How to create a payment gateway and set it up in 4 steps

Key takeaways:

Payment gateways are essential to support digital and international transactions.

You can partner with a third-party payment gateway provider for quick, efficient implementation or build your own payment gateway from scratch (at a cost).

Payment gateways are just the initial step in a transaction, and you might benefit more from an end-to-end processor.

Knowing how to create a payment gateway can unlock several benefits for your business’s growth. A payment gateway can help you expand your payment options, and improve the overall shopping experience.

For example, an effective eCommerce payment gateway can boost international conversions by enabling customers to view and pay in their local currency, reducing confusion, and making the transaction process more comfortable and familiar for global shoppers.

This is huge since 77% of global consumers claim they’ll likely abandon an online cart if their preferred payment method is unavailable1. Learn how to implement a payment gateway, plus plug-and-play alternatives to streamline your payment process below.

What is a payment gateway?

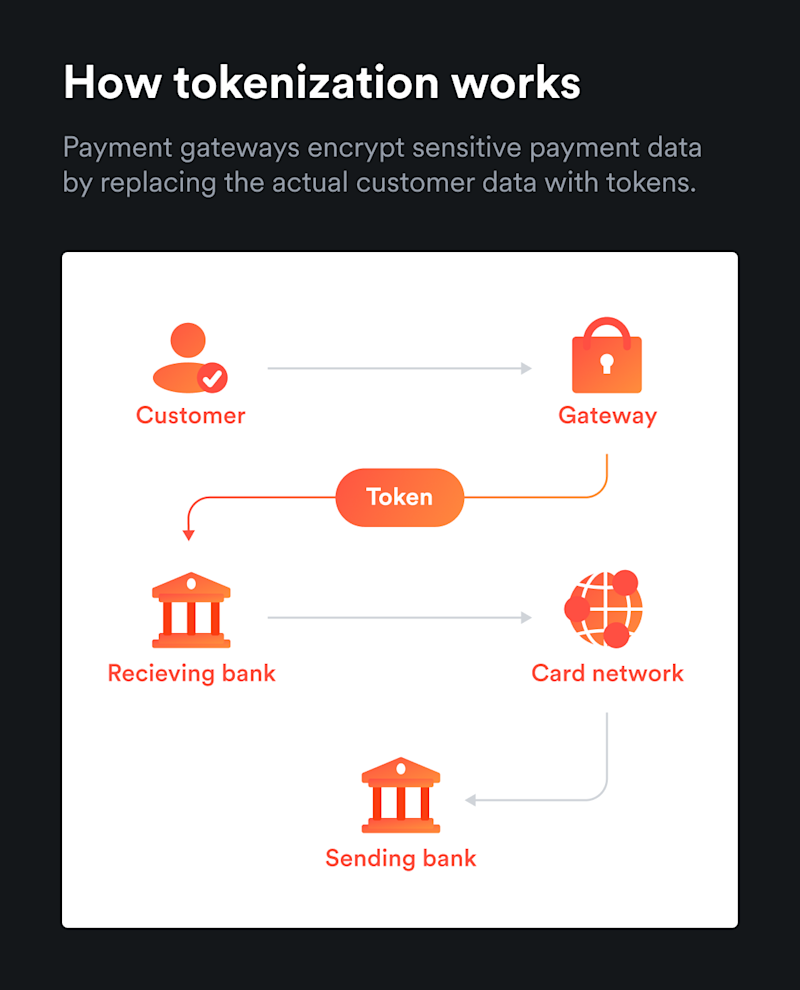

A payment gateway is the first payment processing touchpoint. It’s the interface a customer uses to start an online transaction and facilitates payment acceptance and processing.

A good payment gateway is essential for online transactions and digital payment acceptance. Ideally, a gateway that supports market expansion will have user-friendly interfaces that dynamically display certain elements based on a specific location or language.

