming.

What are the tax implications of having a US entity?

With a US entity, you are required to pay federal corporate taxes, in addition to the state-specific sales taxes. However, on average the corporate tax rates in the US are lower than in Australia. According to KPMG, the US average corporate tax rate in 2020 is 27% compared to Australia’s corporate tax rate of 30%.

In addition to federal corporate taxes, your business will need to pay state-level sales taxes that vary for each state. However, even without a US entity, Australian businesses can be liable for sales tax under certain conditions where sales exceed a certain amount.

It is important to consult a licensed US tax accountant to understand the tax implications as you are incorporating your US entity.

Airwallex’s US Global Accounts can fast track your US expansion and simplify your global funds in a single place

Our mission at Airwallex is to help businesses of all sizes to do business without borders. Australian eCommerce businesses have accelerated their US expansion with Airwallex’s US Global Account. Set up your US global account entirely online, without a single flight for an in-person branch visit.

Collect USD from US payment gateways (e.g. Stripe, PayPal, AfterPay or Klarna) or eCommerce platforms like Shopify or Amazon with local US bank account details. All in a single multi-currency account, without the need to manage multiple accounts. Pay your USD expenses directly with bank transfers, virtual Visa debit cards or convert funds back to AUD at market-leading rates.

Book a demo with our product specialists to discover how you can set up your Airwallex US Global Account to start collecting USD.

Streamline your financial operations

Related article: How To Open a US Bank Account From Australia

Sources

https://www.regus.com/en-gb/virtual-offices/virtual-office-checkout-page

https://www.legalzoom.com/articles/how-much-does-it-cost-to-have-a-registered-agent

Our products and services are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221 (Airwallex). This article is provided for general information purposes only and is correct at the time of publication but may change. This article does not take into account your objectives, financial situation or needs. Airwallex is not providing you with any legal, financial or tax advice. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs and obtain your own legal, financial or tax advice. Please read and consider the Product Disclosure Statement available on our website before using our service.

Airwallex provides third-party links for general informational purposes only. Airwallex does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Airwallex accepts no responsibility for the accuracy, legality, or content on these sites.

Share

Related Posts

Cross-border selling: Four ways to increase your cross-border sal...

•7 minutes

Cross-border fees: Why they are charged and how to reduce them

•9 minutes