How to calculate opportunity cost

Joe Romeo

Senior Growth Marketing Manager

As a business owner, you’re faced with making constant decisions relating to the governance of your business. Decisions requiring you to weigh up how to best use your capital, your time, and your effort. Understanding how each of these decisions can impact your bottom line, whether it’s immediately apparent or not, is critical in building a robust business.

This is where the idea of opportunity cost comes into play.

What is opportunity cost?

When you make a business decision, you’re choosing one outcome over another. You’re choosing to spend money on one thing over something else.

Opportunity cost is the effective difference in cost between the outcomes of both decisions.

An opportunity cost formula provides you with a way to measure the difference between two decisions, as a way to land on a rough value figure of one option over the other. It enables you to work out the potential cost of missing out on the other opportunity when compared with the one you went with. Instead of weighing up theoretical pros and cons, you’re getting a more financially motivated, common-sense answer.

What is negative opportunity cost?

When making these decisions, you want to see that which decision is going to deliver the best financial outcome. So when you determine that the opportunity you’re potentially choosing is losing you more money than you’re likely to make, this is known as a negative opportunity cost.

Determining a negative opportunity cost can act as an early warning system for your investments, and help you avoid potentially costly mistakes.

What is opportunity cost used for?

As a business owner, it’s a quick way to measure the trade-off of one decision against another. It enables you to put a dollar figure against the risks and benefits of each option and calculate the difference in expected returns of your business decisions.

The principles of calculating opportunity costs can be applied to a range of industries, and allows for more profitable decision-making. Effectively, determining the best bang for your buck.

Opportunity cost formula

As you can guess, calculating opportunity cost isn’t a quick process. It requires as much data and cost information as you can provide in order to get a realistic figure—but the value can be priceless.

Monetary factors, such as cost of the asset, income generated from the asset, returns over time, are easier to calculate than intangible factors. So things like the amount of time invested into each asset, the effort taken to use it, or learn how to do so, or the skills required to undertake the option (which can, in turn, involve upskilling, training, and new hires).

Here’s how to calculate the opportunity cost of your business decisions.

Opportunity cost = Return on the next best option — return on the option you’re choosing

It sounds simple, in theory. But it’s working out the cost of each option that takes time.

Related article: How to Calculate ROI

Business owners make these sorts of decisions all the time

Let’s look at some examples of calculating opportunity cost in practice.

Say you’re a business owner looking for a new warehouse storage space. You’ve got two options, one is $1000/month more expensive than the other, but it’s a slightly larger size. Here you’re calculating the difference between the cost of each space itself, plus the potential sales from the stock stored within.

But it can also be more involved. Say you’re an electronics provider looking at options for growth. You’re weighing up the benefit of expanding into a new target market; for example, a group of new suburbs on the other side of town. You’re contemplating whether to look wider for growth, or to grow your existing market by boosting your marketing efforts in your current market.

Here you’d need to calculate what goes into each option. The increasing scope might include costs for market research, creation of new advertising, contracting an agency to undertake the advertising for you, and lead generation. Whereas doubling down at home requires more effort from your existing teams, couple with increased marketing spend, new advertising content, and more effort put into your upselling.

It can also be a long-term game. Let’s look at the example of a business owner with $50k in debt. You’re considering two options: you’re thinking about paying down the debt now, or alternatively, buying a new product manufacturing asset so you can increase your output, and use this to generate additional profit.

In this circumstance, you’re weighing up the current debt, on which you’re paying interest—but also the mental impact it has as it hangs over your head—against the upfront cost of buying a new asset which will put you further in debt, but has the potential to over time bring in more revenue to help pay off the debt quicker.

Opportunity cost can inform your growth plans

As you can see, it’s not always a clear-cut process. Opportunity cost can’t always be accurately or fully quantified at the time you make the decision. The best you can do is create an approximate estimate of the outcomes

However, it can be a useful tool to help inform your growth plans, and has the potential to tell you whether an investment is likely to be positive or negative.

Calculating your opportunity cost goes a long way to helping you understand how you can best use finite resources like time and money.

Airwallex is helping you make these decisions easier

As a business owner, you’re doing what you can with the resources you have available. You’re managing finite capital, and looking at ways to eliminate costs wherever possible.

At Airwallex we help make it easier to weigh up your financial decisions and make those opportunity cost calculations, with products that help reduce the fees you pay for banking.

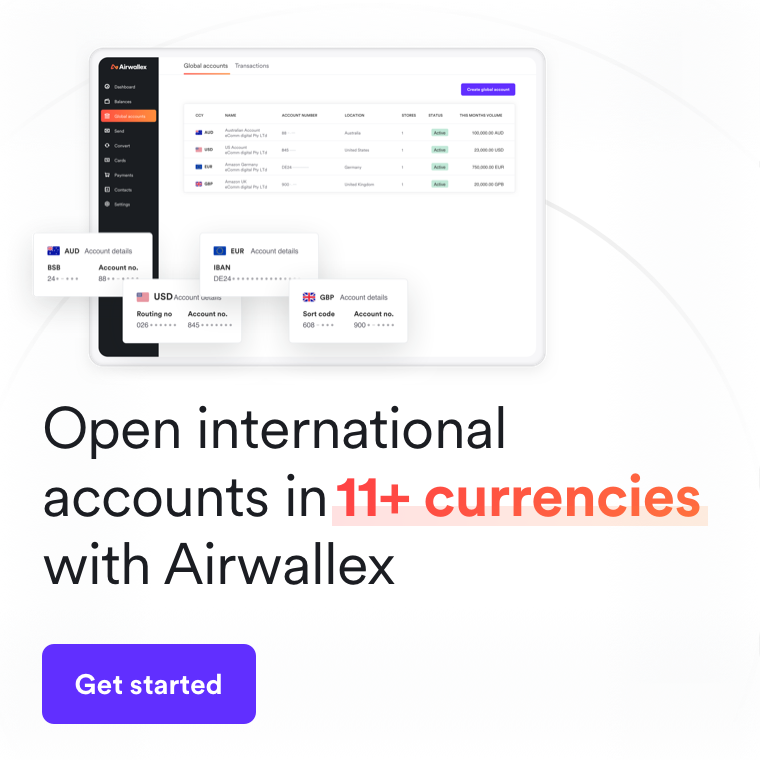

Looking to grow into global markets? Our Global Accounts streamline your expansion. You can create individual foreign currency accounts for 11+ currencies, and lock in FX rates for a more competitive price. You’re able to make international payments to 130 countries in 30+ currencies, with no minimum transfer fees.

Get faster to market with our Borderless Cards. You can create physical and virtual payment cards for your business instantly, so you can start transacting sooner, and building your business quicker.

We’re also helping you to reduce money wasted on fees or inflated FX rates. Our FX rates are only 0.3% or 0.6% above the interbank rate; you get the best possible rate, so you receive a better return on your investments. And you never get charged account fees, international fees, or withdrawal fees—ever.

Watch a 3-minute demo of our platform today. This is one opportunity you don’t need to calculate.

Related article: Break-even analysis

View this article in another region:United Kingdom

Joe Romeo

Senior Growth Marketing Manager

Joe Romeo is responsible for scaling our Airwallex's product adoption in the UK and the world. An all-around growth enthusiast, Joe's speciality lies in SEO, organic acquisition and making lasagna.

Posted in:

Accounting