Why create your own payment gateway

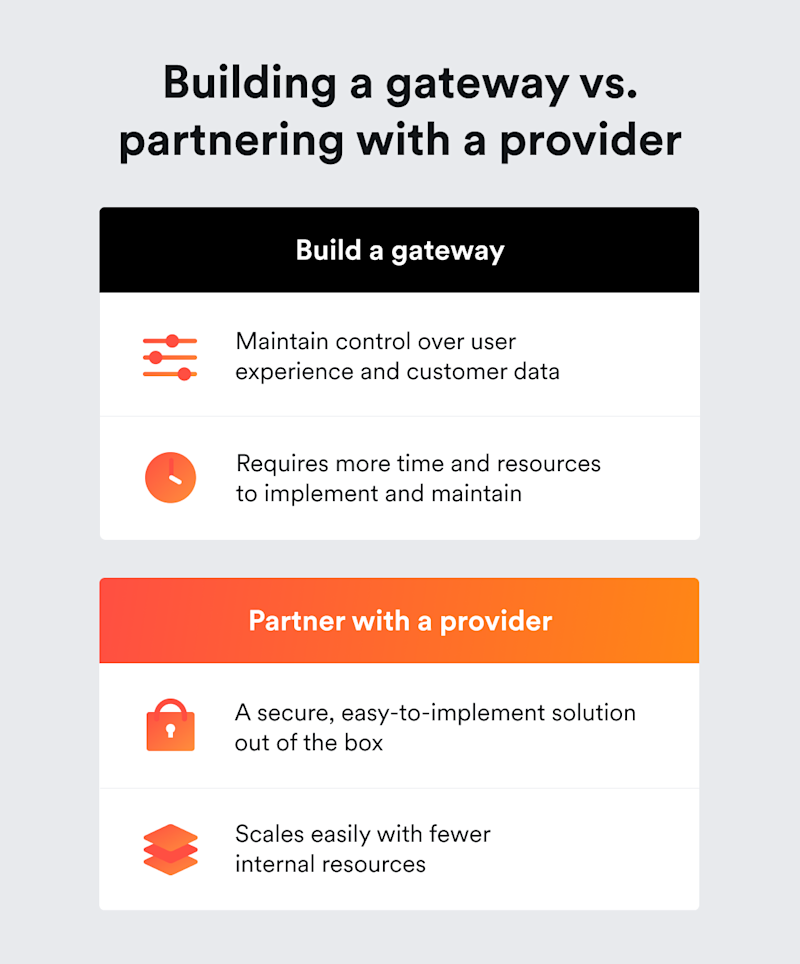

Businesses can also build their own payment gateways for the ultimate custom solution. By creating a gateway internally, you gain more control over functionality, since you can develop the exact features you need to run your business efficiently. This approach also ensures that you’re able to build a custom interface that provides an easy and seamless transaction experience for your customers.

This also means you have full control over valuable customer data, which you can use to analyse for insights to continuously improve your payment gateway. On top of that, if your business has significant sales volume, building your own payment gateway may help you realise long-term cost savings.

However, while having your own payment gateway has its benefits, it can be costly and resource-intensive, and may take many years for businesses to break even, requiring significant initial investment and ongoing maintenance. You’ll have to hire developers and specialists to build the gateway, run testing, and manage data security on your own.

Additionally, the complexity of regulatory compliance, such as PCI DSS, can be overwhelming and time-consuming. Moreover, handling sensitive customer data increases security risks. A data breach can lead to severe financial losses and reputational damage. While you gain control, the responsibility for maintaining top-notch security falls entirely on your shoulders, which can be a significant challenge.

4 Steps to create a payment gateway

If you choose to build a payment gateway with a payment provider like Airwallex, the steps are straightforward.

1. Partner with a payment provider

First, you need to find a payment gateway and processor that works for you. Decide whether you need all-in-one payment processing or prefer a separate gateway and processor.

Many businesses will appreciate the convenience of an all-in-one processor that tracks data in one convenient dashboard. You can also save time and money with a single payment to the same provider rather than splitting expenses.

Mixing and matching gateways and processors has its advantages, too. You can gain access to additional features that one processor doesn’t offer while choosing a gateway that integrates with your site. However, this also means working with different systems and managing separate provider relationships, which gets more complicated at scale.

Once you know what you’re looking for, start researching and comparing service providers. After you find a provider you like, they’ll support you through implementation and the remaining steps.

Learn more about Airwallex’s Payment solutions

2. Consider your security needs

Payment security is a high priority to protect your business from fraud and data breaches that can hurt your reputation and cost your business.

Reputable payment gateways indeed follow the Payment Card Industry Data Security Standard (PCI DSS). This set of security standards was established in 2004 by major credit card companies, including Visa, Mastercard, Discover Financial Services, JCB International, and American Express. The primary goal of PCI DSS is to protect credit and debit card transactions from data theft and fraud. If you maintain your own payment gateway, you're responsible for ensuring ongoing compliance with these standards.

Payment gateways often include robust fraud protection measures that help guard your business from fraud and unauthorised charges. These protections can include features like address verification, CVV checks, and advanced risk analysis tools, which can significantly reduce the risk of fraudulent transactions.

3. Customise your gateway software

The beauty of third-party providers is that they come ready to plug and play, so you can accept payments faster. They may also offer more customisable checkout solutions to tailor your checkout experience.

Your gateway may allow you to choose between simple payment links that require no coding, low-code checkout solutions that are easy to embed, or payment plugins that integrate seamlessly with eCommerce platforms like Shopify, WooCommerce, and Magento. Each option caters to different levels of technical expertise and business needs.

Gateways also sometimes offer payment APIs to integrate your existing website with your preferred gateway and processor. Once you implement the API code in your backend, your customers can complete their transactions on your site without being redirected to an external checkout page, which improves the user experience and can help reduce abandoned carts.

While the API code is generally well-documented and designed to be relatively easy to integrate, it may still require some technical work to ensure it functions correctly. However, you have the flexibility to customise the payment interface to match your brand or collaborate with technical specialists to fine-tune the payment process.

Whether you need SaaS payment processing or run an eCommerce site, reputable payment gateway providers are typically willing to assist you in building the right solution to meet your specific needs.

4. Launch and maintain your payment gateway

Once you have chosen a gateway provider and payment processor, it's crucial to test the integration thoroughly before launching it for customer use. This is particularly important if you have built a gateway from scratch or heavily customised it. Testing helps ensure that everything works as expected, reduces the risk of errors, and provides a smooth experience for your customers.

You can start accepting customer payments after a few successful test runs, but keep an eye out for bugs while ramping up to avoid major mistakes. If you do run into any hurdles, your gateway provider should have customer support to help you resolve issues as they pop up.

DIY vs. third-party payment gateways

For businesses who want fuller control over their customer data, or want to maintain greater control over the customer experience, building a payment gateway from scratch is certainly an attractive option. However, doing so is time-consuming and expensive.

Creating the gateway itself will require considerable setup costs and ongoing expenses. You’ll need to invest more time and resources compared to using an out-of-the-box solution, as it involves extensive UX development and rigorous testing.

You must address evolving compliance standards in each market you operate in. This includes adhering to regulations like PCI DSS and local financial regulations. On top of that, you'll need to continuously update the gateway to support new payment methods and currencies, which is essential for expanding internationally.

Partnering with a third-party payment service provider (PSP) can significantly alleviate the burden of maintaining and ensuring compliance for your payment gateway. PSPs take on the majority of the technical and regulatory responsibilities, allowing your business to focus on its core operations. This is particularly important for avoiding legal issues and maintaining customer trust, as PSPs are obligated to stay up-to-date with local payment protocols and regulations.

PSPs bring a wealth of experience and expertise to the table, having worked with various industries and payment methods. They're well-versed in localisation best practices, which can be invaluable if your business plans to expand into new markets. This expertise ensures that your payment processes are optimised for different regions and customer preferences.

By leveraging a PSP, you can easily scale your payment processing capabilities without straining your internal development team. This scalability is often more cost-effective and efficient compared to building and maintaining a custom solution. In exchange for these benefits, you pay fees to the PSP, which provides the necessary flexibility and support to grow your business seamlessly.

How to compare payment gateways

Payment gateways share a lot of core features, but the best international payment gateways will include:

Easy implementation: The gateway should provide clear API documentation and robust developer support to ensure smooth integration. Look for plug-and-play solutions or pre-built integrations with eCommerce platforms to reduce setup time. For custom needs, assess the API's flexibility and ease of customisation. Ensure the gateway provides a sandbox environment for testing transactions and robust simulation tools to handle various scenarios, including error handling and edge cases.

Ability to scale globally: Ensure the payment gateway supports multiple currencies and local payment methods like bank transfers and e-wallets. Assess the gateway’s ability to handle high transaction volumes and cross-border transactions efficiently, with features like currency conversion and low international fees. Look for flexibility to adapt to your growing business needs, such as adding new payment methods and integrating with additional systems.

Compliance and security: Ensure that the payment gateway complies with industry standards such as PCI DSS (Payment Card Industry Data Security Standard). Check if the provider has robust security measures in place, such as encryption, tokenization, and fraud detection tools. On top of that, verify that the gateway is compliant with local and international regulations, especially if you operate in multiple markets.

Set up secure, global payment gateways quickly with Airwallex

Knowing how to create a payment gateway lets you expand your business globally. Building one from scratch has benefits, but partnering with an end-to-end processor means you can start taking international payments sooner with low- or no-code solutions – all without sacrificing security.

While you can opt for just a payment gateway, we recommend an all-in-one finance solution like Airwallex. Airwallex Payments gives you access to a payment gateway and processor, letting you collect online payments in multiple currencies and local payment methods, while supporting your cross-border payment needs.

Airwallex Payments is designed to work in harmony with our extensive suite of financial services in one Business Account. You can easily manage multiple currencies in one place, send international money transfers with competitive exchange rates, manage expenses via our Corporate Cards and Expense Management tool and integrate our solution with existing accounting software. Get the business account built for global growth here.

Sources:

https://www.airwallex.com/newsroom/cross-border-ecommerce-2024-report

https://www.ibm.com/reports/data-breach

Share

View this article in another region:AustraliaEurope - EnglishEurope - NederlandsNew ZealandSingaporeUnited KingdomUnited States

Related Posts

What is an eCommerce payment gateway and how does it work?

•15 minutes